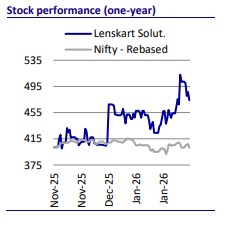

Buy Lenskart Solutions Ltd for the Target Rs.600 by Motilal Oswal Financial Services Ltd

Clear vision, strong execution

* Lenskart is India’s largest vertically integrated, technology-led, omnichannel eyewear platform, addressing a structurally underpenetrated eyewear category in India (53% of population impacted, modest ~35% penetration).

* Lenskart has built strong moats in a difficult-to-scale category through – i) a centralized, highly automated manufacturing facility and logistics network; ii) strong backward integration through in-house frame and lens manufacturing, which provides significant cost advantage; iii) large omnichannel presence through its mobile app and a network of ~2,439 retail stores across 435+ cities in India and ~705 international stores; iv) leveraging technology to ease constraints in scaling up eye tests, store expansions and delivering superior store economics (33% store-level pre-IND AS EBITDA, 10 months payback); and v) house-of-brands architecture spanning mass to premium eyewear, to achieve its goal of making quality eyewear accessible and affordable.

* We expect Lenskart to deliver a CAGR of 25%/53% in pro forma consolidated revenue/pre-IND AS EBITDA, largely driven by volume growth, product margin improvement, and ~625bp operating leverage-driven margin expansion over FY25-28 (~320bp over 9MFY26-FY28).

* Lenskart’s near-term FCF generation is impeded by upfront capex on the upcoming Hyderabad facility (to future-proof the business). However, we expect significant improvement in FCF generation (to ~65-70% of pre-IND AS EBITDA) beyond FY28.

* We initiate coverage on Lenskart with a BUY rating and a TP of INR600, premised on DCF-implied 55x FY28E pre-INDAS EBITDA. Our valuations for Lenskart are at a premium to other leading retailers, but we believe the multiples are justifiable, given Lenskart’s superior growth profile, limited organized competition and long growth runway.

Large addressable markets with unique challenges in scaling up

* Refractive error incidences have risen to 49% (~4b) of the global population, with India and Southeast Asia accounting for ~30% (~1.2b) of such cases.

* The total addressable market (TAM) for Lenskart in its existing geographies stands at ~INR2.3t+, with its market share at ~5% in India and <2% in international markets, providing a large growth runway.

* Despite a large market size (INR790b in FY25) and strong latent demand (53% of the population requiring vision correction), India’s eyewear market is significantly underpenetrated (~35% prescription eyeglass penetration in total incidences), with very low organized retail share in eyewear (~24%).

* The massive under-penetration reflects structural gaps such as significant customization needs to manufacture eyewear for each individual, import dependence, low awareness, limited access to optical stores (~60 per million population), shortage of trained optometrists (~35-50 per million population), lack of affordability, and standardized service delivery.

A scaled market leader with strong moats in eyewear market

* Lenskart’s automated centralized just-in-time manufacturing, which replaces the fragmented, store-level lens cutting, allows the company to deliver micron-level precision at scale at lower costs and faster fulfilment timelines.

* The company’s rising focus on vertical integration into manufacturing of lenses and frames allows it to launch new designs frequently and at ~35-40% lower costs compared to third-party procurement by eliminating huge retail mark-ups.

* Centralized manufacturing and vertical integration also position the company to drive margin expansion while maintaining complete control on product quality.

* Lenskart is investing ahead of the demand in the upcoming Hyderabad facility to extend its manufacturing capabilities to future-proof the business, tackle the large latent demand and improve turnaround times.

* Scaling up the eye-testing infrastructure remains an important KPI for Lenskart. The company is leveraging technologies such as remote optometry, self-eye checkup and rapid expansion in its omnichannel retail footprint.

* Lenskart’s retail footprint spans 2,439 stores across 435+ cities in India and 705 stores internationally, primarily in Japan, Southeast Asia and the Middle East.

* Its house-of-brands architecture, supplemented by strategic acquisitions, spans mass to premium eyewear, allowing Lenskart to address multiple consumer cohorts and use cases. This has structurally increased customer engagement, with recent customer cohorts purchasing ~3.5 units within two years (vs. industry average of ~1.8), driving higher wallet share and repeat behavior.

* Lenskart has embedded technology in every area of its operations across customer engagement, supply chain, and retail store operations to achieve its goal of making quality eyewear accessible and affordable.

* This technology layer allows Lenskart to scale high-volume, standardized medical service delivery with fast-fashion speed while improving repeat rates and personalization. Structurally, Lenskart today operates as a manufacturingscaled consumer-tech platform rather than a traditional optical retailer.

Superior store economics and under-penetration to drive store expansion

* Lenskart’s stores function primarily as experience centers with eye-testing facilities, while the bulk (~75%) of its inventory is centrally managed under justin-time framework, which makes it a capital-light and scalable model.

* The company’s centralized inventory, in-house manufacturing, and technologyled expansion translate into best-in-class store economics, with ~33% store-level pre-Ind AS EBITDA margins, and a consistent ~10-month store payback period across tiers, materially superior to most discretionary retail formats.

* Store expansion has accelerated meaningfully in recent years. During FY23-25, Lenskart added ~760 stores, with incremental additions increasingly skewed toward tier-2+ markets (~215 stores).

