Buy Infosys Ltd For Target Rs. 2,150 By Emkay Global Financial Services

Infosys reported better than expected revenue growth in Q3. Revenue grew 1.7% QoQ CC, partly aided by increase in pass-through revenue and incremental contribution (20bps) from the in-tech acquisition. EBITM expanded by 20bps to 21.3%, in line with expectation. Deal-win (worth USD2.5bn) was steady, with net new deals TCV up 57% QoQ. Deal pipeline has also improved, with the large-deal pipeline becoming stronger. Q3 saw improvement in the discretionary spending environment in the Retail and CPG in North America, and BFSI in Europe; this follows improvement in BFSI in North America in Q2. Demand is stable in other industries, with cost optimization driving the spends. It has upped FY25 revenue growth guidance for the 3rd consecutive quarter to 4.5-5% (3.75-4.5% earlier). However, this implies sequential decline of 2.5% to 0.6% in Q4, negatively impacted by seasonality of pass-through revenue and lesser working days. We tweak FY25-27E EPS by less than 1%, factoring in the Q3 performance. We retain BUY and TP of Rs2,150 at 28x Dec-26E EPS.

Results Summary

Infosys reported revenue growth of 0.9% QoQ (1.7% CC) to USD4.94bn, ahead of our estimate of USD4.87bn. Cost of third-party items bought for service delivery to clients increased by ~150bps QoQ, reflecting increased contribution from pass-through revenue, largely explaining the revenue beat. EBITM expanded by 20bps to 21.3%, in line with our estimate. Margin expansion was aided by currency tailwinds (40bps), benefits accruing from Project Maximus (30bps), and lower provision for post-sales customer support and expected credit loss (20bps), partially offset by higher furloughs and lesser working days (-70bps). Among verticals, Financial Services (3.1% QoQ), Retail (4.7%), Lifesciences (5.1%), and EURS (0.9%) saw growth, while Communications (-5%), Manufacturing (-0.4%), Hi-Tech (-0.3%), and Others (-12.1%) saw a decline. North America, Europe, and India grew 2.7%, 0.9%, and 0.9%, respectively, while ROW declined 9.5%. Headcount grew 1.8% QoQ to 323,379. LTM attrition inched up to 13.7%, from 12.9% in Q2FY25. What we liked: Steady operating performance, healthy cash conversion (OCF/EBITDA 110.7%). What we did not like: Weakness in top-5 clients, Q4 implied guidance.

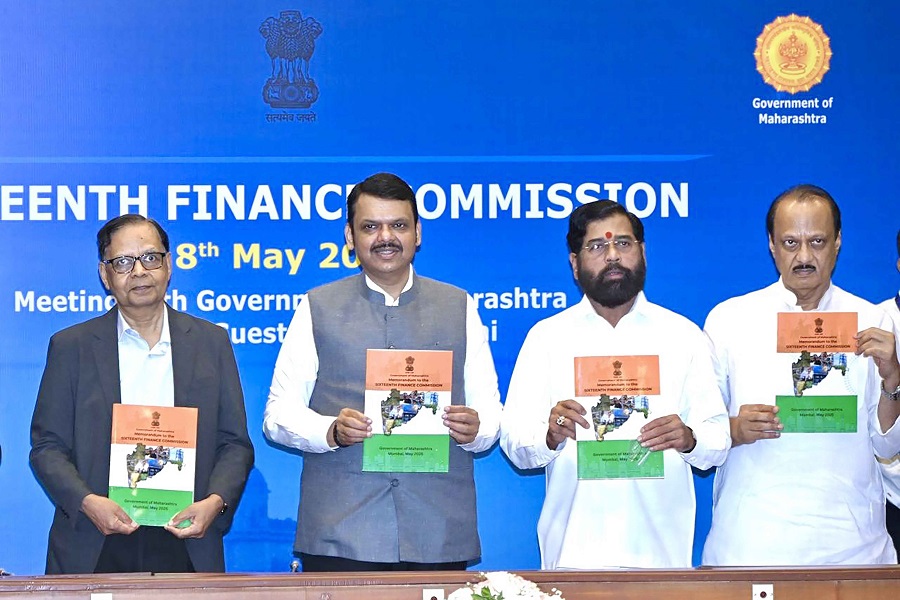

1-Year share price trend (Rs)

Earnings Call KTAs

1) The mgmt highlighted it is beginning to see positivity in discretionary spends led by revival in BFSI in North America since a couple of quarters (esp in capital markets, mortgages, cards, payments), and now in Europe. Retail and CPG in North America is also seeing uptick in demand and deal booking. Automotive sector in Europe, however, remains under pressure, while other verticals saw no change. 2) Client focus continues on cost optimization, though an increased traction is witnessed in spending toward new growth areas like AI, cloud adoption, cybersecurity data, and analytics. 3) The company closed 17 large deals in Q3 – 11 in America and 6 in Europe. 4) BFSI saw a third consecutive quarter of volume growth, reflecting continued positivity in demand. 5) The company plans to roll out wage hikes in 2 phases – first in January (majority of the employees) and the second in April. The average wage hike is likely to be 6-8% for Indiabased employees. 6) The mgmt indicated that realization improved 3.6% YoY in 9MFY25 on the back of progress in value-based selling under Project Maximus. 7) The mgmt attributed weakness in top-5 clients to furloughs and currency impact. 8) The company is developing 100 new Gen AI agents for deployment across clients. It has developed 4 small LLMs – for banking, IT operations, cyber security and, broadly, for enterprise.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354