IT Sector Update : Q3FY26 Quarterly Results Review The New IT Playbook: AI Ambition Meets Valuation Discipline by Choice Institutional Equities

Performance Resilience Continues in Q3FY26; Despite Seasonality

AI is shifting from “strategic theme” for the industry to business driver, especially in enterprise workload signaling an ongoing transformation in how IT services deliver value. To ride on the growing AI wave GOI has also increased AI Mission budget in the Union Budget 2026, from INR 8 Bn to INR 10 Bn, while proposing a tax holiday till 2047 for foreign cloud providers delivering global services from India-based data centres, subject to serving domestic customers via an Indian reseller. This push from GOI, we believe would support structural growth of Indian IT sector ecosystem led by Data, Cloud and AI areas, thereby improving business supply chains for companies like TCS setting up Datacenter in India.

Top-line growth and margins witnessed strong resilience led by AI

Most Indian IT services companies reported flat to ~4% QoQ revenue growth in Q3FY26, despite seasonal headwinds from holidays and furloughs. This resilience in a typically weak quarter signals a steady uptick in AI adoption and continued enterprise digital transformation, driven by cloud, analytics, and AI-led engagements. However, with traditional IT services still accounting for nearly ~90% of industry revenues, the faster growth in AI-led offerings is yet to materially accelerate overall topline growth. That said, productivity gains are increasingly visible, reflected in flat to ~240 bps QoQ EBIT margin expansion across companies under coverage (excluding those impacted by salary hikes) during Q3FY26.

Improving Visibility with Select Leaders Outperforming

COFORGE led with strong order intake of USD 593 Mn and an executable order book of USD 1.72 Bn (+30% YoY). Persistent Systems sustained momentum with double-digit QoQ TCV growth, driven by BFSI, Healthcare, and AI-led engineering. Infosys and TCS reported stable large-deal wins, supported by GenAI, cost optimization, and vendor consolidation. HCLTech saw improving pipeline conversion, while Happiest Minds Technologies reported strong GenAI deal traction. Overall, deal momentum signals a gradual recovery with improving FY27 visibility for AI-led players

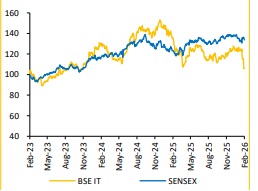

Valuation: Comfort in valuations as Industry Navigates AI Transition

Tier-I IT services companies are expected to deliver a revenue CAGR of 6.9%–13.2%, with EPS CAGR ranging from 6.7% - 22.1% from FY25-28E. In comparison, Tier-II companies are projected to record a stronger revenue CAGR of 8.2%–31.2%, with EPS CAGR of 11.5%–38.0%. Select Tier-II IT players are expected to retain premium valuations, supported by their superior growth trajectory, driving non-linearity through differentiated business models, and early investments in AIled platforms and service capabilities, enabling them to capitalize on the evolving technology trends and rising AI-driven demand

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131