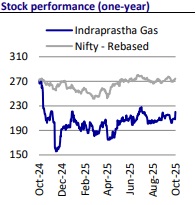

Buy Indraprastha Gas Ltd for the Target Rs. 250 by Motilal Oswal Financial Services Ltd

Tax tweak could deliver margin bonanza

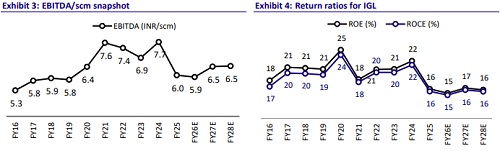

* As per media reports and our channel checks, Indraprastha Gas (IGL) could see a potential EBITDA/scm upside of 16-20% due to a change in the tax rate on gas sourced from Gujarat (official confirmation is awaited). Moreover, IGL could see EBITDA margin benefits of INR0.7-1.3/scm from PNGRB’s move to a two-zone tariff regime. We have a BUY rating on IGL.

* While Mahanagar Gas (MAHGL) has been our preferred pick in the CGD space, we estimate a minor EBITDA upside of 3-4% for MAHGL from this tax change (if confirmed).

~INR1/scm EBITDA margin gain possible for IGL

* As per media reports and our channel checks, tax rates on gas sourced from Gujarat (and sold outside the state) have been revised. The earlier value-added tax (VAT) of 15% has been replaced with a 2% central sales tax (CST), effective 1st Oct’25. However, an official confirmation about this is yet to be received, and we are not factoring in any potential benefits in our current estimates.

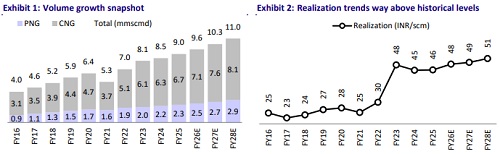

* As per our scenario analysis (refer Exhibit 1 & 2), we estimate an INR0.9/scm EBITDA margin gain for IGL (we currently build in INR5.9/6.5/6.5 per scm EBITDA margin for IGL in FY26/27/28). Hence, if this tax change materializes, it would lead to 8%/15%/15% increase in our FY26/27/28 PAT estimates.

* MAHGL would also record an INR0.3/scm EBITDA margin gain, while GUJGA is unlikely to see any substantial benefits.

Zonal tariff reform to further boost EBITDA margin by INR0.7-1.3/scm

* In the 1QFY26 earnings call, IGL management guided for an INR0.7-1.3/scm EBITDA margin gain from PNGRB’s move to a two-zone tariff regime.

* While IGL could pass on some of the cost decrease to consumers, there is an upside risk to our EBITDA margin estimates.

Reducing raw material costs to drive margin expansion

* We remain bullish on the city gas distribution sector (Marketing sub-sector favored; turning bullish on CGDs) and have been highlighting the scope for margin expansion.

* Weaker crude and lower slope – the twin emerging tailwinds: As highlighted in our recent sector update (Era of margin expansion for CGDs), we expect that a soft crude price outlook, coupled with a lower pricing slope for natural gas amid the upcoming LNG oversupply, will reduce gas costs. This should also ease concerns around the APM deallocation affecting margins.

* R-LNG cost could dip INR2.5/scm: While Brent crude prices averaged ~USD69/bbl in 2QFY26YTD, we forecast Brent to average USD65/60 per bbl in FY26/FY27. We estimate that every USD5/bbl decline in Brent prices reduces the landed cost of natural gas by ~INR2.5/scm. Further, according to our discussions with the listed and unlisted India CGD companies, new long-term gas contracts are already being signed for a 1.0-1.3% lower slope given the expected surge in LNG supply in 2HFY26 and beyond. Note that the risks of crude oil prices falling below the USD60/bbl mark are mounting as OPEC+ strategy shifts from “managing” oil prices to “protecting market share”.

* Lower crude outlook to ease APM/NWG gas costs by ~INR4/scm: Similarly, a weak crude price outlook shall also lower APM & New Well Gas (NWG) price. If the APM/NWG price dips to USD6/7.2 per mmbtu (from USD7/8.4 per mmbtu currently), the cost of natural gas reduces by ~INR3.6/4.3 per scm.

Valuation and view

* We value IGL at 16x FY27E consol. P/E and add INR47/sh as a value of JVs to arrive at our TP of INR250/sh.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412