Add Tata Chemicals Ltd For Target Rs. 945 By JM Financial Services

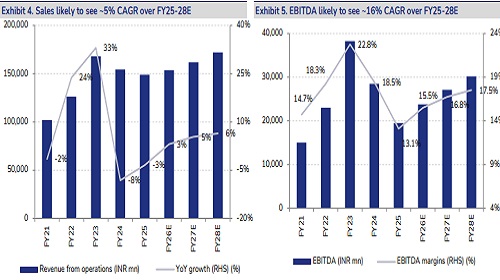

Tata Chemicals’ 2QFY26 earnings print was below our expectation on account of lower realisation in the India business and a decline in US business profitability. The India business saw pricing pressure while the US business saw one-off expenses related to drawdown of WIP stocks and higher share of exports (lower margins) compared to domestic sales. As we have highlighted in our initiating coverage report (click here), going ahead, in our view – i) the recently imposed anti-dumping duty (ADD) is likely to provide a cushion to its soda ash sales realisation in the India business, ii) the US business is likely to see equal split between domestic (higher margin) and exports sales, and iii) with the UK business’ reconfiguration now complete, the company is likely to see benefits from 3QFY26. On account of these factors, it is likely to be on a continuous EBITDA improvement path with an EBITDA CAGR of ~16% over FY25-28E. Factoring in 2QFY26 results and management commentary, we have lowered our FY26-28E EBITDA estimates by ~4-8% and EPS estimates by 5-16%. We roll forward to Dec’27E earnings and maintain ADD rating on the name with a revised SOTP-based Dec’26 TP of INR 945/share (from Sep’26 TP of INR 970 earlier).

* EBITDA miss on account of lower India realisation and decline in US profitability:

Tata Chemical's 2QFY26 consolidated gross profit was 9% below our expectation and stood at INR 29.1bn (down 2.6%/7.4% QoQ/YoY) as gross margin was lower than anticipated at 75% (vs. JMFe of 79.3% and 80.3% in 1QFY26) and sales was lower than expected at ~INR 38.8bn (4%/6% below JMFe/consensus, up 4% QoQ while down 3% YoY). During the quarter, other expenses were lower at INR 18.6bn (vs. JMFe of INR 19.5bn and INR 18.2bn in 1QFY26). As a result, EBITDA came 21%/20% below JMFe/consensus and stood at INR 5.4bn (down 17%/13% QoQ/YoY). Further, PAT (after Minority Interest) was significantly below JMFe/consensus and stood at INR 770mn (down 69%/60% QoQ/YoY) due to exceptional loss of ~INR 650mn during the quarter related to contractual obligations with respect to closure of the Lostock operations.

* Lower US EBITDA/MT on account of WIP inventory drawdown and higher exports:

During 2QFY26, soda ash sales volume stood at ~849KT (vs. 802KT in 1QFY26 and 868KT in 2QFY25), Soda bicarb sales volume stood at 62KT (vs.56KT in 1QFY26 and 52KT in 2QFY25), and salt sales volume stood at 444KT (vs. 407KT in 1QFY26 and 397KT in 2QFY25). EBITDA margin was lower on account of lower EBITDA/MT in the India business at INR 3,934/MT (vs. INR 4,679/MT in 1QFY26 and INR 2,802/MT in 2QFY25), and significantly lower EBITDA/MT in the US business at INR 1,285/MT (vs. INR 3,469/MT in 1QFY26 and INR 3,528/MT in 2QFY25)

* Maintain ADD with Dec’26 TP of INR 945/share:

Factoring in 2QFY26 performance and management commentary, we have revised our FY26-28E EBITDA estimates downwards by ~4-8% and EPS estimates downwards by ~5-16%. The company stands to benefit from ADD on soda ash in the India business, turnaround of UK operations with Lostock unit reconfiguration now complete, and improvement in the US business. We now expect the company to register EBITDA/EPS CAGR of ~16%/70% over FY25-28E. We roll forward to Dec’27E earnings and maintain ADD rating on the name with a revised SoTP-based Dec’26 TP of INR 945/share (from Sep’26 TP of INR 970/share earlier).

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361