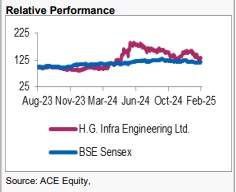

Buy HG Infra Engineering Ltd For the Target Rs. 1720 By the Axis Securites

Recommendation Rationale

Healthy Order Book: As of December 31, 2024, the company's total order book stood at Rs 15,080 Cr, equivalent to 3x FY24 revenue. A significant portion, 94%, of these projects is attributed to the Government of India, with the remaining 6% from the private sector, ensuring strong revenue visibility for the next 2-3 years. The company is anticipated to achieve a 15% CAGR revenue growth over FY24-26E.

Diversified Revenue Streams: Traditionally focused on Roads and Highways, the company has successfully expanded into the Railways and Solar sectors, securing multiple orders in these segments. These now contribute 25% of the total order book, reducing dependence on a single sector. Management is also exploring opportunities in the transmission sector, particularly in Tariff-Based Competitive Bidding (TBCB) projects, which share similarities with EPC projects. This diversification and an expanding sectoral presence are expected to support 15% CAGR revenue growth over FY24-26E

Order Inflow & Segment Diversification: The company anticipates an order inflow of Rs 11,000-12,000 Cr in FY25, with projects worth around Rs 8,200 Cr already secured in 9MFY25. Management expects 35-40% of the order book to come from non-road projects over the next 2-3 years. Additionally, the company aims to secure Rs 10,000- 12,000 Cr in new orders in FY26.The company anticipates an order inflow of Rs 11,000-12,000 Cr in FY25, with projects worth around Rs 8,200 Cr already secured in 9MFY25. Management expects 35-40% of the order book to come from non-road projects over the next 2-3 years. Additionally, the company aims to secure Rs 10,000- 12,000 Cr in new orders in FY26.

Sector Outlook: Positive

Company Outlook & Guidance: The company has guided for an order inflow in the range of Rs 11,000-12,000 Cr and expects revenue growth of 17-18% and an EBITDA margin of 15-16% in FY25. For FY26, the guidance for revenue stands at ~Rs 7000 Cr, EBITDA margins of 15%-16% and inflow of Rs 10000 Cr.

Current Valuation: 14x FY26 EPS (Earlier Valuation: 15x FY26 EPS) and HAM/Solar assets/Battery storage 1.2x/1x/1x book value respectively

Current TP: Rs 1,720/share (Earlier TP: Rs 1,800/share)

Recommendation: We maintain our BUY recommendation on the stock.

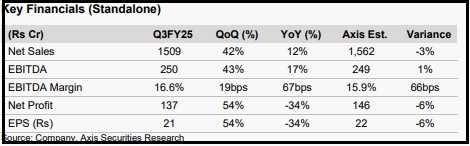

Financial Performance HG Infra Engineering Ltd. (HGIEL) reported mixed numbers in Q3FY25. It reported revenue of Rs 1,509 Cr (up 12% YoY). The company posted EBITDA of Rs 250 Cr (up 17% YoY) and PAT of Rs 137 Cr (down 34% YoY). It registered EBITDA margins of 16.6% in Q3FY25 (our estimate: 15.9%) compared to 15.9% in Q3FY24

Outlook We anticipate HGIEL posting healthy Revenue/EBITDA/APAT growth of 15%/14%/6% CAGR, respectively, over FY24- 26E. This growth will be driven by the company’s strong order book position, improved order intake, diversification into related sectors, and the government’s focus on developing the country’s infrastructure, especially in roads, highways, and renewable energy.

Valuation & Recommendation The stock is currently trading at an implied PE of 12x and 10x of its FY25E/FY26E earnings. We maintain our BUY rating on HGIEL and value its EPC business at 14x FY26E EPS and HAM/Solar/Battery portfolio at 1.2x/1x/1x book value to arrive at a target price of Rs 1,720/share. The TP implies an upside of 35% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633