Pharma Sector Update : Q2FY26 Quarterly Results Preview by Choice Broking Ltd

Mixed Growth Ahead as India, Europe Outperform; US Moderates

Pharma companies under our coverage are expected to report a mixed quarter, as pricing pressure in regulatory markets weigh on generics, while domestic businesses continue to outperform IPM. We believe overall US growth is likely to moderate to mid-single digits, while Europe is expected to sustain strong growth. EBITDA margin is expected to remain broadly stable, as most companies navigate a transition period aimed at improving product mix.

The US had proposed a 100% tariff on Indian pharma imports from October 1, but the measure has been put on hold amid ongoing negotiations between President Trump and major pharma companies. Even if implemented, companies in our coverage are expected to achieve their FY26E targets, as their exposure is primarily to generics. SUNP and DRRD are notable exceptions due to higher exposure to branded generics, though their US-based facilities should help mitigate the impact.

Segment-wise Outlook

Generics and Branded Generics:

* India: Branded generics remain the backbone, with overall growth of 8– 10% in FY26E. Value growth will be supported by new product launches and price hikes, while nutraceuticals are expected to see the strongest growth.

* US: Branded generics pipeline remains strong however, tariff threat looms, but generic volumes are expected to stay on track. Growth is likely to moderate and profit margin remains under pressure with increasing competition.

* Europe: We expect Europe to see the strongest growth, driven by new launches, such as Winlevi and Leqselvi, along with increasing demand for Indian companies.

* Emerging Markets: Branded generics are expected to continue strong growth, benefiting from agreements, such as EFTA..

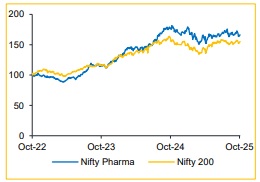

Rebased Price Chart

CDMO

Momentum in the CDMO segment is anticipated to remain robust, supported by capacity expansions from companies, such as DIVI and LAURUS and rising order inflows.

Biosimilars

Companies including GLP, LPC, CIPLA and DRRD are expected to drive growth through new biosimilar launches. CIPLA has already launched its first US biosimilar.

APIs

Focus on high-value oncology APIs is expected to offset ongoing pricing pressure in the segment.

High-conviction investment ideas

We maintain a positive stance on SENORES and GRAN, which are expected to deliver strong growth in Q2FY26.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131