Buy LG Electronics India Ltd For Target Rs. 2,050 By Emkay Global Financial Services Ltd

Growth acceleration ahead; Valuations attractive

We initiate coverage on LG Electronics India (LG) with BUY and TP of Rs2,050 (80% upside), at 50x Sep-27E PER (at 10% premium to Havells). LG has, over the last 3 decades, built a formidable franchise, which leads in key large appliance categories with premium positioning, leveraging its global R&D strength, brand power, and superior execution. Following the parent's 'Global South' strategy (announced in Jul-25; link) of driving global growth, India (the largest appliance market for the parent outside the US, Korea) would play an important role and is likely to contribute 1/3rd of global growth over 5Y; on expansion into mass-premium categories (refer to LG Korea’s 1QCY25 earnings call; link), a higher focus on B2B (HVAC, information displays, etc), and rising exports, India would emerge as a key exports hub with start of the third plant in FY27E and localized innovation-led launches. This, amid signs of demand revival, is set to accelerate LG’s growth, with 13% revenue CAGR over FY26E28E translating into 14% EPS CAGR, robust average RoE/RoCE of ~32%/44%, coupled with net cash of Rs37bn in FY25 (~Rs50bn in FY28E), FCFE yield (basis sales) of 7.6% by FY28E, and an average dividend payout of 65% (FY27E-28E). Key risks: Continued industry-wide demand slowdown, rise in competition.

India business a formidable franchise; strategically important for the parent

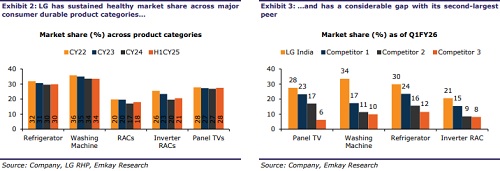

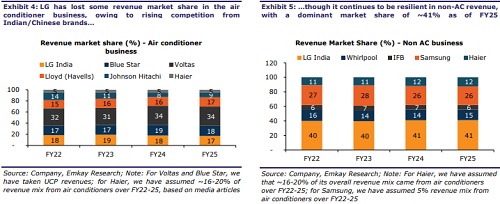

LG is the benchmark franchise, with market leadership across categories: Refrigerators (34%), Washing Machine (30%), TVs (20%), and RACs (18%) in Q1FY26. LG commands a higher market share in premium categories: ~25% of its revenue (vs ~15% industry); likely to rise to ~40% (vs industry’s ~27%) over 5Y. As part of the ‘Global South’ strategy, India is crucial and likely to contribute 1/3rd of growth for LG Korea over the next 5Y.

Parent’s ‘Global South’ strategy to accelerate growth for India operations

As part of the ‘Global South’ strategy, India is increasingly becoming a strategic growth driver for LG Korea. LG Korea is positioning India as an export hub for several markets like Brazil and Mexico as well as entering mass-premium categories in India to drive growth. We believe LG's mass-premium products (for exports), aided by the new plant in FY27E, improving localization trends (~54% of RM sourced domestically in FY25; ~2- 3% improvement expected each year), a higher focus on B2B (HVAC, information displays, etc), and a rising export share from 6% to ~10-15% by FY30P would push revenue to 13% CAGR (8% CAGR over FY19-26E), with 14% EPS CAGR over FY26E-28E.

Earnings to accelerate; valuations attractive

After a relatively muted ~6% EPS CAGR in FY19–26E, we expect a growth revival, with revenue/EPS CAGR of ~13/14% over FY26E–28E on the back of stable margins (~13%) and a net-cash balance sheet, leading to robust return ratios (32% RoE /44% RoCE), and FCFE yield (basis sales) of ~7.6% by FY28E. We believe LG deserves a premium multiple (50x; Exhibit 19) given its diversified category leadership and focus on growth via masspremium product expansion, coupled with high RoE (~31-33% over FY26E-28E) vs peers’ like Havells (~14-20%) and Blue Star (~18-21%), justifying a ~50x multiple.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354