* We expect a potential for Lenskart to add 4,200+ stores over the medium term, based on GeoIQ data on 6,400 viable pin codes for Lenskart stores in existing and new markets. Accordingly, we build in 1,480+ net store additions for Lenskart in India (~20% FY25-28 CAGR).

* International store expansion is likely to be more calibrated, with a focus on improving store throughputs. We build in modest ~65 net store additions annually for Lenskart in its international markets.

India: 27% revenue CAGR with scale-driven margin expansion over FY25-28

* We expect Lenskart’s India segment to deliver a robust ~27% pro forma revenue CAGR over FY25-28, led primarily by volume growth (~24% CAGR) amid accelerated store expansions (~500 annually).

* Based on our estimates, Lenskart’s market share in the Indian eyewear industry is likely to reach ~8.3% by FY30 from ~5% in FY25.

* Driven by rising backward integration and scale efficiencies, we build in ~95bp product margin expansion in India over FY25-28 (vs. 500bp expansion during FY23-25).

* Overall, we expect ~52% CAGR in pre-IND AS EBITDA, driven by ~700bp pre-IND AS EBITDA margin expansion over FY25-28 (~280bp over 9MFY26-FY28).

* The key driver for margin expansion would be ~95bp gross margin expansion and the remaining ~605bp from operating leverage (of which ~420bp gain is already reflecting in 9MFY26) especially on tech, central and marketing costs.

International: 22% revenue CAGR with 550bp margin gain over FY25-28

* We expect Lenskart’s international business to deliver a ~22% pro forma INR revenue CAGR over FY25-28, led primarily by volume growth (~18% like-for-like volume CAGR).

* Unlike India, the growth in international markets would be driven by improved throughput amid calibrated store expansions.

* Based on our estimates, Lenskart’s market share in the relevant international markets is likely to reach ~3.5% by FY30 from ~1.8% in FY25.

* Driven by the ramp-up in under-penetrated markets, we expect Lenskart’s international product margins to improve ~165bp over FY25-28 (or modest ~60bp over 9MFY26-FY28 vs. ~390bp expansion over FY23-25).

* Overall, we expect ~65% CAGR in pre-IND AS EBITDA, driven by ~550bp pre-IND AS EBITDA margin expansion over FY25-28 (~305bp over 9MFY26 levels).

* The key driver for margin expansion would be ~165bp gross margin expansion and the remaining ~385bp from operating leverage (of which ~135bp improvement is already reflecting in 9MFY26).

Est. revenue/pre-INDAS EBITDA CAGR of 25%/53%; FCF to improve by FY28

* Overall, we expect Lenskart to deliver a ~25% consolidated pro forma revenue CAGR over FY25-28, driven by steady store additions (~17% CAGR) and strong volume growth (~24% CAGR), supported by high repeat rates and rising category penetration.

* With improving gross margins, rapid fixed-cost absorption at scale, and capitalefficient store economics, we expect ~53% CAGR in pre-IND AS EBITDA with ~625bp margin expansion over FY25-28E (of which ~305bp improvement already reflecting in 9MFY26).

* With improving profitability, we expect Lenskart to generate cumulative pre-IND AS EBITDA of ~INR41b over FY25-28, with 70%+ conversion to OCF (~INR30b cumulative OCF generation over FY25-28).

* Near-term FCF generation will be impeded by elevated capex for Hyderabad facility and accelerated store expansions. However, beyond FY28, we expect capex to taper to ~INR5.5b annually, leading to improvement in FCF conversion to 65-70% of pre-IND AS EBITDA.

Valuations and view: Initiate coverage with BUY rating and TP of INR600

* We believe Lenskart’s central manufacturing-led architecture, superior store economics, technology-led expansion, and house-of-brands strategy create durable moats in an under-penetrated industry.

* Lenskart trades at ~42x FY28E EV/pre-IND AS EBITDA (~18% premium to other large retailers in India), though we believe the multiples are justifiable, given its superior growth profile, limited organized competition in eyewear category and long growth runway.

* Lenskart trades at ~0.8x FY28E EV/EBITDA vs. FY25-28E EBITDA CAGR (lower vs. ~1.1-3.0x for leading fashion and grocery retailers and ~1.1x for Nykaa). While repeat purchases are less frequent in eyewear, the organized competition is also significantly lower vs. apparel, grocery and beauty & personal care, which could enable stronger growth runway, margin expansion and superior FCF generation.

* We initiate coverage on Lenskart with a BUY rating and a TP of INR600, based on DCF-implied ~55x FY28E consolidated pre-IND AS EBITDA (implies ~36x FY28E reported EBITDA and ~91x FY28E pre-IND AS EPS).

* Lenskart’s valuations are highly sensitive to growth and margin expansion in the India business. We believe at CMP, the stock is pricing in ~23% India revenue CAGR (vs. our base case estimate of ~27%) and ~15.8% India pre-INDAS EBITDA margin (~100bp lower than our base case estimate).

* Stronger-than-expected revenue growth and/or sharper margin expansion could drive further upside risks to our TP, while lower growth and or weaker-thanexpected margin expansion poses downside risks (bull case: INR735; bear case: INR395).

Key risks and concerns

* Significant dependence on China for import of raw materials

* High concentration of manufacturing operations in North India ? Loss-making overseas subsidiaries dilute overall profitability

* Shortage of trained optometrists

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412