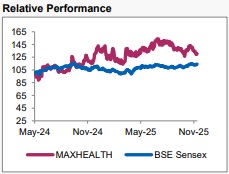

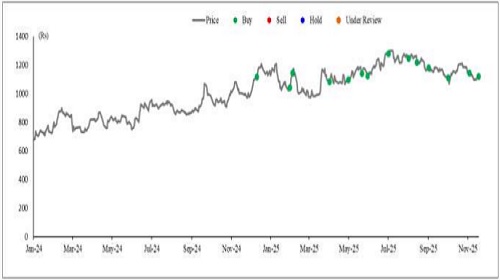

Buy Max Healthcare Institute Ltd For Target Rs. 1,425 By Axis Securities Ltd

Robust Performance Led by Occupancies

Est. Vs. Actual for Q2FY26: Revenue: INLINE; EBITDA: BEAT; PAT: BEAT

Changes in Estimates post Q2FY26

FY26E/FY27E: Revenue: 0.9%%/0.7%; EBITDA Abs: 2.5%/1.1%; PAT: 2.9%/1.6%

Recommendation Rationale

* Strong Revenue Growth: Max Healthcare reported net revenue of Rs 2,580 Cr, registering 21.4% YoY and 5% QoQ growth, broadly in line with expectations. The performance was supported by steady ARPOB, stable occupancy, and the addition of new beds, which together drove a 19% increase in occupied bed days. International patient revenue rose 25% YoY and now contributes 9% to overall revenue. Existing units delivered a strong 14% likefor-like revenue growth, reflecting sustained operational momentum across the network.

* Stable ARPOB and Improved Occupancy: ARPOB stood at Rs 77,300, flat YoY (with existing units delivering 3% YoY growth), while overall occupancy improved to 77% with a 19% increase in occupied bed days, and mature hospitals reported 79% occupancy. IP and OP volumes grew 22.5% and 27%, respectively.

* EBITDA Margins and Profitability: EBITDA margins expanded by 55 bps YoY to 26.2% and by 218 bps QoQ. EBITDA grew 24% YoY and 14.4% QoQ, while existing units delivered 19% like-for-like EBITDA growth. Reported PAT came in at Rs 473 Cr (+26% YoY), supported by a Rs 149 Cr favourable tax impact arising from the merger of CRL and JHL. Adjusted PAT stood at Rs 406 Cr.

* Expansion-Focused Growth with Prudent Leverage: Max Healthcare’s aggressive yet capital-efficient brownfield expansion strategy supports a strong multi-year growth trajectory. The company plans to scale its bed capacity from approximately 5,000 in FY25 to 9,000– 9,500 by 2028, with key brownfield additions—Nanavati Max (268 beds), Max Smart Saket (400 beds), and Max Mohali (160 beds)—either recently commissioned or coming onstream shortly. Additional projects in Lucknow and Gurgaon further strengthen the pipeline. Brownfield assets typically ramp up faster, achieve quicker EBITDA breakeven, and enhance earnings visibility. Despite deploying Rs 456 Cr toward capex in Q2, net debt remains comfortable at Rs 2,067 Cr, translating to a Net Debt/EBITDA of around 0.79x. Strong internal accruals and disciplined capital deployment are expected to keep leverage below 1x through the expansion cycle, supporting sustained growth and value creation.

Sector Outlook: Positive

Company Outlook & Guidance: Management reiterated guidance of 6–7% ARPOB growth in mature hospitals, supported by higher case complexity and an improving clinical mix, alongside sustained occupancy of around 80%. Developing hospitals are expected to ramp up gradually, driving incremental occupancy and revenue growth. The company remains focused on scaling oncology and international patient businesses while maintaining strong return ratios. The recent CGHS rate revision is expected to generate a revenue uplift of over Rs 200 Cr once fully implemented across CGHS and CGHS-linked schemes such as ECHS. Management indicated that 85–90% of this incremental revenue is likely to flow through to EBITDA, as the cost base for servicing these patients is already largely established. The full benefit, particularly from the newly introduced “super-specialty hospital” category, is expected to materialise from FY27 onward.

Current Valuation: EV/EBITDA 35x for H1FY28E EBITDA (Earlier: EV/EBITDA 35x H1FY28E)

Current TP: Rs 1,425/share (Earlier TP: Rs 1,450/share)

Recommendation: BUY

Financial Performance

Max Healthcare delivered a robust Q2FY26 performance, with revenue at Rs 2,580 Cr, rising 21.4% YoY and 4.9% QoQ, marginally ahead of expectations. The performance was supported by strong patient volumes, stable ARPOB, and incremental contributions from recently acquired hospitals. EBITDA stood at Rs 677 Cr, up 24% YoY and 14.4% QoQ, supported by the ramp-up of brownfield expansions, while the EBITDA margin improved by 55 bps YoY to 26.2%. The company reported PAT of Rs 473 Cr, while Adjusted PAT came in at Rs 406 Cr.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633