Capital Goods : Sector update : The Data Center Renaissance by PL Capital

In the span of a few months, India has gone from digital potential to digital powerhouse - and data centers are the linchpin of that transformation. At the recent India AI Impact Summit, global tech majors including Microsoft, Google, and Amazon collectively pledged tens of billions of dollars toward AI infrastructure, while domestic giants like Reliance Industries and the Adani Group announced multi-billion-dollar plans to build AI-ready, renewable-powered data center campuses across the country.

Complementing this investment momentum, the Union Budget 2026–27 introduced a landmark tax holiday for data center operators, extending exemption from Indian income tax until 2047 for eligible foreign cloud service providers using India-based data center infrastructure to serve global workloads - a move designed to anchor high-value compute capacity domestically and provide decades of investment certainty

This policy pivot comes at a time when India is already asserting itself as a strategic node in the global data infrastructure ecosystem. With rapid adoption of AI, IoT and 5G, demand for scalable compute and storage has sharply accelerated - so much so that data centers are no longer just support facilities but structural drivers of power demand and economic growth.

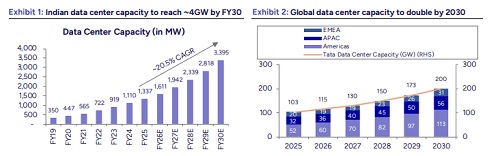

India currently hosts ~1,337 MW of data-center capacity in FY25, making it the largest in the Asia-Pacific region (excluding China); this is expected to surge by around 2,000 MW by FY30 to roughly 3,395 MW. With data center set-up costs approaching Rs600-700mn per MW, the cumulative capital expenditure through FY25-30 is estimated at about Rs1.3trn - underlining sustained demand for high-reliability power, transmission infrastructure, and ancillary services.

On the global stage, a similar expansion narrative is unfolding: total data center capacity is projected to nearly double from the current ~103 GW to 200 GW by 2030, propelled by a ~17% CAGR in the Americas - where the United States accounts for around 90% of installed capacity - and continued growth in APAC led by China. These vast capacity additions are not just about digital storage; they create export opportunities for Indian equipment manufacturers and service providers integrated into global supply chains

Together, policy support, corporate capital flows, and structural technology adoption are repositioning India’s data center story: from a back-office digital ecosystem to a core competitive advantage in the age of AI and digital services. While the macro narrative is anchored in megawatts and capex, the real earnings inflection lies with the equipment suppliers, an ecosystem where our capital goods universe is meaningfully positioned.

Key Equipment Applications and Beneficiaries:

* Transformers and Switchgear: Core components of the T&D value chain supporting grid expansion, renewable integration and high-reliability power supply for data centers. Transformers account for ~10% of total data-center set-up costs, while switchgear contributes ~20%, underscoring their materiality. Key beneficiaries include Hitachi Energy India, Siemens Energy India, GE Vernova T&D, CG Power, TARIL, Voltamp etc.

* Cooling Solutions: Higher compute density and faster processing increase thermal loads in data centers, making efficient cooling solutions mission-critical. Companies such as Thermax and Praj Industries are expanding their cooling portfolios to address this emerging demand.

* Cables and Conductors: Expansion of transmission lines and rising interconnection needs for renewables and data centers are driving demand for high-quality cables and premium conductors, benefiting players such as Apar Industries.

* Backup Power and Captive Power Generation: Uninterrupted power is critical for data centers, creating demand for gensets and backup power systems from Cummins India and Kirloskar Oil Engines. Additionally, increasing scale and energy intensity are supporting captive power generation deployments, positioning Triveni Turbine, Siemens Energy, TD Power Systems as key beneficiaries.

Above views are of the author and not of the website kindly read disclaimer

More News

NBFC Sector Update : RBI draft on gold loans: Stricter norms ahead By JM Financial Services