Buy Sunteck Realty ltd For Target Rs. 615 By JM Financial Services

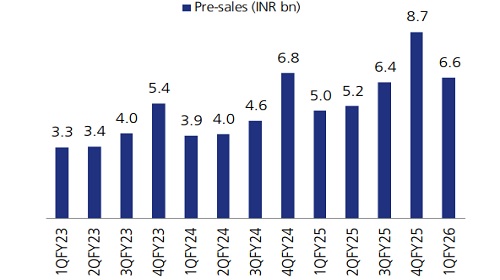

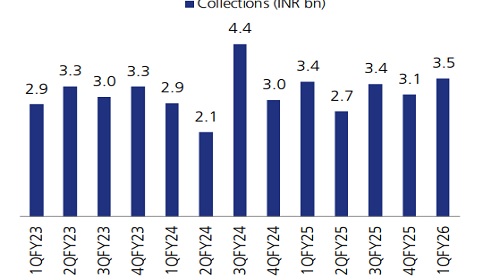

Sunteck Realty (Sunteck) had a strong quarter as it reported bookings of INR 6.6bn (+31% YoY, -24% QoQ; +10% JMFe) despite lack of launches. The bookings were driven by its recently launched ultra-luxury project at Nepean Sea road which accounted for ~45% of the quarterly pre-sales. Collections were flat at INR 3.5bn, but company expects it to increase by 20-25% in FY26E. Sunteck has planned INR 110bn worth of launches during the year which includes the new projects at Bandra (Bullock Road) and Andheri along with new phases across all its on-going projects. Given the strong project pipeline of INR 400bn, we expect the momentum to sustain in the near term and build in a 28% CAGR in bookings over FY25- 28E; collections could clock 35% CAGR during the same period. We maintain BUY rating with a Mar’26 TP of INR 615.

* Nepean Sea drives strong sales performance: Sunteck Realty reported strong performance in terms of pre-sales which came in at INR 6.6bn (+31% YoY, -24% QoQ; +10% JMFe) despite lack of launches during the quarter. The bookings were driven by its ultra-luxury project at Nepean Sea road which continues to witness encouraging traction since its soft launch in 3QFY25. It had a contribution of INR 3bn to overall pre-sales and the ultraluxury segment had c. 60% share in total sales followed by premium projects with 34% share. With bulk of the bookings coming from new projects, collections are yet to pick up as it came in at INR 3.5bn, up 3% YoY. However, the management highlighted that the collections could grow by 20-25% in FY26E.

* Launches to accelerate: Sunteck is targeting to launch INR 110bn worth of new inventory in various projects/phases over the next three quarters. Key projects among them include Avenue 5 ODC (INR 15bn), Bandstand (INR 10bn), Mira Road (1 tower: INR 5bn), Vasai (2 towers: INR 5-6bn) and Naigaon (INR 5bn). Sunteck has re-iterated its guidance of achieving 30% growth in bookings in FY26E.

* Business development: During the quarter, Sunteck added a redevelopment project in Andheri East having Gross Development Value (GDV) of INR 11bn, thus maintaining the traction on the business development front. With the addition of Napean Sea, Bandra and revival of the Dubai projects, the upcoming pipeline has been significantly strengthened to a GDV of INR 400bn. The management team is confident of adding few more projects soon at it intends to reach INR 500bn worth of pipeline by end-FY26E.

* Financial performance: Revenue came in at INR 1.9bn (-41% YoY, -9% QoQ) but EBITDA was up 51% YoY to INR 480mn. Margin in base quarter (1QFY25) were impacted by higher FSI cost at ODC, Goregaon and have now normalized to 25%. ? Maintain BUY with TP of INR 615: Sunteck continues to do exceedingly well in pre-sales and business development. The pre-sales momentum can continue in the near term given the strong launch pipeline across multiple locations in MMR. We build in a 28% CAGR in bookings over FY25-28E and maintain BUY with a TP of INR 615.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361