Chemical Sector Update : Earnings visibility dims as EPS cuts continue by PL Capital

Quick Pointers:

* Consensus estimates for FY26 EPS of our coverage revised downwards for past 8 consecutive quarters

* China’s continued expansion of chemical capacity and high-end production is fueling global oversupply, keeping operating rates and margins under pressure

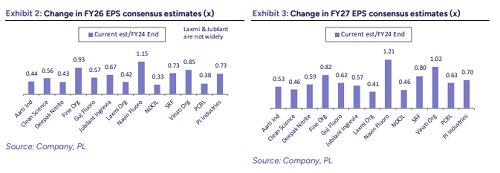

Declining demand, falling realizations and spreads, inventory de-stocking, and continued dumping combined with rising overcapacity across key chemical chains and weak visibility, have led to sharp downward revisions in consensus estimates for specialty chemical companies under our coverage. Such sharp EPS cuts have resulted in sliding stock prices, with a few names nearly halving over the past few quarters, along with de-rating. Since FY24-end, companies have witnessed upto 67% cut in FY26 estimates- Aarti Industries-56%, Deepak Nitrite-57%, Laxmi Organics-58%, PCBL-62%, and NOCIL-67%, Clean Science-44%, Jubilant Ingrevia-33%, SRF-27% and Vinati Organics-15%. FY27 consensus estimates have also witnessed up to 60% cut.

In contrast, Fine Organics remains relatively resilient, with FY26/FY27 estimates cut by only 7%/18%, while Navin Fluorine stands out with 15%/21% increase. Compared with the previous quarter (Q3FY26), current consensus estimates have moved up sequentially for a few names, led by Aarti Industries (15%) and Navin Fluorine (13%). However, the majority still witnessed further trims, with the sharpest sequential cuts seen in PCBL (35%), Deepak Nitrite (7%), PI Industries (7%), and Gujarat Fluorochemicals (6%). These indicate that earnings expectations remain under pressure, despite selective upticks.

* Margin compression dominates, with a few resilient performers: Amid an increasingly adverse macro environment, most companies under our coverage have witnessed a sharp contraction in gross margins since FY20. Aarti Industries saw margins plunge to 34% in Q3FY26 from a peak of 61% in Q3FY22. Clean Science’s gross margin declined from 78.6% in Q4FY21 to 60.7% by Q3FY26. Deepak Nitrite experienced one of the steepest erosions, with margins falling from 50.7% in Q2FY21 to 27.8% in Q3FY26. In contrast, PI Industries’ margins expanded from 45% in Q2FY22 to 59% in Q3FY26 due a favorable product mix, while most companies in the coverage universe reported marginal decline of 100-200bps, indicating relatively stable margin performance.

* Bearish outlook amid supply glut: Lack of clarity persists in the global chemicals industry amid sluggish demand recovery, tariff uncertainties, structural overcapacity, and ongoing inventory destocking across several regions. China continues to increase exports at aggressive pricing, with CEFIC noting that Chinese chemical production grew 8% in H1CY25, significantly outpacing global production growth of 4.2%, further worsening global oversupply. EU demand remained largely stagnant, while concerns of a broader global economic slowdown persist. Elevated dumping in both domestic and non-US export markets is intensifying competitive pressures. Reflecting these challenges, global chemicals companies continue to remain cautious on the near-term outlook.

* Chinese cuts key to market stability: Global chemicals industry downturn is being exacerbated by China’s continued capacity expansion, despite weakening demand fundamentals. In CY25, China added 9mmtpa of ethylene capacity, driving surplus capacity to 11.5mmtpa (up 121% YoY), while propylene oversupply is projected to reach 20.3mmtpa, following a record ~9.6mmtpa capacity addition, as per ICIS. These additions are cascading into downstream polymers and intermediates, increasing exportable surplus and intensifying price competition across global markets. At the same time, China’s policy target of >5% annual growth in petrochemicals and chemicals industry value during CY25–26 and its push to expand high-end polyolefins, electronic chemicals, and integrated chemical parks indicate that supply will continue to grow even as demand recovery remains fragile. As a result, global operating rates are declining, spreads are compressing, and margins are weakening across commodity chemical chains. Without meaningful capacity rationalization in China, the downcycle is likely to persist, delaying any sustained recovery in profitability.

* Positive on Navin Fluorine and Fine Organics: Fine Organics’ Rs7.5bn SEZ greenfield project, for which environmental clearance has been received, is expected to be commercialized from FY27. With an estimated 3.5x asset turnover, the project offers a peak revenue potential of ~Rs26bn, providing strong topline growth visibility from FY28. The company’s US manufacturing initiative and recent land acquisition further strengthen its long-term expansion plans. The stock trades at ~25x FY28E EPS; we maintain ‘BUY’ rating with TP of Rs5,117. Navin Fluorine’s growth outlook remains robust, supported by full-capacity R32 operations, contributions from the Project Nectar, and a strong CDMO order book extending beyond CY26, with the management reiterating its USD100mn CDMO revenue target by FY27. Ongoing capacity expansion and debottlenecking initiatives are expected to sustain growth momentum. The stock trades at ~37x FY28E EPS; we maintain ‘Accumulate’ rating with TP of Rs7,038.

Above views are of the author and not of the website kindly read disclaimer

More News

Monthly Auto Sales - February 2025 by ARETE Securities Ltd