Hold Hindalco Industries Ltd for the Target Rs.907 by PL Capital

Quick Pointers:

* Oswego hot mill to restart in late Q2CY26 lowering FY27 volumes while fire impact to continue. Bay Minette volume to start flowing from FY28.

* Leverage rises sharply from Novelis to bridge the gap of impacted FCF, management guides cons. net debt/EBITDA to remain below 2x.

We downgrade our rating to ‘Hold’ from ‘Accumulate’ with a revised TP of Rs907 (earlier Rs962) valuing Hindalco India biz at higher multiple of 6x EV of Sep’27E EBITDA (earlier 5.5x) on higher leverage arising from Oswego incident and potential risk of capex delays while higher LME aids India. Hindalco Industries (HNDL) delivered in-line Q3 cons operating performance, supported by strong India performance which offset drag from Novelis. Ally hedging and 1% rise in CoP has limited India EBITDA. While higher LME is supporting India, sharp rise in net debt to compensate for USD1.3-1.6b hit on Novelis FCF is erasing our TP.

Novelis reported a volume miss and parent’s USD750m equity infusion during Q3 as Oswego fire has strained cash flows in reorienting supply chain. Delays in plant restart along with rising debt levels ahead of insurance recoveries are likely to keep leverage elevated till FY28E. Consistent improvement in downstream volumes and coal supply from captive Chakla/Bandha mines over next few quarters would drive India earnings. We cut our FY27/28E EBITDA by 3/1% incorporating higher debt, volume loss and tad higher LME (USD3,000/ 2,970 Vs USD2,905/ 2,847 earlier). Novelis is undergoing temporary headwinds and to be keenly watched as we build in ~200kt volumes from Bay Minette in FY28. At CMP, the stock is trading at EV of 6.7x/6.2x FY27/28E EBITDA. Hold.

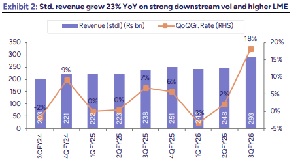

Higher LME and better downstream ally volumes aids India revenue: Standalone AL revenue grew 7% YoY while copper revenue grew 33% YoY. Upstream AL revenue is up 6% YoY on better realization (avg LME ally up 8%; hedging restricted benefits) and EBITDA up 14% due to lower operating cost driving upstream EBITDA to USD 1579/t. Downstream revenue is up 22% YoY on account of higher shipments (9% YoY to 108kt) and realization. EBITDA is up 55% YoY on account of favorable product mix leading to downstream EBITDA of USD 243/t. Copper revenue is up 33% YoY despite 14% decline in CCR sales (due to higher channel inventories and weak demand), on account of higher realization (avg LME CU up 21%) while EBITDA continues to decline on weak TcRc (-23% YoY). AL upstream sales volumes grew 2% YoY to 345kt, downstream sales volumes grew 9% YoY to 108kt. Blended realization for AL business inched up 7% QoQ to Rs256k/t (up 3% YoY) while copper business realization improved 16% QoQ to Rs1,494k/t (up 31% YoY).

Strong 12% India EBITDA growth but sharp rise in net debt too: Standalone EBITDA grew 59% YoY to Rs42.5bn (+14% QoQ) on higher LME, strong 9% YoY growth in downstream volumes and lower operating expenses. Cons. EBITDA grew 5% YoY at Rs80bn (-11% QoQ; PLe Rs81bn) impacted by Novelis despite strong HIL performance. Cons. reported PAT declined 45% YoY to Rs20.5bn. Exceptional items include Rs26.bn for expenses related to the Oswego fire and 0.59bn on account of new labor code. Cons. net debt increased by Rs180.46bn QoQ to Rs 594bn. Net debt to EBITDA increased to 1.73x vs (1.23x in Q2FY26).

Novelis: cost savings guidance raised while net leverage rises: Novelis has increased its guidance under global cost efficiency program to exit FY26 at USD 150mn run rate (from USD125mn earlier). Net debt increased USD 405mn QoQ to USD 6.2bn in Q3FY26. Net leverage increased to 3.7x (from 3.5x) with total liquidity at USD 2.55bn. Management indicated that net leverage could temporarily rise to the range of over high 4x due to fire related restoration costs and lower EBITDA during reorientation of supply chain to serve North American markets.

Region wise volumes & EBITDA/t: Shipments of flat rolled products (FRP) were down 10.5% YoY to 809kt (-14% QoQ, PLe 829kt) impacted by twin fire incident at Oswego. Lower shipments to the automotive, beverage packaging and specialties segments were due to production disruption of ~72kt at Oswego, which was partially offset by higher aerospace shipments. Shipments of FRP declined ~21% YoY in N.A. to 283kt due to Oswego fires; Europe volumes grew ~16% YoY to 262kt on higher beverage packaging, aerospace and specialty shipments. Automotive volumes supported North America amid disruptions at customers end. Asia volumes grew ~23% YoY to 189kt driven by beverage packaging and aerospace but automotive shipments were lower and S.A were up 3% YoY to 170kt led by beverage packaging, mix deterioration and poor weather impacted operations.

Novelis’s adjusted EBITDA/t was up ~6% YoY to USD 430/t (-4% QoQ; PLe USD 500/t) impacted by USD54mn from Oswego fire and USD34mn from tariffs. EBITDA/t declined 2% YoY in N. A. to USD332/t; grew ~37% YoY to USD298/t in Europe. While in Asia EBITDA/t fell 37% YoY to USD 254/t and in S.A. almost up 5% YoY to USD 765/t.

Above views are of the author and not of the website kindly read disclaimer.

.jpg)