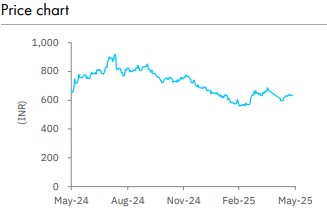

Accumulate Sun TV Network Ltd for Target Rs. 750 by Elara Capitals

Ad weakness persists

Sun TV Network (SUNTV IN) Q4 ad revenue declined 7.0% YoY, less than expected, dragged by low general entertainment content (GEC) viewership due to IPL and continued FMCG ad budget shift to digital. FY25 ad revenue fell 4.0%, down 13% pre-COVID levels. Q4 subscription revenue shrank 1.1% YoY on high base, expect ~2% revenue CAGR during FY25-28E. EBIDTA margin was hit by IPL-related cost; after factoring in this cost, we cut our EBITDA by 3-4% and EPS by 5-7% in FY26-27E. Ad demand recovery and calibrated cost structure are key margin levers. We introduce FY28E and retain Accumulate with a SOTP-based TP of INR 750.

Ad revenue dip lower than expected: In Q4, linear TV advertising revenue declined 7.0% YoY, less than estimated. A large part of Q4 was busy due to the sports calendar (IPL + Champions Trophy), which hit GEC viewership and ad revenue. Moreover, leading FMCG brands (key revenue drivers) relocating ad budget to digital and newer mediums, put additional pressure on the segment. FY25 ad revenue dropped by 4.0%, down 13% below pre-COVID levels. Recovery remains muted; thus, Q4 pressure could flow into Q1FY26. On low base, we expect ad revenue to grow 1.5% YoY in FY26E, 1.8% YoY in FY27E and 2.5% YoY in FY28E. SUNTV continues to back non-Tamil TV channels (Marathi and Hindi) with new content launches

Muted subscription growth, with recovery ahead: On high base, subscription revenue dropped by 1.1% YoY, stood at 50% of Q4 revenue. In FY25, SUNTV undertook a price hike on its platform; this should support growth during FY26-27E as segment-wise revenue growth was muted at 0.9% in FY24 and 0.7% in FY25. The company continues to invest in better content for its OTT to drive growth amid competition. With this, we expect subscription revenue CAGR of ~2% during FY25-28E. Films pipeline in FY25 was subdued; the movie distribution and content trading revenue in Q4 was at a mere INR 43mn while down 47% in FY25; we expect INR 3bn revenue in FY26E, backed by Rajanikanth-starrer Coolie movie to be released in Q2.

Production cost to weigh on margin: Production cost run-rate in H2 was elevated at ~INR 2.2bn, up from INR 1.7-1.8bn in FY24, on higher content cost in its Hindi and Marathi TV channels even as sports revenue lifted gross margin. IPL-related cost of INR 1.2bn hit EBITDA margin, down by 790bp YoY to 47.0% in Q4 (54.0% FY25). Sustained elevated production cost to weigh on margin. We expect margin in the range of 54.8-55.6% in FY26- 28E. Moderation in production cost, linear ads recovery are key drivers for margin upgrade.

Retain Accumulate with a TP of INR 750: Ad revenue is 13% below pre-COVID; we expect a 92% recovery by FY28E, (2.0% CAGR during FY25-28E), with likely muted show in Q1, and ad revenue recovery in H2. Subscription revenue is set to grow ~2% CAGR, lower than peers on limited regional content exposure. After factoring in margin pressure, we cut our EBITDA by 3-4% and EPS by 5-7% in FY26-27E. We introduce FY28E. Despite margin cuts, SUN TV offers the best margin among peers and sustains a consistent dividend distribution policy. We retain Accumulate with a SOTP-based TP of INR 750 as we value the core TV segment at 13x Jun-28E P/E (trading at 7x) and 12x Jun-28E price/sales for the IPL segment.

Please refer disclaimer at Report

SEBI Registration number is INH000000933