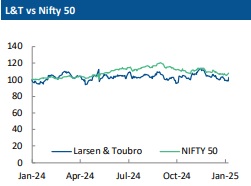

Buy Larsen & Toubro Ltd For Target Rs. 4,070 - LKP Securities

Stable Q3, Strong order inflow continues

L&T reported 17.3% YoY revenue growth, driven by a 53.7% surge in Hydrocarbon segment. Consolidated EBITDA rose 9% YoY, but margins fell 77bps to 9.7%. P&M revenue/EBITDA grew 20% each to Rs.473bn/Rs.36bn, with margins flat at 7.6%. Order prospects remain strong at Rs.5tn (down 19% YoY), despite moderation in Hydrocarbon and Infrastructure segments. Global prospects are robust, especially in the Middle East, fueled by oil & gas, renewables, and thermal power investments. With strong 9MFY25 performance, management is confident of exceeding FY25 order intake and revenue targets. NWC to sales stood at 12.7% in Dec-24 (vs. 12.2% in Sept-24), supported by improved gross working capital to sales ratio and robust collections. Order inflows jumped 53% YoY to Rs.1.16tn, with domestic inflows doubling to Rs.540bn and international inflows up 23% to Rs.621bn. Order backlog grew 20% YoY to Rs.5.64tn (3.1x TTM revenue). We see L&T as well-positioned for long-term growth due to strong international prospects in the Middle East, a solid domestic pipeline from public and private capital expenditure, improving profitability in development projects, and expansion into sectors like green energy, electrolyzers, semiconductors and data centers. We maintain BUY rating and roll forward to FY27 estimates with an unchanged SoTP-derived TP of Rs4,070 reflecting L&T’s strong execution capabilities, healthy order inflow prospects, and positive future outlook.

Q3FY25 result summary

Consolidated revenue grew 17.3% YoY to Rs.646.7bn, driven by robust international business performance (+34.8% YoY to Rs.327.6bn), particularly in Infrastructure and Energy projects. Domestic revenue edged up 3.5% YoY to Rs.319bn. EBITDA increased 8.6% YoY to Rs.62.5bn, but margins contracted 77bps YoY to 9.7%, primarily due to lower gross margins (-100bps YoY to 35.1%). P&M EBITDA/EBIT margins stood at 7.5%/6.4% (vs. 7.5%/6.3% in Q3FY24). PAT rose 14.0% YoY to Rs.33.6bn, supported by revenue growth, higher other income (+15.5% YoY to Rs.9.7bn), and lower interest costs (-6.8% YoY to Rs.8.4bn), partly offset by increased D&A expenses (+13.7% YoY to Rs.10.5bn). The working capital cycle in Q3FY25 improved to 12.7% (vs. 16.6% in Q3FY24), with L&T expecting it to remain between 12.5%-13% of sales for FY25, better than the initial 15% guidance. Core business debt remained stable at Rs.416bn. L&T anticipates enhanced operational performance and plans to reduce Hyderabad Metro debt from Rs.130bn to Rs.70bn through the sale of ToD rights and securing soft loans from state governments. With strong 9MFY25 performance, management is confident of exceeding FY25 order intake and revenue targets

Strong ordering pipeline

L&T’s Q4FY25 prospect pipeline stands strong at Rs.5.5 tn, (down 12% YoY), led by lower hydrocarbon and CarbonLite opportunities. Domestic prospects are likely to be driven by public health infrastructure, energy, urban infra, water, and buildings & factories (B&F) segments. Consolidated order inflows surged 52.7% YoY to Rs.1.16 tn in Q3FY25, driven by large orders in renewables, power T&D, and mega deals in CarbonLite and Hydrocarbon segments. Domestic/ international order mix stood at 47%/53%. Order book rose 20.1% YoY to Rs.5.6 tn (2.3x TTM revenue), with a 58%/42% domestic/export split.

Outlook & Valuation

Given record OB with strong order pipeline and gradual revival in private capex provides healthy outlook ahead. Overall strong balance sheet, diversified business portfolio and proven execution capabilities gives L&T an edge in the current volatile and challenging economic environment. We expect L&T to benefit from an improving prospect pipeline and improvements in NWC and RoEs. We maintain BUY rating and roll forward to FY27 estimates with an unchanged SoTP-derived TP of Rs4,070 reflecting L&T’s strong execution capabilities, healthy order inflow prospects, and positive future outlook.

Key Risks:

Slowdown in the domestic macro-economic environment or weakness in international capital investment can negatively affect business outlook and earnings growth.

Above views are of the author and not of the website kindly read disclaimer