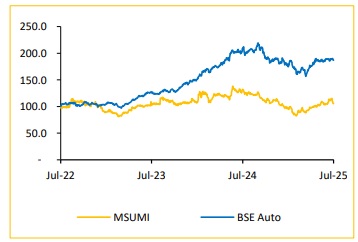

Add Motherson Sumi Wiring Ltd For Target Rs. 42 By Choice Broking Ltd

EBITDA margin is expected to remain under pressure in the near-term

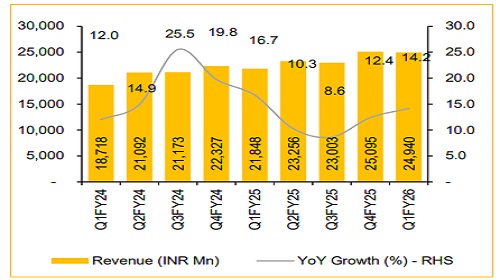

MSUMI reported a strong revenue growth of 14.2% YoY, but EBITDA margin was down 114 bps YoY due to a sharp jump in employee costs this quarter. This was primarily due to the new greenfield projects that involved significant manpower hired for training and upskilling before production lines are fully commissioned. We believe the EBITDA margin will remain negatively impacted in the next few quarters and start-up-related costs will also remain high in H1FY26. It is expected to moderate thereafter in H2FY26 and further improve in FY27 as new plants ramp up production and volumes come in.

View and Valuation:

We revise our FY26 and FY27 EPS estimate upwards by 1.9% and 1.5%, respectively, arriving at a target price of INR 42, valuing the company at 30x (maintained) of the average FY27/28E EPS while introducing FY28E estimates. We assign an ‘ADD’ rating to the company, which was previously ‘REDUCE’.

Q1FY26 results, led by margin pressure, are below estimates

* Revenue for Q1FY26 was at INR 24,940Mn, up 14.2% YoY and down 0.6% QoQ (vs consensus est. at INR 24,171Mn).

* EBITDA for Q1FY26 was at INR 2,443Mn, up 2.3% YoY and down 9.9% QoQ (vs consensus est. at INR 2,598Mn). EBITDA margin was down 114 bps YoY and 101 bps QoQ, respectively, to 9.8% (vs consensus est. at 10.7%).

* PAT for Q1FY26 was at INR 1,431Mn, down 3.9% YoY and 13.2% QoQ, respectively (vs consensus est. at INR 1,551Mn).

Revenue growth to be driven by greenfield projects:

MSUMI is in the process of scaling up three greenfield plants located in Pune (Maharashtra), Navagam (Gujarat) and Kharkhoda (Haryana). These greenfield plants are in different stages of completion and ramp-up. We remain positive on the long-term opportunity as the company is well-positioned to benefit from the industry’s shift towards EV and hybrid powertrains. These are expected to increase the content per vehicle as the content value in EV programs in passenger vehicles is approximately 1.5 to 1.7 times higher than ICE vehicles. Ongoing capacity expansion and incremental order wins are expected to drive a steady growth.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131