Automobiles Sector Update : Strong growth; raw materials headwinds to remain by Elara Capital

Strong growth; raw materials headwinds to remain

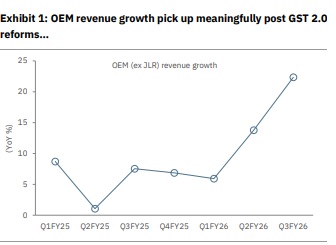

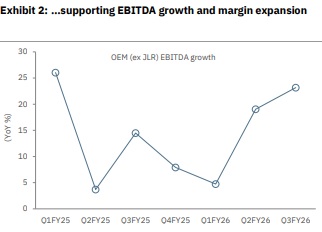

We analyze Q3 performance of listed original equipment manufacturers (OEM). Among our coverage universe, OEM have reported revenue growth of ~22% YoY, with sustained demand momentum post the festival season, led by the GST 2.0 reforms. OEM have seen revenue growth in the range of 5-37% YoY, with TVSL seeing the highest growth. While most OEM have seen EBITDA margin expansion YoY, MSIL and TMPV have seen YoY contraction. OEM have seen healthy average selling price (ASP) expansion; ex-CV, which saw YoY ASP decline, due to weaker mix. Adj PAT growth for the quarter was at ~27% YoY (excluding one-time exceptional item related to new Labor code). TVSL has outperformed peers in terms of adj PAT growth while EIM has seen the highest margin expansion. JLR revenue was down 39% YoY, with EBIT margin at -6.9% vs +9.1% YoY. We tweak our FY26- 28E EPS by 1-7% for OEM (ex TMPV). Post Q3FY26 most OEM has seen earning upgrades.

Growth momentum to sustain in Q4 and FY27: OEM expect strong demand momentum post the GST 2.0 reforms to sustain in Q4 and into H1FY27 as well (January PV domestic growth at 8% YoY and 2W at 26% YoY). However, growth could moderate in H2FY27, given high base. CV would report strong double-digit growth in Q4 as OEM see replacement demand kicking in post the GST 2.0 reforms, which improved fleet operating matrices. While OEM refrained from sharing the FY27 outlook, most continue to see high singledigit growth for the passenger vehicles and two-wheeler industries. We expect FY27E industry growth at 8% for PV, 10% for 2W, 6% for MHCV, 9% for LCV, and 5% for tractors. Inventory in the system remains lean, which gives OEM comfort to push inventory in Q4, sustaining the growth trend.

Raw materials headwinds to persist in Q4: Most OEM have reported a 40-70bp impact, due to higher raw materials price, especially for noble metals. While most have undertaken slight price hikes to offset the impact, MSIL management says it has not undertaken any price increases, as it may deter demand momentum post the GST 2.0 price reduction.

EIM, TVSL, MM, and MSIL remain our top picks: We continue to like 2W (EIM & TVSL) and PV-focused names (MM & MSIL), given the strong demand momentum likely continuing into FY27. We remain negative on TMPV, given persisting global demand headwinds. As we had expected, EIM margin has started to see a gradual improvement, as we see volume growth at the expense of pricing is behind us (see our note Strong growth momentum continues, dated 6 January 2026) and demand for the flagship model Classic 350cc should aid in EBITDA growth outperforming volume growth during FY26-28. TVSL continues to impress with sustained above industry growth and market share gains (Vahan market share up 148bp in FY26 YTD). For MM, recent capacity addition plans and positive management commentary gives us confidence on volume growth ahead of the industry. We slightly tweak our OEM EPS estimates by 1-7% during FY26-28. We revise our rating to Buy for MSIL with a lower TP of INR 18,686, and increase our TP for TMCV to INR 523 (we include the IVECO stake). We raise our TP of HMCL to INR 6,558.

OEM: strong growth momentum in Q3FY26, with most seeing margin expansion

* Revenue: For OEM, revenue grew in the range of 5-37% YoY in Q3, driven by strong volume growth. Product mix and ASP growth was mixed across OEM. TVSL outperformed in terms of volume and revenue growth with improving mix as well. Export focused OEMs (notably BJAUT) has seen strong demand and improved realization (due to INR depreciation) in export markets.

* EBITDA: EBITDA grew 5-51% YoY in Q3FY26, with TVSL outperforming peers with 51% YoY growth. However, margin was mixed for OEM, with most seeing YoY expansion while MSIL and TMPV saw a margin decline in the range of 65-71bp YoY. MSIL margin took a hit from the sharp contraction in gross margin, due to higher raw materials prices.

* Adjusted PAT: PAT growth was in the strong double digits across firms for Q3FY26 (ex-Hyundai and TMPV), with YoY growth in the range of 20-59%. For Hyundai and TMPV (ex-JLR), profit growth was in the range of 4-6% YoY.

* Demand: OEM continue to see strong demand momentum (double-digit growth) to continue well into Q4 and H1FY27, growth moderation likely in H2FY27 on high base. Demand buoyancy comes from the recent GST 2.0 reforms, which increases affordability across segments. This was evident in Q3, when entry-level cars and compact SUV outperformed larger SUV growth. Due to improved fleet operability metrices, CV OEM expect replacement demand to kick in the upcoming quarters. On the tractor side, OEM sounded a bit cautious, especially after likely 24% industry growth in FY26

Please refer disclaimer at Report

SEBI Registration number is INH000000933

More News

Consumer Durables Sector Update : Summarising takeaways from JM Financial India Xchange 2025...