Buy Ambuja Cements Ltd for the Target Rs. 750 by Motilal Oswal Financial Services Ltd

Consolidation of the cement business under one entity

* The Adani group has announced the simplification of its group structure and decided to consolidate the cement business under one entity. Currently, ACEM holds a 50.05% stake in ACC and 72.66% in Orient Cement.

* Under the merger of ACC and Orient Cement with ACEM, the company will issue: 1) 328 equity shares of FV INR2/sh for every 100 equity shares of FV INR10/sh of ACC, and the merger ratio is almost at par at today’s closing price of ACC; and 2) 33 equity shares of FV INR2/sh for every 100 equity shares of FV INR10/sh of Orient Cement, and the deal values Orient Cement at a ~9% premium to today’s closing price. There will be no cash consideration in the schemes.

* Earlier, the group had announced the amalgamation of Sanghi Industries and Penna Cement with the company and is awaiting regulatory approvals for the same. Upon this merger becoming effective, 12 equity shares of FV INR2 of ACEM will be issued for every 100 equity shares of FV INR10 of Sanghi Industries. ACEM will pay INR321.5/share to the eligible shareholders of Penna Cement.

* This will lead to an equity dilution of ~12% for ACEM, and the promoter group holding in the company will reduce to 60.94% from 67.65%, postamalgamation of all the companies as discussed above. Though the deal appears to be neutral for ACC, we believe that it is positive for ACEM shareholders, as ACC trades at a steep discount to ACEM.

* At CMP, ACEM trades at 15.4x FY27E EV/EBITDA and USD128 FY27E EV/ton, while ACC trades at 7.1x FY27E EV/EBITDA and USD71 FY27E EV/ton. This deal also removes the uncertainties about the merger timelines (subject to regulatory approvals) and would help to create a single pure-play cement entity for the Adani group.

Strategic merger to simplify structure and drive long-term value

* The transaction represents a step towards simplifying the group’s cement structure and is in line with management’s stated focus on consolidation, scale, and capital efficiency. The merger improves balance sheet flexibility and strengthens ACEM’s ability to drive synergies across the cement portfolio.

* The amalgamation will unify ownership and control of the group’s cement operations, streamline manufacturing and supply chain functions, logistics, and procurement, and simplify the corporate structure for better decision-making.

* It aims to enable more efficient allocation of capital and management, unlock scale benefits, and enhance long-term shareholder value. The merger will simplify and rationalize the network, branding, and sales promotion-related spending. This will help to optimize costs and improve margin by INR100/t. Also, the merger will facilitate achieving targeted cost, margin expansion, and growth metrics.

* Post completion of the mergers, the ACEM and ACC brands will continue to operate independently, with each brand retaining its leadership and positioning in its respective segments. Further, the incentives benefit under various state industrial promotion schemes, which are available to ACC (such as Maharashtra, Madhya Pradesh, and Uttar Pradesh), will continue to accrue to ACEM for the remaining period of the incentive schemes.

* We had highlighted in our earlier company update note (Link) that we expected the Adani Group to consolidate its cement operations under a single listed entity, to streamline the group structure, and to improve operational synergies.

Valuation and view

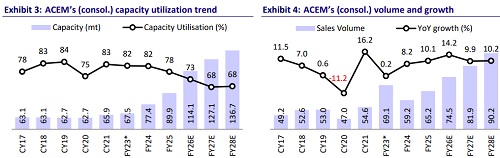

* ACEM has reported steady improvements in profitability, achieving EBITDA/t of +INR1,000/t in the third consecutive quarter. Resilient performance was led by steady realization and QoQ reduction in opex/t. Further, the integration of acquired assets (Orient Cement/Penna/Sanghi brands) with the company was encouraging.

* The company’s net cash balance declined to INR25.6b as of Oct’25 vs. INR101.3b as of Mar’25, mainly due to its aggressive expansion strategy (both organic and inorganic expansions) and efficiency improvement initiatives (green power/modernization and upgrade of works/logistics capabilities). The company is estimated to move from a net cash position to net debt over FY26-27E due to high capex and turn net cash positive in FY28E, supported by healthy operating cash flow generation from expanded scale.

* We believe the announcement is a positive development. We maintain our constructive view on the company, given its rising scale of operation, balanced capacity mix, and profitability improvement. We value ACEM at 20x Sep’27E EV/EBITDA to arrive at our TP of INR750. We don’t give any Holdco discount in our TP for ACC and Orient Cement.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)