Buy Hindalco Ltd for the Target Rs.1110 by Motilal Oswal Financial Services Ltd

In-line performance; Novelis to remain overhang on earnings

Consolidated performance

* Consolidated net sales came in line at INR665b (+14% YoY and flat QoQ), driven by favorable pricing and a better product mix.

* Consolidated EBITDA stood at INR80b (in line with our estimate), rising 5% YoY, but declining 11% QoQ, primarily due to muted Novelis earnings amid lower shipments following the Oswego fire.

* Adj. PAT came in line at INR39b (+3% YoY), declining 20% QoQ, primarily led by weak earnings from the Novelis business.

* The company recorded an exceptional item related to repair, clean-up, and restoration expenses at the Oswego plant following the fire incident. The costs associated with the event (net of insurance proceeds) amounted to INR26b (USD291m) during the quarter.

* Consolidated net debt increased to INR595b as of Dec’25 from INR353b in Mar’25 and INR418b in Dec’24.

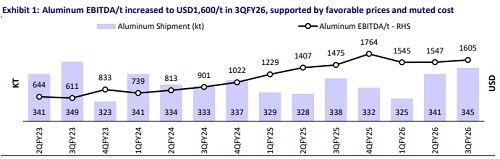

Aluminum business

* Upstream revenue stood at INR106b (+6% YoY) and EBITDA stood at INR48b (+14% YoY; USD1,572/t), driven by higher volume and favorable pricing in 3Q.

* Downstream revenue stood at INR39b (+22% YoY) on account of higher shipments and favorable pricing. Downstream EBITDA stood at INR2.3b (+55% YoY), led by a better product mix. This translated into EBITDA/t of USD241 (+35% YoY) in 3QFY26, compared to USD265 in 2QFY26.

* Upstream aluminum sales stood at 345kt (+2% YoY) and downstream aluminum sales stood at 108kt (+9% YoY) in 3QFY26.

Copper business

* Copper business revenue stood at INR182b (+33% YoY) on account of higher average copper prices.

* EBITDA for the copper business came at INR6b in 3QFY26, down 23% YoY, led by a sharp decline in TC/RCs.

* Copper metal sales stood at 122kt (+1% YoY) in 3QFY26, and CCR sales were at 82kt, down 14% YoY, primarily due to a weaker domestic market amid higher LME and elevated channel inventories.

Novelis - 3QFY26 result update

* Revenue was largely in line at USD4.2b, rising 3% YoY due to healthy NSR, but declined 12% QoQ over muted shipments.

* NSR stood at USD5,174/t (+15% YoY and +3% QoQ), supported by favorable aluminum prices. Total rolled product shipments stood at 809kt, down 11% YoY and 14% QoQ, primarily due to a shipment disruption of 72kt at Oswego following the fire incident (guided ~75kt earlier). Shipments (excl. fire impact) declined 3% YoY, largely due to underlying muted demand.

* Adj. EBITDA declined 5% YoY and 18% QoQ to USD348m (our est. USD320m) due to an adverse shipment impact of USD54m following the Oswego fire and tariff impact of USD34m. The beat on adj. EBITDA was mainly driven by lower-thananticipated impact from the Oswego fire and tariff of USD100m.

* Adjusted EBITDA/t stood at USD430 (our est. USD380), up 6% YoY/down 4% QoQ. Adjusted EBITDA/t (excl. tariffs and Oswego fire-led shipment impact) stood at USD495.

* The company reported a net loss of USD160m, which included an exceptional item of USD286m. The exceptional item consisted of USD327m related to the Oswego fire losses/net recoveries and USD86m related to others, partially offset by a metal price lag of USD127. Adj. PAT stood largely in line with our estimate at USD69m, down 45% YoY and 53% QoQ.

Highlights from the management commentary

* India Aluminum (Upstream) CoP is expected to rise ~1% QoQ, primarily due to higher CP Coke (anode) prices amid China supply-demand tightness.

* Novelis’ cost to serve is expected to remain elevated, in line with 3Q levels, due to increased external slab sourcing and supply chain reorientation, though Midwest premium arbitrage could provide some offset.

* Consolidated net debt/EBITDA stood at 1.73x. Management targets to keep it below the threshold of 2x. Net debt increased ~INR240b during 9MFY26, largely driven by Novelis’ negative FCF (capex + working capital + fire impact) and working capital build-up of ~INR40b due to higher copper concentrate inventory.

* AV Minerals raised USD800m at SOFR + 105bp (five-year tenure) to fund higher Bay Minette costs. The weighted average cost of Novelis debt stands at ~5.3%, while the cost of capital is in the mid-8% range.

* 4QFY26 aluminum hedging: 64% commodity hedged at USD2,807/t and 26% currency hedged at INR88.18/USD. For FY27, the aluminum hedging stood at 21% at USD2,925/t and targets to achieve ~25% at USD3,000/t.

Valuation and view

* HNDL posted in-line consolidated performance in 3QFY26. Earnings growth was primarily driven by favorable pricing. Going forward, the strong earnings outlook for the Indian business will remain intact. However, the overall Hindalco business outlook has weakened following the Oswego fire incident and the Bay Minette project cost escalation to USD5b from USD4.1b.

* Novelis’ volumes are expected to decline 150-200kt, with an FCF impact of USD1.3-1.6b (incl. an EBITDA impact of USD150-200m till 2QFY27), which erodes near-term earnings visibility and stretches the working capital. Management expects to recover ~70-80% via insurance in the next 18-24 months in a phased manner.

* We maintain our consolidated earnings, supported by a strong domestic business outlook, offsetting the muted Novelis profitability for FY26-27E.

* At CMP, the stock trades at 7.4x EV/EBITDA and 1.7x P/B on FY27E. We reiterate our BUY rating on HNDL with an SoTP-based TP of INR1,110.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)