Buy KPR Mill Ltd for the Target Rs.1,215 by JM Financial Services Ltd.

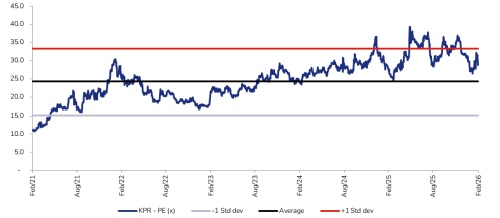

KPR Mill reported consol. EBITDA of INR2.9bn, lower than JMfe of INR3.4bn primarily driven by miss in revenue. Revenue miss of ~9% was driven weak sugar segment performance (down 22% YoY). Despite the top-line pressure, gross margins expanded meaningfully to 44.2% (+290 bps YoY), supported by favourable raw material costs. Consequently, EBITDA margin improved by 30bps YoY to 20.1% in 3QFY26 depicting better cost control and easing input pressures. Garment segment performance remained flattish YoY with volumes up ~8% YoY and NSR down ~7% YoY. We await the formal announcement for capacity expansion in the garment and fabric segment. In our understanding, capacity expansion of ~25% each in garment and fabrics is expected over the next 2 years with an expected capex of ~INR4bn on each project. This is expected to drive volume and earnings growth over the next few years. KPR, being the industry leader, has a proven track record and will be a key beneficiary to the recently announced BTAs / FTAs, in our view. We value the company at 32x P/E multiple for FY28E, implying a TP of INR1,215/sh (upside of ~34%). Maintain BUY.

? Top-line compress given weak Sugar performance: Consolidated revenue for the quarter came in at INR14.7bn down 4% YoY led by weakness in the sugar segment performance. Textile revenues were relatively resilient (-2% YoY), while sugar saw a sharp 22% YoY decline. Despite the top-line pressure, gross margins expanded meaningfully to 44.2% (+290 bps YoY), supported by favourable raw material costs. KPR Mill reported consol. EBITDA of INR2.9bn, down ~3% YoY driven by higher staff costs (+14% YoY), with margins at 20.1% (+30 bps YoY). EBITDA compression YoY was primarily operating leverage-led, given lower revenues, though sequential improvement in EBITDA margin reflects better cost control and easing input pressures. In the near-term, capacity expansion by ~25% in the garment and fabric segments (each with ~INR4bn capex) is expected to drive volume and earnings growth over the next few years.

? Lower NSR partially offset higher volumes in Textile segment: Revenue for Garment segment came in at ~INR 7bn, up 1% YoY and down 2% QoQ. While garment sales volumes jumped 8% YoY and 13% QoQ to 44mn pieces, net sales realization (NSR) declined by 7% YoY and 16% QoQ to INR 157/piece (calculated). Yarn & fabric sales volumes increased by 6% YoY and 4% QoQ to 19.3k tonnes but was offset by a similar decline in NSR (-6% YoY and -4% QoQ) to INR 251/kg (calculated) leading to flattish revenue (both YoY and QoQ). Textiles EBIT declined 5% YoY and 9% QoQ to Rs 2.2bn. EBIT margin declined by 117bps YoY and 122bps QoQ.

? Weak Sugar segment performance driven by lower volumes: Revenue for the Sugar segment came in at INR840mn, down sharply by ~50% YoY and down 54% QoQ. This was led by a significant 54% YoY and 53% QoQ decline in volumes to 21.9k tonnes. NSR was higher 7% YoY but declined by 2% QoQ to INR 38.4/kg. Ethanol revenue increased by 9% YoY while it decreased by 33% QoQ to INR 1.04bn, with 11% YoY rise in volumes while volumes declined by 39% QoQ at 16.0mn litres. NSR declined 2% YoY while it increased by 10% QoQ at INR 65.1/litre. Segment EBIT (Sugar + Ethanol) increased by 11% % YoY to INR 209mn. EBIT margin expanded sharply by 282bps YoY to 9.5%.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

Ltd.jpg)