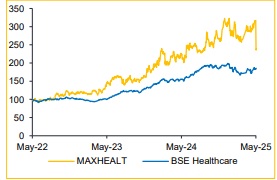

Buy Max Healthcare Institute Ltd For Target Rs. 1,620 - Choice Broking Ltd

In-line financial performance, however operating metrics set to detoriate:

Results were in-line with the expectations, however the operating performance negatively impacted due to capacity expansion. ARPOB for the year was 73.9K compared to 75.8k in FY24, indicating a decline of 2.5%, and occupancy also saw a decline from 75% in FY24 to 74% in FY25

Occupancy & ARPOB to remain impacted due to strong capacity expansion Despite Max Healthcare’s commendable growth trajectory, its aggressive expansion plan—particularly the ramp-up of ~1,500 beds across greenfield and brownfield projects—poses near-term headwinds to operational metrics. With new facilities such as Dwarka, Nanavati, Saket, and others still in their early stages of occupancy buildup, the network-level occupancy is likely to remain suppressed. Notably, newer units are operating at occupancy levels significantly below the core network (e.g., 45%–65% vs 78% in mature units). Additionally, ARPOB will also remain muted and grow at ~2% YoY.

View and Valuation:

We cut on the operating metrics for FY27E, including ARPOB by 3.9% (from 80k to 77k) and occupancy by 500bps (80% to 75%), which is also negatively impacting the financial performance of the company. We expect ARPOB to grow by ~2% over FY27E, and occupancy to remain intact at 75%. Revenue/EBITDA/PAT are expected to grow at a CAGR of 22.7%/28.7%/28.5% over FY25-27E (refer exhibit 1). Given the performance risks, we downgrade our rating to ‘SELL’ (from HOLD) with a target price of INR 965. We maintain our multiples and value the business on a SOTP basis (refer exhibit 2), assigning 26x EV/EBITDA to the core hospital business (factoring in expansion overhang), 15x to Max Lab, and 3x to Max Home.

Strong YoY growth, driven by an increase in OBDs (Occupied Bed Days)

* Revenue grew 27.9% YoY / 1.5% QoQ to INR 230.0 Bn (in-line with consensus estimate: INR 23.2 Bn), driven by growth in new units.

* EBITDA rose 20.7% YoY and flat on QoQ to INR 6.1 Bn; margins contracted by 158 bps YoY and 52 bps QoQ to 26.4% (vs. consensus: 26.7%).

* APAT grew by 15.7% YoY and flat on QoQ to INR 3.9 Bn (vs. consensus estimate: INR 4.0 Bn).

Max Healthcare to add ~3,300 beds over 3 years

The company is targeting a ~58% increase in capacity over the next three years, with plans to add approximately 3,000 beds through an ambitious expansion strategy:

* FY26: ~1,500 beds are expected to be added through ongoing expansions at key facilities, including Nanavati, Saket Smart, Mohali, Phase 1 of the Gurugram project, along with smaller-scale expansions across existing hospitals.

* FY27: ~Another ~700 beds are anticipated from Phase 2 of the Gurugram project, the Patparganj facility, and other locations.

* FY28: In addition to these, the company is also pursuing an asset-light model through built-to-suit agreements, with plans to commission a 500-bed hospital in Thane, 400 beds in Mohali, and O&M of a 200-bed hospital in Pitampura — all situated in high-growth micro-markets, which are expected to be operational by FY28

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)