Monthly Auto Sales - December 2025 by ARETE Securities Ltd

In the month of December, auto dispatches normalized seasonally after festive highs, falling 14% MoM, but grew 32% YoY, with positive growth across all segments. PV volumes declined 3% MoM but rose 25% YoY, led by MSIL, supported by sustained Mini and Compact demand; notably, MSIL was the only OEM to post sequential growth amid broad-based softness. CV volumes strengthened 14% MoM and 25% YoY, reaching the highest level of the fiscal, led by TAMO on strong truck dispatches, while AL's bus volumes grew 30% MoM, reflecting continued strength in state transport orders. 2W volumes declined 17% MoM but grew 35% YoY, led by TVS, supported by leadership in EVs and balanced premium-commuter mix; HERO stood out on exports with 10% MoM growth despite domestic normalization. Tractor volumes corrected 28% MoM but rose 39% YoY, led by M&M, underpinned by strong agri cash flows, healthy reservoirs, and higher Rabi sowing, while ESC's exports rose 64% MoM, providing incremental support.

2W Segment

The 2W segment recorded a 17% MoM decline in December dispatches, reflecting elevated dealer inventory following the festive push, which typically normalises by year-end and rebounds in January with new launches and wedding-season demand. However, volumes rose 35% YoY, led by TVS, supported by its balanced premium and commuter portfolio, leadership in the e2W segment, and a 35% YoY increase in YTD export dispatches. On the collective export front, dispatches increased 1% MoM, led by BAJAJ, and grew 27% YoY, driven by TVS, with HERO reporting double-digit growth across both periods. In e2W, TVS/BAJAJ/HERO recorded 25,039/18,790/10,701 retail units, yielding

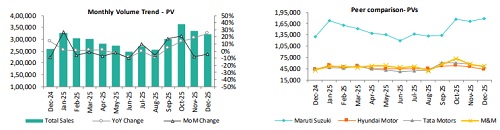

PV Segment

The PV segment recorded a 3% MoM decline in December volumes, with MSIL being the only OEM to report higher dispatches, driven primarily by strong Mini segment car volumes for the sixth consecutive month. This was supported by a boost in the segment received after GST tax benefits, along with continued support from key volume-driving segments such as UVs and Compact cars. HMIL, M&M, and TAMO collectively reported a 13% MoM decline in volumes. However, volumes were up 25% YoY, led predominantly by MSIL, with HMIL contributing the least. M&M secured the runner-up position in the domestic market and, with the launch of the XUV 7XO in January, appears positioned to maintain this ranking, supported by its diversified SUV portfolio. On the export front, volumes declined sharply, down 34% MoM and 16% YoY, with MSIL emerging as the weakest performer

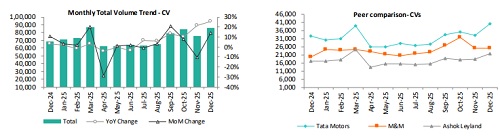

CV Segment

The CV segment reported a 14% MoM and 25% YoY increase in December, reaching the highest monthly volumes of the current fiscal, supported by sustained government-led infrastructure spending, healthy freight movement, and replacement demand following the festive season. Demand remained resilient amid stable economic activity and improved fleet utilisation. Trucks, accounting for 64% of CV volumes, recorded a 16% MoM and 34% YoY increase, with M&M leading the growth. LCVs, which contribute 20% of volumes, posted a 10% MoM and 28% YoY rise, driven primarily by TAMO. The Bus segment reported a 27% MoM and 12% YoY increase, with TAMO leading sequential growth and AL driving growth on an annual basis.

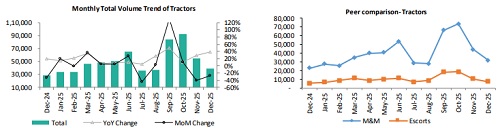

Tractor Segment

Tractor volumes declined 28% MoM but rose 39% YoY, indicating sustained underlying demand despite near-term normalization. The sequential moderation was broad-based across OEMs, while annual growth was supported by improved farm cash flows following a strong Kharif harvest, healthy reservoir levels, and a ~7 lakh-acre increase in Rabi sowing acreage compared to the previous year. Domestic tractor demand remained resilient, aided by supportive government policies, lower GST, state subsidies, and favourable weather conditions. M&M led the segment with domestic volumes up 37% YoY but down 29% MoM, reflecting steady retail traction. Exports in the segment grew 74% YoY, led by M&M, with a 7% MoM surge observed, driven by ESC, despite volume leader M&M declining 7% MoM. Overall, positive rural sentiment and better water availability are expected to sustain tractor demand in the coming months.

Please refer disclaimer at http://www.aretesecurities.com/

SEBI Regn. No.: INM0000127