Buy Genesys International Ltd for Target Rs. 1,310 by Elara Capitals

Precision execution with platform acceleration

Genesys International (GENE IN) delivered a resilient Q4FY25, with EBITDA at INR 498mn (+37.3% YoY, +17% QoQ), beating our estimates by 16.8%. This was led by strong margin expansion (+190bps YoY, +510bps QoQ) to 52.9%, despite revenue coming in 11% below expectations. Q4 also marked strategic progress, with GENE raising INR 1.1bn via QIP to accelerate its 2D/3D platform build-out. Backed by a differentiated technological edge in 3D digital twin solutions and traction in high-value contracts across government and enterprise segments, GENE is well-positioned for long-term growth. We revise our earnings estimates downward by 9.1% for FY26E and 5.3% for FY27E, while introducing FY28E into our forecast. These revisions factor in the enhanced capex outlay of INR 2.7bn over FY26E–28E and the impact of the recent capital infusion via QIP. Maintain BUY with a trimmed TP of INR 1,310

Operational outperformance continues: Q4FY25 revenue grew 32.3% YoY to INR 942mn, driven by timely execution of domestic and export projects, including BMC, NEOM, and township planning mandates. Adjusted PAT rose 28.4% YoY, though impacted sequentially by a temporary spike in effective tax rate, expected to normalize from FY26E. For full-year FY25, revenue and PAT grew 56.9% and 159% YoY, respectively, reflecting operating leverage and improved execution efficiency.

Robust orderbook visibility: GENE’s’ orderbook stood at ~INR 4.2bn as of March 2025, driven by strong order inflows of INR 5.2bn in FY25. With 70-80% of the current book executable by mid-FY27, visibility remains strong. Given a qualified pipeline of INR 18.8bn, we expect annual new order inflows to remain healthy at 20-25% CAGR through FY26-28E, driven by increasing traction in the 3D digital twin segment.

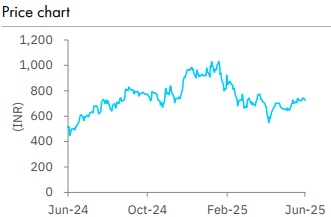

Capital infusion to support scalable digital infrastructure: GENE raised INR 1.1bn via QIP in Q1FY26, priced at INR 632.2/share, leading to a 4.4% equity dilution. The funds will support a stepped-up INR 2.7bn capex plan through FY26-28E, aimed at accelerating 2D/3D platform build-out, tech infrastructure, and SaaS capabilities to reinforce its digital twin leadership.

Maintain BUY with a trimmed TP of INR 1,310: We maintain our BUY rating with a revised DCFbased target price of INR 1,310 (earlier INR 1,370), implying an 80% upside from current levels. The target price has been revised downward to reflect the impact of higher depreciation linked to the company’s enhanced capex plan and earnings downgrades of 9.1%/5.3% for FY26E/FY27E, despite a strong structural growth outlook. Our positive stance is underpinned by GENE’s strong technological moat in the 3D digital twin space, wherein it is gaining meaningful traction across both public and private sectors in India and the Middle East, particularly in Saudi Arabia. Adoption of 3D solutions is accelerating, and GENE is well-positioned to benefit from this secular shift.

We forecast a revenue CAGR of 37.7% and a PAT CAGR of 50.6% in FY25-28E, supported by robust demand for high-precision geospatial solutions across urban planning, infrastructure, utilities, and real estate. Current orderbook of INR 4.2bn, along with a qualified pipeline of INR 18.8bn, provides strong visibility for future revenues. At 20.7x FY27E P/E and 9.5x EV/EBITDA, valuations remain attractive considering the growth runway and expanding platform capabilities. We believe GENE is poised to emerge as a leader in the high-growth geospatial intelligence market, both in India and globally.

Please refer disclaimer at Report

SEBI Registration number is INH000000933

.jpg)