Accumulate ELGI Equipments Ltd for the Target Rs. 561 By Prabhudas Liladhar Capital Ltd

Decent Q2; Cautious on exports amid tariffs

Quick Pointers:

* Order conversion cycle has been elongated in international and domestic market amid tariffs related uncertainties

* Rs25bn of the Rs60bn capex plan has been delayed by about 12 months due to site rock conditions slowing construction

We revised our FY26/FY27 EPS estimates by -2.3%/-1.3% factoring in a cautious stance amid delays in order finalization and tariff-related uncertainties. Elgi Equipments (ELEQ) delivered a decent quarter with revenue up 11.4% YoY, though EBITDA margin contracted 184bps YoY to 14.5%. Domestic enquiry momentum remains healthy across industrial segments, but geopolitical and tariff-related uncertainties have elongated order-finalization cycles. In exports, the US business continued to grow across Industrial and Portable compressors with EBITDA at breakeven; tariff headwinds (~$9mn impact) could weigh on performance, though largely offset through pricing and cost actions, positioning ELEQ well for any potential benefit from rollback of tariffs. Europe remains challenging, prompting a structural reset—workforce rationalization and a shift to a hybrid go-to-market model—to improve customer reach and curb losses. Overall, while domestic momentum is supportive, global uncertainties and tariff-led pressures weigh on near term visibility. The stock is currently trading at a PE of 33.5x/29.2x on FY27/28E. We roll forward to Sep’27E and maintain our ‘Accumulate’ rating on the stock valuing it at a PE of 35x Sep’27E (37x Mar’27E earlier) with a TP of Rs561 (Rs559 earlier).

Long-term view: While order finalization and export scale-up amid tariff-related uncertainties remain key near-term monitorable, we believe ELEQ is poised for healthy long-term growth on the back of 1) it being among top 2/10 players in the Indian/global air compressors market, 2) technology development along with strong backward integration, 3) its growing global installed base driving highmargin aftermarket sales, 4) new product launches, and 5) market leadership in automotive garage equipment.

Higher employee costs and other expenses lead to margin contraction: Consol. revenue increased by 11.4% YoY to Rs9.7bn (Ple: Rs9.1bn). EBITDA declined by 1.2% YoY to Rs1.4bn (Ple: Rs1.2bn). EBITDA margin contracted by 184bps YoY to 14.5% (Ple:13.6%) primarily due to higher employee cost (+14.6% YoY to Rs1.9bn) and other expenses (+15.6% YoY to Rs1.7bn). Adj. PAT increased by 4.3% YoY to Rs988mn (Ple: Rs846mn) supported by higher other income (+42.2% YoY to 201mn)

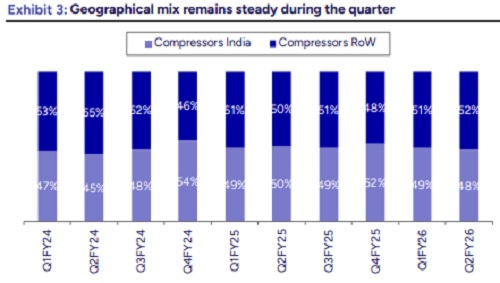

Regional performance: India, Middle Eastern and South American sustained growth momentum, with US and Australia seeing positive momentum with double digit growth. However, Europe was subdued due to economic headwinds ELEQ’s compressor mix stood at 48%/52% from India/RoW in Q2FY26 (vs 50%/50% in Q2FY25).

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271