Buy Hindware Home ltd for the Target Rs.375 by Choice Broking Ltd

Outlook:

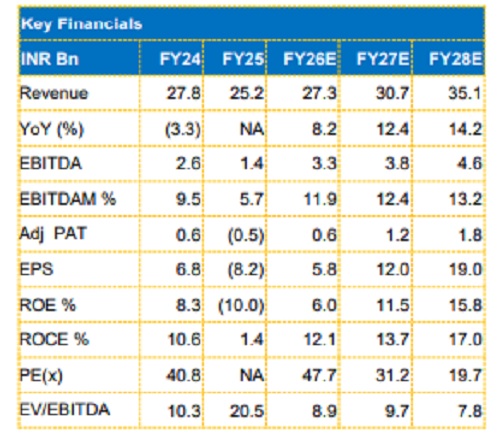

We maintain our BUY rating on HINDWARE with an increased TP of INR 375 (from INR 325 earlier). We factor in: 1) FY25-FY28E Revenue/EBITDA CAGR of 12/30% for Bathware Segment, 2) FY25-FY28E Volume /Revenue /EBITDA CAGR of 12/12/18% for Piping Segment, driven by expected improvement in Real Estate and Infra activity, and 3) FY26E/FY27E/FY28E EBITDA margin of 7/8/10% for Consumer Appliance Business which implies a rebound to FY23 levels due to focus on profitable product categories. Consequently, we arrive at FY25-FY28E consolidated Revenue/EBITDA CAGR of 12/48%.

We now value HINDWARE on 1 year forward (blend of FY27E-FY28E) EV/EBITDA multiple of 9x which we believe is conservative given significant turnaround expected in ROCE from 1.4% in FY25 to 17.0% by FY28E. We do a sanity check of our EV/EBITDA TP using implied P/BV, and P/E multiples. On our TP of INR 375, FY27E implied PB/PE multiples are 3.4x/31x. Slowdown in construction activities due to external factors and sudden fall in PVC/CPVC prices as a result of various global dynamics are risks to our BUY rating.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131