Buy Hindalco Industries Ltd for the Target Rs.1,120 by JM Financial Services Ltd

Hindalco reported 3Q consol. adj. EBITDA of INR79.7bn, marginally lower than JMfe of INR84bn. EBITDA decline of ~11% QoQ was driven by weak performance in Novelis given Oswego fire incident. India aluminium EBITDA incl Utkal came in at ~INR50.6bn, up 6% QoQ driven by strong LME during the quarter. Copper EBITDA was down 6% QoQ to INR5.9bn from INR6.3bn last quarter. Key takeaways from the call are a) aluminium CoP expected to be up ~1% up in 4Q driven by higher CP coke prices b) hedging for 4QFY26; 64% of commodity at USD2,807/t and 26% currency hedged at INR88.1 per dollar while 21% of commodity is hedged at USD2,925/t for FY27 c) capex guidance for India operations for FY26 stands at INR100bn while FY27 capex guidance at INR100-120bn d) Alumina sales guidance for 4QFY26 at 170-180kt. Net debt increased significantly to INR594bn in 3QFY26 from INR414bn in 2QFY26 driven by a) Increase in Net Debt at Novelis by ~USD400mn and USD750mn infusion by parent entity (debt raise) - ~INR140bn adjusting for forex fluctuations b) Increased working capital requirement for copper business to the tune of ~INR40bn. However, the current strong LME is likely to drive earnings trajectory for the company coupled with 100% security post acquisition of Meenakshi, Bandha and Chakla mines. Maintain BUY.

? Novelis top-line driven by higher realizations; margins impacted by Oswego fire: Company reported revenue at USD4.2bn (+3% YoY) primarily driven by higher realisations (+15% YoY) partially offset by lower volumes (-10.5% YoY). The total rolled product shipments decreased YoY to 809ktons in 3Q with lower automotive volumes in the mix. Volumes were lower primarily due to the two Oswego fire accidents that happened in Sep’25 and Nov’25. Adj. EBITDA came in at USD388mn, though higher than JMfe of USD317mn the underlying core EBITDA weaker on Oswego plant fire. Adjusted EBITDA/t came in at USD430/t - down from USD448/t in 2Q. North America and Asia witnessed EBITDA contraction to the tune of 23% YoY and 36% YoY respectively, whereas South America and Europe witnessed EBITDA expansion to the tune of 7% YoY and 59% YoY respectively. Novelis witnessed a net negative tariff impact to the tune of ~USD34mn in 3QFY26 – expected at USD60-65mn on EBITDA in 4QFY26. Guidance for FY26 stands at USD1.9-2.2bn including USD300mn of maintenance capex. Company expects a similar capex amount (slightly lower in FY27).

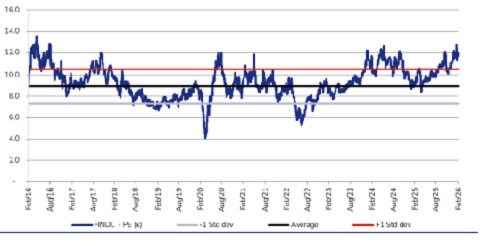

? India Al business spreads improve given strong LME: India aluminium EBITDA incl Utkal came in at ~INR50.6bn, up 6% QoQ driven by strong LME during the quarter. Copper EBITDA was down 6% QoQ to INR5.9bn from INR6.3bn last quarter. Aditya Smelter expansion is on track to take total upstream capacity to 1.71 mn tons by FY29. Of this, the Aluminium smelter of 181kt is expected to be commissioned in FY28. Capex guidance for India operations for FY26 at ~INR100bn while FY27 capex guidance at INR100-120bn. It expects CoP to be up ~1% in 4Q.

? Net Debt trending up; cool-off post Bay Minette commissioning: Net debt increased significantly to INR594bn in 3QFY26 from INR414bn in 2QFY26 driven by a) Increase in Net Debt at Novelis by ~USD400mn and USD750mn infusion by parent entity (parent had raised debt to infuse that money) - ~INR140bn adjusting for forex fluctuations b) Increased working capital requirement for copper business to the tune of ~INR40bn. Novelis net debt is currently at USD6.2bn and is expected to go up with capex spend on Bay Minette and until the time insurance payments start coming in. Company expects this to go up to high USD8bn – will come down FY28 onwards with insurance repayments and completion of Bay Minette capex. Overall cost of capital at Novelis is in mid-8% range while cost of debt stands at ~5.3%.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361