Buy Home First Finance Ltd for the Target Rs. 1,450 by Motilal Oswal Financial Services Ltd

Soft quarter amid transient asset quality deterioration

AUM growth tracking lower than estimates; BT-OUT and credit costs elevated

* Home First Finance’s (HOMEFIRS) 2QFY26 PAT grew 43% YoY to INR1.32b (in line). PAT in 1HFY26 grew ~39% YoY, and we expect PAT in 2HFY26 to grow 48% YoY. NII grew ~32% YoY to INR2.1b (in line). Other income surged 66% YoY to INR699m (vs. MOFSLe of INR600m), aided by higher assignment income during the quarter, which stood at INR250m (PY: ~INR202), higher investment income, and higher fee and commission income.

* Opex grew 21% YoY to INR879m (inline). PPoP rose ~49% YoY to INR1.9b (~5% beat). Credit costs stood at INR152m (vs. MOFSLe of INR110m), translating into annualized credit costs of ~52bp (PQ: ~42bp and PY: ~25bp).

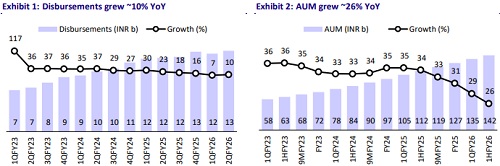

* Management acknowledged that disbursement volumes were marginally lower than earlier expectations, led by broader macro uncertainties, monsoon-led disruptions, and a deliberate tightening in underwriting amid tariff-related uncertainties in select regions. However, the growth momentum for disbursements is expected to strengthen in 2H, driven by improving macros, GST rate cuts, and benign inflation. The company guided for AUM growth of over 25% in FY26, and our FY26 AUM growth estimates are in line with the company’s guidance.

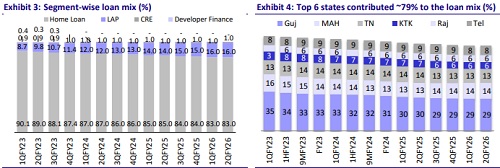

* Asset quality weakened QoQ and resulted in sequentially higher credit costs. There was an increase in both 1+ dpd and 30+ dpd buckets, largely attributed to stress in a few localized markets, particularly in Chennai, Tiruppur, Coimbatore, and Surat. While Surat is showing some signs of recovery, Coimbatore and Tiruppur continue to exhibit higher delinquencies. Management shared that while some stress from the MFI/micro-LAP segments could have spilled over into affordable housing, it was further amplified into certain pockets due to uncertainties arising from US tariffs.

* Even though the bounce rate rose to ~17.4% in Oct’25, recovery trends remained strong, implying that the recent weakness was largely seasonal rather than any structural trend. While the company acknowledged that sustained collection efforts will be required to arrest slippages, it expressed confidence in its ability to restore asset quality in 2HFY26. We model credit costs of 40bp/35bp in FY26/FY27E.

* HOMEFIRS is a resilient franchise, currently navigating transitory headwinds. Its execution track record has been consistently better than its peers, and we expect the company to emerge stronger from this transitory stress in asset quality. We estimate a CAGR of ~25%/~27% in AUM/PAT over FY25-28E. The company is expected to recover from recent elevated delinquencies, with a gradual improvement in asset quality in the subsequent quarters. Reiterate BUY with a TP of INR1,450 (based on 2.8x Sep’27E BV).

AUM grows ~26% YoY; BT-OUT remains elevated

* Disbursements grew 10% YoY to ~INR12.9b, leading to AUM growth of 26% YoY to ~INR142b.

* The BT-OUT rate (annualized) in 2Q rose to ~7.6% (PQ: ~6% and PY ~6.7%), driven by increased competitive intensity during the quarter. Earlier, BT-OUTs from HOMEFIRS were primarily directed to nationalized banks. However, in recent quarters, even peer affordable HFCs have become aggressive in pursuing balance transfers.

Yields decline ~10bp QoQ; reported NIMs expand ~20bp QoQ

* Reported yield declined ~10bp QoQ to 13.4%, and reported CoF declined ~30bp QoQ to 8.1%. Reported spreads (excl. co-lending) rose ~20bp QoQ to 5.3%. Management guided for spreads between ~5.0% and 5.25% in FY26.

* Incremental CoF and origination yield in 2QFY26 stood at 7.9% and 13.3%, respectively. Reported NIM expanded ~20bp QoQ to 5.4%. NIMs (calc.) expanded ~5bp QoQ to ~6%. Management highlighted that the decline in CoB was supported both by the reduction in benchmark (repo) rates and the earlier credit rating upgrade. It further indicated that the CoF is expected to decline to <8% by Mar’26. We model an NIM of 6.1% each in FY26/FY27 (FY25: 5.7%).

1+dpd rises ~10bp QoQ; bounce rates rise sharply in Oct’25

* GS3 rose ~10bp QoQ to 1.95%, and NS3 rose ~10bp QoQ to 1.5%. PCR declined ~1pp QoQ to ~21%. GS2 rose ~10bp QoQ to 1.7%.

* The company’s 1+dpd rose ~10bp QoQ to 5.5%. Bounce rates declined ~50bp QoQ to ~16.3% in 2QFY26 (vs. ~16.8% in 1QFY26). In Oct’25, bounce rates again rose to 17.4%.

* Capital adequacy stood at 48.4% (Tier 1: 48%) as of Sep’25.

Highlights from the management commentary

* Quarterly run-rate for assignment volumes will be INR1.5-2b, while insurance commission income quarterly run-rate will be INR180-200m.

* The company will continue to add 5-7 branches per quarter, with expansion balanced across both its focus markets and emerging geographies.

* Co-lending is expected to scale up to ~10% of total disbursements over time, as the company continues to expand and deepen its co-lending partnerships.

Valuation and view

* HOMEFIRS reported a soft operating performance in the quarter, with AUM growth tracking marginally below expectations, driven by both lower disbursement volumes as well as higher BT-OUT. The weakening of asset quality in certain geographies, impacted by tariff-related uncertainties, resulted in sequentially higher credit costs. A key positive was the NIM expansion, supported by the lower cost of borrowings and better liquidity management.

* HOMEFIRS has invested in building a franchise, positioning itself well to capitalize on the significant growth opportunity in affordable housing finance.

* We estimate the company to clock a ~25% AUM CAGR over FY25-FY28 and NIM (as % of average AUM) of 6.1% each in FY26/FY27. Reiterate our BUY rating on the stock with a TP of INR1,450 (premised on 2.8x Sep’27E BVPS).

* Key downside risks: a) higher BT-outs, leading to lower AUM growth; and b) deterioration in asset quality in its LAP product and self-employed customer segments, resulting in higher credit costs. Asset quality will be a key monitorable in 2HFY26.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412