Buy ACC Ltd For Target Rs.2,545 by Centrum Broking Ltd

Volume growth at the expense of realizations

ACC reported weak results with EBITDA adjusted for prior period incentives coming in 25% below our estimate. While volume growth was much better at 20% YoY (including MSA and Sanghi volume), margins took a dent owing to a QoQ decline in realizations against our expectation of an increase. Even operating costs were marginally higher than our expectations. Higher volume from recently acquired capacities of Sanghi and Penna affected realizations and margins. The management expects profitability to improve as capacity utilization of acquired capacities improves and impact of efficiency improvement measures kicks in. We maintain our estimates on ACC and continue to value it based on 10x FY27E EV/EBITDA to arrive at our target price of Rs2,545. We maintain our BUY rating.

Q3FY25 result highlights

ACC reported weak numbers for Q3FY25 as adjusted EBITDA came in at Rs4.7bn, which was down 48% YoY and 25% below our expectation. Reported numbers are higher owing to couple of one-off items viz. (1) reversal of tax provision of earlier years amounting to Rs5.3bn and (2) refund of incentives / exemption of excise duty of earlier years amounting to Rs6.37bn. Adjusted for the same and higher income tax, the PAT at Rs2.3bn was down 57% YoY and 28% below our estimate. Volume growth at 20% YoY was much higher. However, the same came at the expense of lower realizations, which declined by 11% YoY and were 2% below our estimate. EBITDA/mt came in at Rs442, down 56%/4% on YoY/QoQ basis.

Visibility on future volume growth low

Adani group is planning large capex to increase its capacity from current 98mn mt to 140mn mt. Out of the 42mn mt planned capex, 21mn mt is under construction and 21mn mt is under the planning stage. Most of the upcoming clinker capacities and associated grinding capacities are currently planned in Ambuja and only 4mn mt grinding capacity is coming up in ACC. As a result, we expect ACC’s volume growth to lag industry as well as Ambuja’ growth. Additionally, all the acquisitions from Adani group have naturally come through Ambuja and hence ACC’s volume growth will be limited in future

Valuation and Outlook

We are building in 5%/12% revenue/EBITDA CAGR for ACC over FY24-FY27. Volume growth for ACC will largely be driven by MSA agreement with Ambuja and incremental volume from Sanghi and Penna assets. We believe that the timing and valuation of ACC’s merger with Ambuja will remain an overhang on the stock. We value ACC based on 10x FY27E EV/EBITDA to arrive at our target price of Rs2,545.

Valuations

We are building in 5%/12% CAGR in revenue/EBITDA for ACC over FY24- FY27E. We value ACC based on 10x FY27E EV/EBITDA to arrive at our target price of Rs2,545

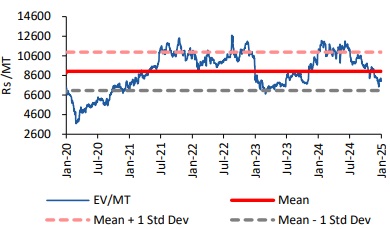

1-year forward EV/MT

EV/EBITDA mean and standard deviation

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331