Media & Entertainment Sector Report : Netflix-WBD deal: global entertainment reset

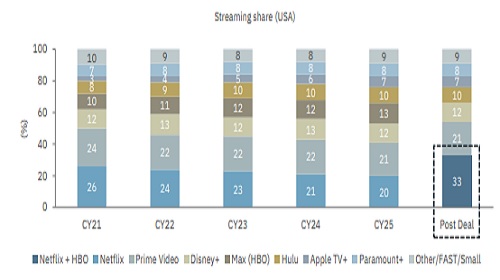

Netflix’s (NFLX US) lure for Warner Bros Discovery’s (WBD US) premium content outbids Paramount and Comcast in a USD 83bn deal. NFLX and HBO together could command ~33% of US streaming and surpass YouTube in total TV share. In India, the deal sharpens Netflix’s Subscription-video-on-demand (SVOD) leadership, expands its catalogue, and may unlock average revenue per user (ARPU) upside. For India exhibitors, Hollywood contributes 15-20% of Gross box office collection (GBOC), with WBD at ~4%; NFLX’s ability to shorten windows or test OTT-first launches could meaningfully drag EBITDA. With JioStar dominating sports and NFLX consolidating entertainment, smaller (OTT) and linear broadcasters (Z, SUNTV) may face rising competition with limited scale.

India’s movie exhibitors in a venerable position: Hollywood contributes ~15-20% of PVRINOX’s GBOC, and, within this, WBD accounts for ~20%, sharing ~4% GBOC. Although small in volume, English films deliver higher F&B and advertising yield, making them strategically important for exhibitors. For e.g., Superman-2025 film collected USD 395mn globally, but only ~USD 10mn in India (2% of global). Because India represents such a minor revenue pool for Hollywood studios, NFLX may gain room to experiment with WBD’s largefranchise titles by shortening theatrical windows or even testing direct-to-OTT launches in India to drive subscriber growth. Any such shift materially impacts exhibitors, especially in a post-COVID era where dependency on big-budget franchise films has increased. Therefore, in worst case, ~4% revenue impact on PVR-INOX may drag EBITDA by 6% in FY28E. Overall, the Netflix–WBD deal may pose a negative outlook for India’s exhibitors if release tilt toward OTT-first models.

Clouds to get darker on traditional entertainment: NFLX’s India M&E positioning is to get sharp, gaining share within SVOD and widening its appeal through catalogue across movies, originals, and global TV. With JioStar holding a sports monopoly, NFLX with the strongest entertainment recall, may aid in potential ARPU expansion in a highly pricesensitive market, renegotiate MG & distribution terms. NFLX leads India’s SVOD (~25% share) while JioStar leads AVOD (ex-YouTube); this deal further entrenches both players at scale, reinforcing their competitive strengths. It bolsters Netflix’s movie, IP and franchise development capabilities, accelerating India-based film production across OTT-first and theatrical formats. The strategic importance of IPL may rise, as JioStar needs to retain digital rights post-2028 to defend AVOD leadership against NFLX. Amazon Prime’s scaling ability may diminish as NFLX and JioStar dominate; smaller and niche OTT may seek partnerships with Amazon to remain viable. This could be negative for linear broadcasters like Zee Entertainment and Sun TV Network, with limited digital contributions (~15-10% of revenue) and restrict OTT growth amid content competition.

Competition for global streamers and multiplex to increase: In the US, NFLX and HBO could command a 33% market share withing streaming hours, 50% bigger than Prime at 21%. Also, with combined TV watch time share of ~14%, it is set to beat YouTube at ~13%, making it largest entertainer in the US, per Nielsen. NFLX strengthen its arsenal, posting against Disney Plus, Amazon Prime & boutique Apple TV, and all three will have to rethink content spend & M&A and improve library content. For cinema, the duo can fund mega budget scripts, likely risking blockbusters to go straight to OTT or lower box-office windows, dragging exhibitors as WB fills a big chunk of Hollywood weeks outside the US

NFLX-WBD “filtered” buyout: In an interesting deal, the world’s largest OTT platform (by subscriber count) has “tailored” the deal that powers its streaming services. NFLX is buying only WBD’s content engine valued at USD 83bn EV, including HBO, HBO Max, WB studios & DC Entertainment, and gives NFLX a super-premium content bundle instantly. Interestingly, this transaction spins-off Discovery Global (networks & sports assets, cable nets), keeping most of the linear part, rather a non-aligned part outside the deal. This deal is likely to close in the next 12-18 months once it gets US and EU regulatory approvals.

Advantage NFLX: The deal gives NFLX a ‘global must-have status’ in the entertainment space, due to: 1) premium content library that is already built and enjoys strong recall (Harry Potter, DC, Friends & Game of Thrones) and viewers can access all of them under one roof as a result, giving it 2) potential churn reduction between apps and pricing power, which may support better ARPU, 3) NFLX could emerge as a strong vertically integrated behemoth as WBD’s production engine with NFLX’s global distribution could accelerate content generation, and this could result in 4) cost synergies & scale efficiency, as NFLX has set a USD 2-3 bn annual savings target by the third year and the traction to be EPS-accretive by the second year

Above views are of the author and not of the website kindly read disclaimer

.jpg)