Quant : Slice and dice : Quarterly sectoral performance – Q3FY26 by PL Capital

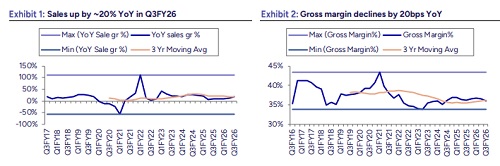

? Automobiles sales grew 19.6% YoY. Gross margin contracted by 20bps YoY, while EBITDAM saw a modest improvement of 25bps YoY. PATM declined slightly, falling by 9bps YoY.

? Capital Goods sales grew a strong 21.4% YoY. Gross margin expanded by 289bps YoY, while EBITDAM improved by 187bps YoY. PATM also strengthened, rising by 184bps YoY.

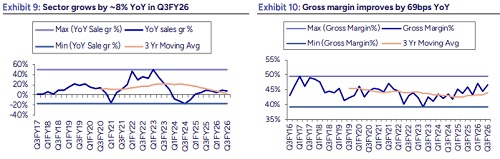

? Chemicals sales grew 7.6% YoY. Gross margin improved by 69bps YoY, while EBITDAM was relatively stable with a marginal 2bps YoY uptick. PATM, however, weakened, declining by 153bps YoY.

? Construction Materials sales grew 13.2% YoY. However, gross margin contracted by 71bps YoY, and EBITDAM declined by 20bps YoY. PATM weakened sharply, falling by 476bps YoY.

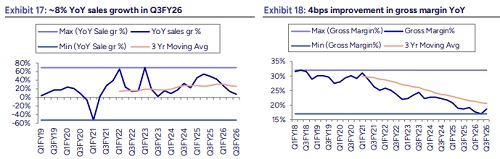

? Consumer Durables sales grew 7.7% YoY. Gross margin expanded slightly by 4bps YoY, while EBITDAM improved by 16bps YoY. PATM, however, declined by 61bps YoY.

? Electricals sales rose a strong 33.9% YoY. However, gross margin contracted by 136bps YoY, and EBITDAM declined by 46bps YoY. PATM inched up by 28bps YoY.

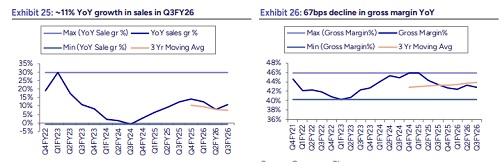

? FMCG sales grew 10.9% YoY. However, gross margin contracted by 67bps YoY, and EBITDAM declined by 74bps YoY. PATM weakened further, falling by 118bps YoY.

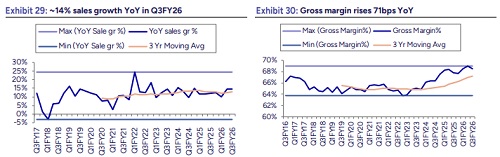

? Healthcare sales grew 14.4% YoY. Gross margin improved by 71bps YoY, while EBITDAM declined by 25bps YoY. PATM weakened further, contracting by 181bps YoY.

? Metals & Mining sales grew 8.3% YoY. Gross margin improved by 77bps YoY, while EBITDAM declined by 48bps YoY. PATM strengthened, rising by 104bps YoY.

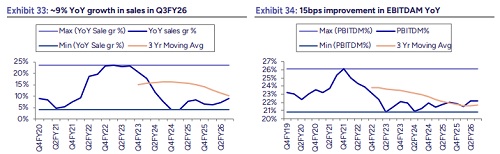

? IT sector sales grew 8.9% YoY. EBITDAM inched up by 15bps YoY. PATM, however, declined sharply by 216bps YoY.

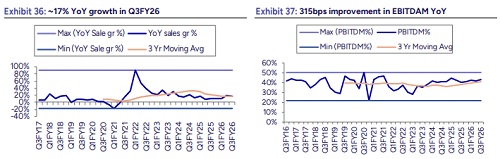

? Logistics sales grew 16.7% YoY. EBITDAM improved sharply by 315bps YoY. PATM also increased, by 34bps YoY.

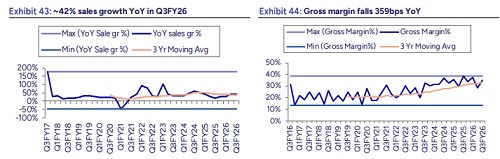

? Retail sales surged 42.1% YoY. However, gross margin contracted sharply by 359bps YoY, and EBITDAM declined by 68bps YoY. PATM also weakened, falling by 50bps YoY.

Above views are of the author and not of the website kindly read disclaimer