Add Ashok Leyland Ltd for the Target Rs. 225 by Choice Institutional Equity

Structural Recovery Gains Traction across Core CV Segments: In Q3FY26, AL delivered its highest-ever volumes and revenue. Revenue rose 21.7% YoY, supported by GST-led price rationalisation and a revival in freight demand. EBITDA grew 26.7% YoY and margin improved 53 bps YoY to 13.3%, reflecting operating leverage and disciplined cost control. Volume momentum was broadbased, with domestic M&HCV and LCV industries growing 24% and 23% YoY, respectively, while AL continued to outperform in LCVs with 30% YoY growth. The re-entry of bulk buyers from January 2026, coupled with rising freight rates, reinforces demand sustainability. We believe this marks the early phase of a multi-year replacement cycle.

Strong Product Pipeline Underpins Market Share Expansion: AL continued to gain market share across key segments, with domestic M&HCV share at 30.9% YTD-FY26 and LCV share at 12.7%, supported by strong execution and an expanding network. Recent launches of 360 HP Hippo tractors and Taurus tippers align well with customer preference for higher productivity and lower total cost of ownership, while new LCV offering enhances competitiveness in last-mile logistics. Exports grew 20% YoY, adding diversification benefits. With improving subsidiary performance and an expanding green portfolio, earnings visibility continues to strengthen. We expect AL to deliver sustained earnings growth and market share gains through FY27E and beyond.

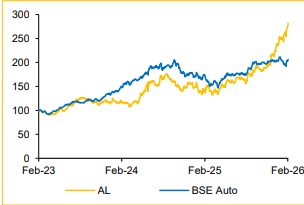

View and Valuation: We revise our FY26/27/28E EPS estimate upwards by ~6.0%/9.8%/12.4%, supported by stronger domestic volume assumptions amid the ongoing upcycle. We value AL’s core business at 22x on FY28E EPS, arriving at a value of INR 200. We assign a value of INR 18 to Hinduja Leyland Finance and INR 7 to Switch Mobility, resulting in a target price of INR 225. We downgrade the rating to ‘ADD’ from ‘BUY’ due to recent stock price appreciation and near-term margin pressure from commodity headwinds, while remaining positive on long-term fundamentals and growth prospects.

Revenue/EBITDA largely in line, while earnings beat our estimate

? Revenue was up 21.7% YoY and up 20.3% QoQ to INR 1,15,339 Mn (vs CIE est. at INR 1,17,707 Mn), led by 24.2% YoY growth in volume, partially offset by 2.0% YoY degrowth in ASP

? EBITDA was up 26.7% YoY and up 32.1% QoQ to INR 15,350 Mn (vs CIE est. at INR 15,067 Mn). EBITDA margin was up 53 bps YoY and up 119 bps QoQ to 13.3% (vs CIE est. at 12.8%)

? APAT was up 45.0% YoY and up 36.2% QoQ to INR 11,045 Mn (vs CIE est. at INR 9,994 Mn)

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131