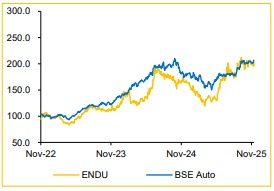

Reduce Endurance Technologies Ltd For Target Rs. 2,820 By Choice Broking Ltd

Broad-based Growth despite Near-term Margin Pressure: ENDU delivered a strong operational performance in Q2FY26, led by broad-based growth across India and Europe and sustained traction in proprietary and EV-linked products. Consolidated revenue grew 23% YoY to INR 35,828 Mn, with EBITDA rising 24.8% YoY to INR 4,768 Mn (13.3% margin), demonstrating steady topline expansion despite short-term margin pressure. On a standalone basis, revenue grew 16.2% YoY, significantly outpacing domestic 2W industry’s 10.3% YoY growth, reaffirming Endurance’s ability to outperform the market through customer diversification and value-added product offering. However, EBITDA margin declined 116 bps YoY to 12.5%, primarily due to temporary cost headwinds, which we view as strategic investments for growth.

We believe the company’s focussed investments in capacity expansion, R&D and technology partnerships position it well to capture upcoming regulatory tailwinds (ABS/Brakes) and EV market opportunities.

EU Delivers Steady Growth with Accelerating EV and Hybrid Transition: ENDU’s European operations exhibited resilient growth momentum with 32.5% YoY revenue growth in EUR terms. Excluding the Stöferle acquisition and tooling income, underlying growth stood at 7.8%, broadly in line with the 7.7% rise in EU’s new car registrations. While sequential turnover softened due to seasonal factors (August holiday period), we expect Europe to sustain mid-to-high single-digit growth in FY26E, supported by strong EV and hybrid order pipelines.

View and Valuation:

We revise our FY26E/27E EPS estimate downwards by 6.3%/0.5%, factoring in near-term margin pressure from elevated raw material cost, higher employee and consulting expenses and maintain our target price of INR 2,820. We value the company at 30x (maintained), on the average of FY27/28E EPS. Hence, we maintain our “REDUCE” rating on the stock.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131