Buy LG Electronics India Ltd for the Target Rs.1,770 by Motilal Oswal Financial Services Ltd

Earnings miss; demand momentum improving in 4Q

FY27 positioned for stronger growth and margin normalization

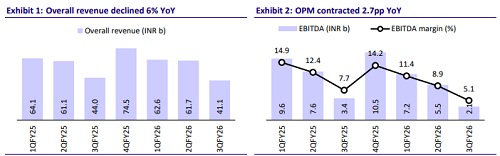

* LG Electronics India (LGEIL)’s 3Q revenue declined ~6% YoY to INR41.1b (in line), while EBITDA declined ~39% YoY to INR2.1b (~23% miss, due to weak performance in the home appliance segment). OPM contracted 2.7pp YoY to 5.1% (est. 6.5%). Adj. PAT declined ~50% YoY to INR1.2b (~37% miss due to higher depreciation/interest and lower other income).

* LGEIL indicated that in 3Q, margin pressure was temporary due to seasonal revenue softness, operating deleverage in compressor-based products, higher raw material costs, and currency depreciation. However, strong traction is being seen in 4Q, and revenue growth should be in double digits, with the margin better than the same quarter last year. LGEIL’s FY26 guidance remains early single-digit revenue growth with double-digit margins, while FY27 is projected to achieve double-digit revenue growth with margins reverting to FY25 levels. Further, LGEIL’s target is to double export revenue in FY27E; currently, exports contribute ~6-7% of its revenue.

* We maintain our EPS estimates for FY26-FY28. The stock trades at 44x/37x FY27/FY28E EPS. We value LGEIL at 45x FY28E EPS to arrive at our TP of INR1,770. Reiterate BUY.

Revenue declines ~6% YoY; OPM contracts 2.7pp to 5.1% (est. 6.5%)

* LGEIL’s consol. revenue/EBITDA/adj. PAT stood at INR41.1b/INR2.1b/ INR1.2b (-6%/-39%/-50% YoY; -2%/-23%/-37% QoQ). OPM contracted 2.7pp YoY to 5.1% (vs. est. 6.5%) in 3QFY26. Depreciation and interest costs rose 23%/9% YoY, while other income declined ~4% YoY.

* Segmental highlights: a) Home Appliances & Air Solutions (H&A) revenue declined 10% YoY to INR27.9b, and EBIT declined 49% YoY to INR1.1b. EBIT margin dipped 3.1pp YoY to 4.0% (vs. est. 6.5%); b) Home Entertainment (HE) revenue inched up ~2% YoY to INR13.3b. EBIT declined 28% YoY to INR1.3b. EBIT margin contracted 3.9pp YoY to 9.6%.

* In 9MFY26, LGEIL’s revenue/EBITDA/PAT stood at INR165.5b/INR14.7b/ INR10.2b, declining ~2%/28%/30% YoY. OPM contracted 3.3pp YoY to 8.9% for the period.

Key highlights from the management commentary

* Management highlighted a strong start to 4Q with a broad-based demand recovery, mainly in home appliances, supported by new BEE norms and premium product traction.

* The home appliances and air solutions segment maintained category leadership, with YTD Dec’25 market share at ~33% in washing machines, ~30% in refrigerators, and ~17.3% in RACs. Side-by-side refrigerator share improved to ~43.3%, reinforcing premium leadership.

* The company secured INR7.1b in incentive support from the Maharashtra government. This will be realized over 15 years from May’25, with ~INR430m expected to be accounted for in FY26.

Valuation and view

* LGEIL’s 3QFY26 earnings were below our estimate due to margin pressure and softening in consumer demand post-festive season. However, looking ahead, management indicated that the implementation of new norms is accelerating replacement demand and driving recovery across appliance categories. The industry outlook remains constructive, led by rising preference for premium, energy-efficient products, while low penetration levels continue to offer volume-led growth opportunities.

* We estimate LGEIL’s revenue/EBITDA/PAT CAGR at 10%/20%/21% over FY26-28. We estimate the H&A segment’s revenue CAGR of ~11% over FY26-28E and margin at ~12%/13% in FY27/FY28 vs. ~11% in FY26E. The HE segment’s revenue CAGR of ~8% over FY26-28, and the margin is projected at ~14%/16% in FY27/ FY28 vs. ~13% in FY26E. The stock trades reasonably at 44x/38x FY27/FY28E EPS. We value LGEIL at 45x FY28E EPS to arrive at our TP of INR1,770. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Tag News

Buy LG Electronics India Ltd for the Target Rs.1,808 by PL Capital