Buy JK Cement Ltd for the Target Rs.780 by Motilal Oswal Financial Services Ltd

On-time expansion reinforces execution strength

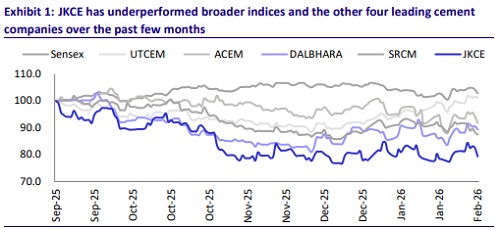

Capacity concerns drive underperformance; structural growth intact

* JK Cement’s (JKCE) stock has underperformed broader indices and other top cement companies in the past few months (over Sep-Feb’26 MTD) on account of margin contraction and higher expected capacity additions in its core markets (North and Central) over the next two years. However, the company remained resilient in terms of robust volume growth, strong execution strategies, market share gains, and timely completion of capacity expansion projects. The company recently completed its 6.0mtpa grey cement capacity expansion in the Central and Bihar markets.

* We believe North and Central region markets remain structurally attractive, supported by sustained demand from infrastructure and housing segments. We estimate average capacity utilization in the North/Central regions at +80%/+75% in FY27/FY28, despite higher capacity additions. While headline cement capacity expansion announcements remain elevated, execution cadence and timely commissioning are critical in assessing the real extent of oversupply risk.

* JKCE will continue to have a higher capacity mix in the North and Central regions, at ~80% of its overall grinding capacity by FY28E vs. ~75% currently. The company is among the earliest movers in Jaisalmer, with an integrated cement plant (clinker/grinding capacity of 4.0mtpa/3.0mtpa) to be commissioned in 1HFY28. The company has secured long-term limestone reserves at benign costs, providing long-term raw material security and cost benefits. In addition, it is setting up two split-location grinding units (GU) in the North—at Bikaner (Rajasthan) and Bathinda (Punjab)—with capacities of 2mtpa (each).

* We expect JKCE to report robust volume growth (~13% CAGR over FY26- 28), driven by capacity expansions. We estimate its consolidated revenue/EBITDA/PAT CAGR at 13%/17%/19% over FY26-28, and EBITDA/t at INR1,107/INR1,140 in FY27/FY28 vs. INR1,060 in FY26. We value it at 17x FY28E EV/EBITDA to arrive at our TP of INR6,780. We reiterate our BUY rating on the stock.

Strong demand tailwinds drive higher utilizations in North and Central

* Northern and Central regions continue to remain structurally attractive despite concerns around higher capacity additions. These regions are key beneficiaries of sustained infrastructure spending, housing demand, and urbanization-led construction activity. States such as Uttar Pradesh, Rajasthan, Madhya Pradesh, Haryana, and Delhi NCR continue to witness strong demand from roads, bridges, affordable housing, and urban redevelopment. We estimate average grinding capacity utilization in the North/Central regions at +80%/+75% by FY28. We believe continued higher utilization will support strong pricing in the regions.

* In FY26, North region was expected to add ~14mtpa of capacity; however, only ~10mtpa has been commissioned YTD. Similarly, Central region had ~15mtpa of planned capacity additions, of which just ~8mtpa has been commissioned so far. At the all-India level, against an anticipated ~63mtpa of capacity additions, only ~35mtpa has materialized YTD. This divergence between announced and commissioned capacity suggests that the effective supply addition is tracking meaningfully below initial expectations, moderating near-term oversupply concerns.

* JKCE will continue to have a higher capacity mix in the North and Central regions, at ~80% of its overall grinding capacity by FY28E vs. ~75% currently. We estimate the company’s grey cement volume CAGR at ~14% over FY26-28, backed by strong demand and capacity expansions. We estimate the company’s average capacity utilization at ~75% over FY26-28 on the expanded capacity vs. ~79% over FY22-25.

Panna phase-2 commissioned on time; Jaisalmer expansion in full swing

* In Jan’24, the company announced its Phase-2 expansion in Panna, with 3.3mtpa clinker and 3.0mtpa grinding capacity in Central region and one 3.0mtpa greenfield GU in Bihar. The company has completed this expansion on time, and its consolidated grey cement grinding capacity now stands at 31.8mtpa.

* The company is currently focusing on its greenfield expansion in Jaisalmer, Rajasthan. Construction work for the 4.0mtpa clinker unit, along with 3mtpa GU at Jaisalmer, is progressing according to schedule, and ordering for equipment has been completed. In addition, the company is setting up two split-location GUs in Rajasthan and Punjab, with capacities of 2mtpa (each). In Rajasthan, it is setting up a GU in Bikaner, for which Bhoomi Poojan was performed in Feb’26. This GU is situated ~400km from the Jaisalmer plant. In Punjab, it is setting up a GU in Bathinda, for which it has started placing orders. The lead distance for this GU from the Jaisalmer plant is expected to be ~550-600km.

* The Jaisalmer expansion is likely to be completed in 1HFY28. The expansion will strengthen its competitive positioning in northwest Rajasthan by securing longlife, low-cost limestone reserves in a region with limited existing clinker capacity. This expansion will enable efficient dispatches into parts of Rajasthan, Gujarat, Haryana, and Punjab, improving its regional market share.

View and valuation

* We estimate JKCE’s consolidated revenue/EBITDA/PAT CAGR at 13%/17%/19% over FY26-28, driven by robust volume growth and improved profitability. We anticipate the company’s consolidated volumes to post ~13% CAGR over FY26- 28, and OPM to expand 1.4pp to ~19% by FY28. We estimate its EBITDA/t at INR1,107/ INR1,140 in FY27/FY28 vs. INR1,060 in FY26.

* We estimate JKCE to generate a cumulative OCF of INR76.7b during FY26-27, with cumulative capex estimated at INR75.0b over the same period. The company’s net debt is estimated to increase to INR68.5b due to the Jaisalmer expansion in FY27. However, this is estimated to decline in FY28 to INR58.9b, given the strong OCF generation from new capacities. Meanwhile, the net debtto-EBITDA ratio is estimated to remain below 2.5x by FY27. We anticipate its RoE/RoCE (post tax) at ~17%/11% in FY28, higher than its peers and best in class in the industry.

* Our EBITDA estimates of JKCE for FY27/FY28 are broadly in line with consensus estimates. It is currently trading at 17x/15x FY27/FY28E EV/EBITDA. We value JKCE at 17x FY28E EV/EBITDA to arrive at our TP of INR6,780. We reiterate our BUY rating on the stock

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412