Oil & Gas Sector Update : Oil Prices Poised to Climb; India Faces Supply Risk Choice Broking Ltd

Oil Prices Poised to Climb; India Faces Supply Risk

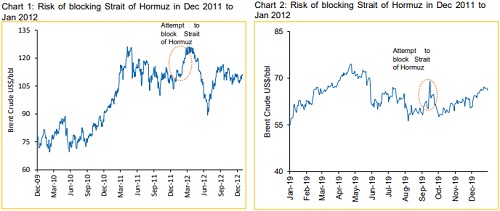

• Brent crude prices advanced by 7% on Friday, primarily driven by escalating geopolitical tensions between Iran and Israel. Reports suggest that Israeli airstrikes have targeted key Iranian refineries and natural gas infrastructure, heightening concerns over potential near-term supply disruptions. We estimate that the anticipated reduction of approximately 1.6–1.7 million barrels per day of Iranian crude exports have been largely priced into the recent increase. However, the likelihood of a blockade of the Strait of Hormuz by Iran appears to have risen over the weekend.

• We expect the oil price to spike up to US$95/bbl in the coming weeks in case the tensions do not ease. However we don’t expect prices to sustain at elevated levels for longer.

• Approximately 40% of India’s LNG imports and 50% of its crude oil imports transit through the Strait of Hormuz, making the country’s energy supply highly vulnerable to any potential disruption along this critical maritime route.

We maintain our CY25 forecast for Brent Oil at US$69/bbl.

There have been several instances over the past four decades wherein oil or overall trade through Strait of Hormuz has been under risk. We cite most recent instances of 2011 and 2019, wherein such a scenario had occurred and draw the differences between how the situation has evolved in 2025 since 2011.

What has changed since in 2011?

We believe the countries and energy markets are probably better placed as it is becoming recurring event.

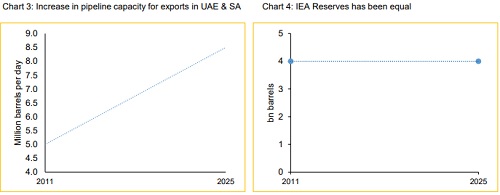

1. Capacity explanation to divert crude oil has increased

• Overall pipeline capacity which can bypass the Strait of Hormuz has been increased from ~5 mn barrels per day in 2011 to ~8.5 mn barrels per day. The current spare capacity for east-west pipeline to diversify the crude away from the straight is 2.0 to 2.5 mn barrels per day. Meanwhile the spare capacity of UAE’s is at 1.5 mn barrels per day.

• These pipelines are well-maintained and can facilitate the diversion of crude oil flows away from the Strait of Hormuz within days, rather than months. As a result, they help reduce the potential disruption to global oil supply from 20% to just over 15%—a notable improvement compared to past disruptions in the 1980s and 2011.

• While most of this bypass capacity was already in place by 2019, we believe improvements in operational readiness and crisis management may enhance their effectiveness in addressing potential supply disruptions.

2. Expanded U.S. presence mitigates Strait of Hormuz disruption risk

The U.S. naval presence in the Gulf has expanded significantly since 2011, enhancing its ability to deter potential disruptions in the Strait of Hormuz. The number of minesweepers has doubled, and the U.S. has further strengthened its operational capability by deploying 12 integrated platforms comprising unmanned underwater vehicles (UUVs), unmanned surface vehicles (USVs), and unmanned aerial vehicles (UAVs). These advanced systems collectively bolster surveillance, threat detection, and response, thereby contributing to the continued security and uninterrupted flow of maritime trade through the Strait.

3. IEA is equally equipped compared to 2011, however has been better aware since the past two instances

IEA has about 1.2 billion barrels of crude oil in reserve, as informed by Director Faith Birol on June 13, 2025. It has ~4 billion of overall crude oil reserves, much similar to levels it had in 2011. The Director has informed that the organization remains prepared to deploy if the Strait of Hormuz gets blocked. The 31-member countries of IEA are mandated to hold 90 days’ worth of net oil imports. The organization also interacts with non-member like India and China.

4. India has Strategic Petroleum Reserve

India is significantly better positioned in 2025 to manage potential supply disruptions, such as a closure of the Strait of Hormuz, compared to 2011. The country’s Strategic Petroleum Reserve (SPR) was not operational in 2011, with the first phase of SPR infrastructure completed between 2015 and 2018. As a result of this development, India now holds an estimated 74 days of oil reserves, comprising both government-controlled strategic stockpiles and inventories maintained by the industry—providing a stronger buffer against external supply shocks.

Overall, the preparedness of countries has improved significantly over the past fifteen years, reducing the likelihood of a severe and prolonged disruption in oil and gas flows through the Strait of Hormuz, as well as its lasting impact on global energy markets. Therefore, we continue to forecast Brent Oil for CY25 at US$69/bbl.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131