Building Materials Sector Update : Demand Softness Persists; Margins Offer Cushion by Prabhudas Lilladher Ltd

Demand Softness Persists; Margins Offer Cushion

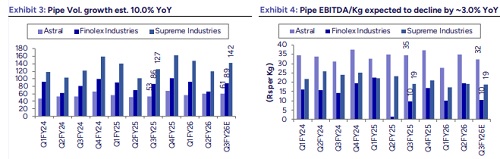

Building Material companies under our coverage universe are expected to report single digit revenue growth due to weak demand and extended monsoon, however margins are expected to expand due to cost reduction measures and because of cooling of timber cost. We anticipate moderate volume growth of 10.0% YoY in plastic pipe sector. Tiles and bathware sectors are likely to experience single digit growth expecting demand to pick up in coming years. Wood panel segment CPBI is expecting good revenue growth mainly driven from plywood segment (contributes 55% to the topline). We expect coverage companies to register sales/EBIDTA/PAT growth of 8.3%/19.5%/19.5% YoY. We expect Astral (ASTRA) and Century plyboards (CPBI) to outperform in the BM space.

* Plastic Pipe - Moderate vol. growth continue: The coverage plastic pipe companies are expected to report moderate volume growth of 10.0% YoY, primarily due to delays in ADD implementation, extension of BIS for PVC resin, subdued demand and due to extended monsoon. We estimate revenue growth of +7.6% YoY. However, EBITDA and PAT are expected to increase by 9.8% and 8.1% YoY, respectively, mainly due to margin expansion of ~25bps YoY, Supreme Industries and Astral are expected to post moderate sales growth of +9.3% and +11.9% YoY, respectively, with volume growth in the Pipes & Fittings (P&F) segment at 12.0% for Supreme and 15.0% for Astral. We are expecting Inventory loss of Rs 200/250mn for Astral/Supreme in Q3FY26.

* Tiles & Bathware – soft performance for KJS & CRS: Kajaria is expected to report soft revenue growth of 5.7% YoY in the quarter, primarily driven by modest tile volume growth of 3.7% YoY. Domestic demand remains moderate, due to extended monsoon also competitive intensity increased due to reduced exports from Morbi players, leading to increased domestic supply. However, as export-related challenges begin to ease, Morbi exports are expected to pick. Despite steady volumes, EBITDA margin for Kajaria is expected to expand to 18.0%, due to cost rationalization measures and closure of the low-margin plywood business. Cera Sanitaryware (CRS) is expected revenue to increase by 6.2% YoY. Faucets segment is expected to grow by 12.0% and sanitaryware by 2.0% YoY. EBITDA margin is expected to expand by ~60bps YoY to 13.8%, with PAT likely to grow by 17.7% YoY.

* Woodpanel – plywood continue to outperform: Century Plyboards (CPBI) is expected to sustain volume growth in the plywood segment, driven by market share gains. CPBI is expected to deliver healthy sales growth of 15.6% YoY, with EBITDA margin of 12.0%. We expect MDF volume growth of +20.0% YoY for CPBI and +7.3% YoY for Greenpanel (GP). Plywood volume growth is estimated at +14.5% YoY for CPBI and 2.0% YoY for GP. Additionally, CPBI’s laminate segment expected volume growth of 12.0% YoY, aided by an improvement in export business. Overall, the wood panel coverage universe is expected to report revenue growth of +13.1% YoY, while EBITDA and PAT increase by 38.7% and 31.5% YoY, respectively, due to estimated EBITDA margin expansion of ~220 bps YoY.

* Coverage target price changes: As we roll forward our target prices to Mar’28E, we have revised the target prices for all the companies, while maintaining our ratings

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271

More News

ESG: ICM progresses with carbon offset plan by Kotak Institutional Equities