Hold Deepak Nitrite Ltd For Target Rs.1,768 by Prabhudas Liladhar Capital Ltd

Soft realizations keep margins under strain

Quick Pointers:

* Nitric Acid plant and MIBK/MIBC project expected to be commissioned by Q4FY26

* Capex guidance of Rs15bn in FY26, Rs30bn and Rs40bn in FY27 and FY28 respectively

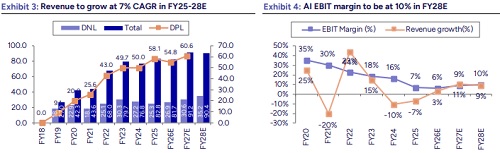

DN’s Q2FY26 adjusted revenue stood at Rs18.8bn, declining by 7.2% YoY but was stable QoQ. Operating performance was impacted by ongoing pricing pressure, oversupply from China, and a decline in spreads. The Advanced Intermediates segment was impacted by effects of US tariffs as well as due to continued influx of Chinese products, leading to 3% decline in revenue. The Phenols segment reported 2%-3% volume growth, but profitability remained subdued due to lower spreads. Projects such as Nitric acid and MIBK/MIBC are likely to come online in Q4FY26. The total planned capex for the polycarbonate value chain stands at Rs85bn, the project timeline has been changed from previously guided Dec’27 to March’28, we believe that the project may face further delays.

DN has been undertaking numerous growth initiatives, primarily in the Phenolics segment. Domestic demand for phenol is expected to remain stronger; however, the threat of cheap imports will likely keep margins under pressure. The stock is currently trading at ~28x Sep’27 EPS. We value the stock at 28x Sep’27 EPS and maintain ‘HOLD’ rating.

* Adj consolidated revenue declined by 7.2% YoY: DN reported consolidated revenue of Rs19bn. Adjusting for government incentives of Rs164.6mn, revenue came in at Rs18.8bn, down 7.2% YoY, but flat QoQ. Adj H1Y26 revenue was down by 10.5% vs H1FY25. Topline growth was constrained by continued pricing pressure across the company’s portfolio.

* Adj EBITDAM declined to 10% during Q2FY26: Adj gross profit margin was 26.9% (vs 32% in Q2FY25 and 27.3% in Q1FY26), down 510bps YoY due to lower spreads. Adj EBITDA stood at Rs1.9bn, down 36.9% YoY, but up 9% QoQ (vs Rs3bn in Q2FY25 and Rs1.7bn in Q1FY25). Adj EBITDA margin came in at 10% (vs 14.6% in Q2FY25 and 9.2% in Q1FY26).

* Segmental mix: Adj Phenolics revenue mix was 69% of total adj revenue with adj EBIT/kg at Rs10.9 (calculated), vs Rs17.9 in Q2FY25 and Rs8.7 in Q1FY25. Advanced Intermediates’ revenue share was 31% with 4% EBIT margin. Phenolics contributed 85% of overall adj EBIT, while Advanced Intermediates’ contribution was 15%.

* Concall takeaways: (1) Domestic and export revenue mix stood at 86%:14% in Q2FY26. (2) Advanced Intermediate segment witnessed pressure due to US tariffs and cheap imports from China (Products like Sodium Nitrate, DASDA are impacted). (3) In Q2FY26 few products in the Advance Intermediate segment had zero sales. (4) In H2FY26, advance intermediate is expected to see some upside driven by agro chemical intermediate supplies to Europe. (5) H2FY26 expected to be better than H1FY26, driven by expected recovery in market as well as commission of new projects. (6) Short-term benefits are already visible from the transition to renewable energy; the company targets meeting 60% of its power consumption from renewable sources by FY27. (7) The polymer compounding facility will be used as a pilot unit for the resin plant, helping fast-track approvals. (8) Capex guidance of Rs15bn for FY26 is maintained, while capex for FY27 and FY28 is expected to be Rs30bn and Rs40bn, respectively. (9) The hydrogenation plant was commercialized in Sep’25, with a capex of Rs1.18bn. (10) Nitration and MIBK/MIBC projects are expected to be commissioned in Q4FY26. (11) The MPP plant is expected to be commercialized between March’26 and June’26, with ramp-up dependent on customer validation, which will take 1–5 months. (12) Polycarbonate resin commercialization is expected between Jan’28 and March’28 (earlier guidance: Dec’27).

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271