Cement Sector Update : A ‘typically’ weak quarter that refused to be by Emkay Global Financial Services Ltd

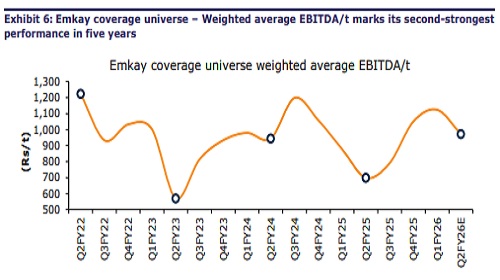

We expect average EBITDA of our cement universe to surge ~56% YoY (low base following the General Elections-2024 quarter), albeit decline ~22% QoQ. Per our channel checks report “Prices steady with full GST benefits; pet coke rears its head”, we see the industry logging a low single-digit (3-4%) YoY volume growth in Q2FY26E, while our coverage stocks are estimated to report 10% YoY growth. However, excluding estimated volumes from acquired entities (UTCEM and ACEM), we see the growth aligning with industry levels. Energy costs are expected to be rangebound on the back of stable fuel prices (QoQ), though companies shall see negative operating leverage and hence a >2% (~Rs100) QoQ rise in total operating cost/t. Stable cement prices (down a mere ~1.5% QoQ) during Q2FY26E have provided the industry a vantage point, which should arrest the downside in profitability. On the valuation front, the riskreward ratio for cement stocks appears balanced, and the street is banking on improvement in the pricing and demand parameters in the ensuing quarters.

Aided by the range-bound cost scenario, coupled with an improving demand outlook (post Diwali), we remain positive on the sector and retain UTCEM, SRCM, and JKCE as our top picks. In Q2FY26E, SRCM shall continue outperforming peers in terms of profitability, in our view.

Our cement universe volume to increase 10% YoY

Demand trends indicate continuity of a low single-digit (3-4%) YoY volume growth in Q2FY26 as well (H1FY26E: 3-4%). Lackluster demand growth can be attributed to factors like severe rainfall, low channel inventory due to re-alignment of GST rates, and festive/ritual period (Navratri, Pitru-Paksh in Sep-25). We estimate our coverage stocks would clock 10% YoY volume growth in Q2FY26E. However, excluding volumes from acquired entities UTCEM and ACEM, we expect growth to align with industry levels.

Marginal drop in blended realization

Our checks suggest ~1.5% QoQ realization drop on pan-India basis in Q2FY26E, implying that the cement industry has seen its 2 nd best performance in the past five years (best performance seen in Q2FY24, when prices were flat QoQ). We believe sector players with exposure in North and Central India (SRCM, JKCE) would report a lower QoQ realization dip as against companies with exposure in South and East India (TRCL, Dalmia). We believe blended realization of our overall cement coverage would dip by a meagre 0.6% QoQ (or ~Rs35/bag) and thus restrict any profitability decline.

Negative operating leverage to hurt margins slightly

Major fuel costs (barring imported pet coke) stood rangebound in Q2FY26, and we expect unit energy costs to be flat QoQ. However, lower volumes should trigger negative operating leverage which shall result in total operating costs rising >2% (~Rs100/t) QoQ.

Stable prices + controlled costs + improving demand run-rate = Strong H2FY26

Due to negative operating leverage and marginally lower cement prices, we expect the average EBITDA/t to fall ~14% QoQ to ~Rs970 (albeit rise ~40% YoY). We expect players like UltraTech, Shree, Star, JK Cement, and Dalmia Bharat to maintain EBITDA/t above Rs1,000, whereas Ambuja (consolidated) and Ramco are likely to clock EBITDA/t of ~Rs900. SRCM shall continue to outperform peers in terms of profitability and is expected to report EBITDA/t above Rs1,200.

Ahead, we estimate robust profitability in H2FY26 as we see 1) a better demand run-rate owing to a busy construction period coupled with benefits of reduced GST rates, 2) checks suggesting the possibility of price hikes in Dec-25, 3) steady input costs; hence we remain positive on the sector..

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

.jpg)