Reduce Hindalco Industries Ltd For Target Rs.631 By InCred Equities

Downgrade to REDUCE

* Peak aluminium: Macro-driven rally + rising scrap (1.4bn tonne pool; Source: IAI) may drive a 20% price dip, hurting Hindalco Industries’ India biz margins.

* High capex = higher leverage: Rs700bn FY26F-28F capex likely lifts debt; stock typically trades 7.5× EV/EBITDA in such cycles.

* EBITDA may fall to Rs260bn by FY28F; downgrade to REDUCE with a lower target price of Rs631. The upside risk is sustained high aluminium prices

Peak aluminium prices don’t bode well for Indian operations Aluminium’s rally appears largely macroeconomic-driven particularly by expectations of a weaker US dollar rather than tight fundamentals. Current prices keep most primary smelters globally viable, limiting supply discipline. Meanwhile, higher prices are boosting scrap collection, with the primary-over-scrap spread at +2SD above the long-term average, typically triggering a strong recycling response. The global used-aluminium pool is 1.4bnt (billion tonne), as per data from the International Aluminium Institute (IAI), and the scrappage rate can rise from the historical 1.4–1.5% to 1.7% during high-incentive periods. As macroeconomic support fades and scrap supply improves, we expect aluminium prices to decline by 20% over the next year, which would negatively impact Indian operations of Hindalco Industries, given the company’s sensitivity to London Metal Exchange (LME) prices.

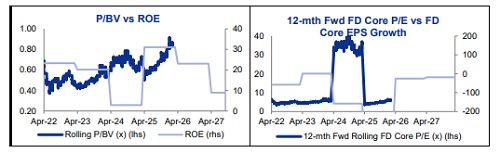

Higher capex will lead to leveraging of balance sheet Hindalco Industries is undertaking a massive capex program of Rs700bn over FY26FFY28F, which is likely to increase balance sheet leverage. As capital work-in-progress rises, the market may begin assigning incremental value to ongoing investments. Historically, during such capex cycles, Hindalco Industries has traded at 7.5x EV/EBITDA.

EBITDA to decline to 260bn in FY28F from 366bn in FY26F The decline in aluminium prices will lead to decline in EBITDA, which will lead to a rise in net debt/EBITDA ratio to more than 2 in FY28F. While this is not alarming, remember our numbers build in no increase in working capital as aluminium prices decline. If working capital requirement increases, then debt/EBITDA ratio can be higher.

We downgraded our rating to REDUCE with a lower TP of Rs631 We value Hindalco Industries at 7.5x EV/EBITDA and downgrade its rating to REDUCE (from ADD) with a lower target price of Rs631 (Rs785 earlier). Upside risk: Sustained strength in aluminium prices.

Above views are of the author and not of the website kindly read disclaimer