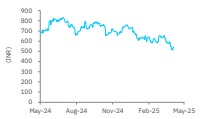

Buy Jindal Stainless Ltd For Target Rs. 743 By Elara Capital

Margin hits near-term trough

Jindal Stainless (JDSL IN) reported an EBITDA of ~INR 10.7bn, slightly above our estimate of ~INR 10bn, led by better-than-expected volume. Consolidated net sales rose ~8% YoY/3% QoQ to ~INR 102bn, broadly in line with our/Consensus estimates of ~INR 103bn/101bn, respectively. Adjusted PAT increased ~19% YoY but declined ~9% QoQ to ~INR 6bn. Going ahead, we expect a gradual improvement in JDSL’s margin, aided by an expected uptick in high-margin exports volume, improved product mix and reduced volume from low-margin domestic segments. Thus, we reiterate Buy with a lower TP of INR 743, based on 15x March 2027E.

A 4mn tonnes greenfield project planned in Maharashtra: JDSL has signed a non-binding MoU with the Maharashtra government to set up a stainless steel plant for INR 400bn. As per the management, the land acquisition process is underway, and the proposed facility will have a capacity of 4mn tonnes. JDSL intends to add capacity gradually (1.0mn tonnes in each phase), with the entire capacity expected to become operational over a 15-year period.

JDSL expects volume to grow ~9-10% YoY in FY26: Standalone sales volume grew ~13% YoY/9% QoQ to 642,641 tonnes in Q4FY25, ~3% ahead of our estimates. Although exports remained muted, with export share declining to 8% in Q4FY25 from 11% in Q4FY24 and unchanged from Q3FY25, JDSL was able to report a healthy volume growth in Q4, led by higher volume push in domestic markets. As per the management, exports conditions should improve in FY26 and thus, JDSL targets ~25-30% YoY jump in FY26 exports volume. Overall, the company targets a volume growth of ~9-10% YoY in FY26.

FY26 consolidated EBITDA/tonne target of INR 19,000-21,000: Q4 realization rose ~1% YoY but dipped ~2% QoQ to INR 167,831/tonne. Operating cost increased ~1% YoY but remained largely flat QoQ at INR 153,975/tonne. Thus, standalone EBITDA/tonne declined ~4% YoY/19% QoQ to INR 13,857, versus our estimates of INR 12,709. Consolidated EBITDA/tonne (on standalone volume) was down ~9% YoY/20% QoQ to INR 16,508. Weak Q4 EBITDA/tonne was due to soft stainless steel prices, inventory loss on account of falling nickel prices and higher volume share from low-margin domestic segments. For FY26, JDSL expects a consolidated EBITDA/tonne of INR 19,000-21,000.

Reiterate Buy, TP pared down to INR 743: We believe JDSL’s margin has bottomed out in Q4FY25, and a gradual improvement is likely going ahead, aided by an expected uptick in high-margin exports volume, improved product mix, benefit of operating leverage and reduced volume from low-margin domestic segments.

In the long term, completion of ongoing projects would be a key trigger to improve performance. Thus, we reiterate Buy. We introduce FY28E and cut our EBITDA estimates by ~8% for FY26E and ~5% for FY27E, to factor in lower-than-expected volume growth going ahead. As a result, our TP is pared down to INR 743 from INR 783, based on 15x (unchanged) March 2027E P/E. Increased imports of low-cost material from China and other countries and demand slowdown from key end-user industries are key risks to our call.

Please refer disclaimer at Report

SEBI Registration number is INH000000933