Buy Happiest Minds Technologies Ltd for the Target Rs. 730 by Choice Broking Ltd

Business Overview:

HAPPSTMN is an AI-led, customer-first digital engineering company offering secure, scalable solutions, from chip to cloud. It specialises in product engineering, cybersecurity, analytics & automation, serving industries such as BFSI, EdTech, Healthcare, Mfg. & Retail. With expertise in GenAI & strong partnerships with Microsoft & AWS, HAPPSTMN drives innovation through platforms, such as Arttha, a unified digital payments suite & FuzionX, a next-gen gaming studio. With over 6,500 professionals in 43 global offices and more than 280 clients, the company blends creativity and advanced tech to deliver a transformative digital experience across diverse sectors.

How can HAPPSTMN benefit from value migration in India’s tech sector ?

HAPPSTMN has a well-diversified portfolio in over 9 industry verticals, which helps de-risk its operations from adverse micro- or macroeconomic conditions affecting any single sector. The company is a leading digital services provider, with approximately 95% of its revenue generated from digital offerings, such as Cloud, SaaS and Analytics — segments that continue to deliver robust, double-digit annual growth.

Among its business units, the GenAI division, which currently contributes 2.3% to the company’s top line, is also experiencing strong sequential double-digit growth. We believe this sustained momentum in digital services positions HAPPSTMN uniquely in India’s IT sector and supports its long-term growth outlook.

Why invest in HAPPSTMN ?

HAPPSTMN’s growth is backed by consistent execution & strategic initiatives amid market uncertainties. The company posted its 20th consecutive quarter of QoQ growth in Q1FY26. HAPPSTMN’s strategic transformation focuses on vertical reorganisation, GenAI & client acquisitions driving sustainable growth. Targeting high-potential sectors, such as Cloud, Data, Cybersecurity & AI, it emphasises BFSI & Healthcare. Arttha Banking platform is projected to grow 20–25% YoY, while the SaaS-based "Insurance in a Box" gains traction, alongside strong momentum in Medical Devices & Bioinformatics.

Operationally, HAPPSTMN continues to improve efficiency, with utilisation increasing by 150 basis points to 78.9%. This improvement was driven by non-linear growth, supported by negligible headcount addition. Its GenAI unit grew 12% QoQ & Automation services grew 14% QoQ, helping clients manage cost pressures. India revenue rose 21% QoQ, now comprising 17.6% of total, showing successful geographic diversification. With 10 transformational initiatives underway, robust vertical growth (TME 18%, Manufacturing 22%) & continued investments, HAPPSTMN is on track for double-digit profitable growth in FY26E & FY27E.

Valuation:

We currently have a ‘BUY’ rating on the stock with a target price of INR 730.

Key Risks:

Platform Performance & Scalability Concerns: Arttha Banking & Insurance-in-a-Box platforms must meet scalability & performance expectations; any underperformance or technical flaws could hinder client satisfaction & market adoption.

Margins & Competition Pressure: The digital IT services sector faces fierce competition, with pricing pressure from major players or shift in client demands. Investments in GenAI are vital, yet delayed or failed returns could strain margins & impact short-term financial performance.

Deal Conversion at Risk amid Economic Volatility: The rebound in tech spending is contingent upon favourable macro trends. Any global economic downturn or delayed recovery could weaken enterprise IT budgets, affecting pipeline conversion and revenue growth.

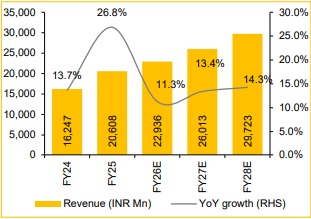

Revenue expected to grow at 13.0% CAGR over FY25-28E

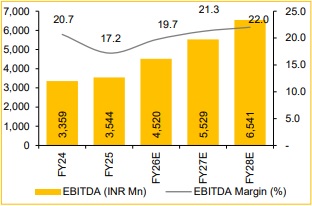

EBITDA expected to grow at 22.6% CAGR over FY25-28E

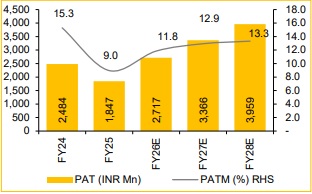

PAT to grow at 28.9% CAGR over FY25-28E

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131