Hold Voltas Ltd for the Target Rs.1,441 by Prabhudas Lilladher Pvt Ltd

Moderate quarter ahead for RAC segment

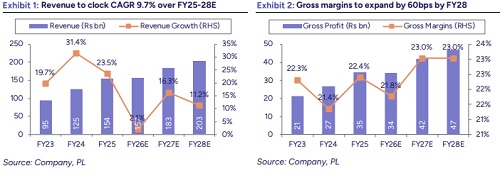

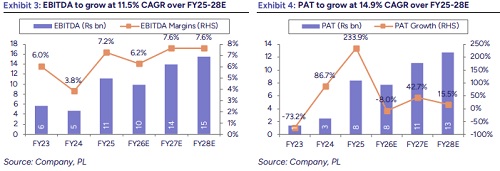

We attended VOLT’s analyst conference call wherein the management highlighted its focus on regaining sales momentum in cooling products, diversifying into a full-stack appliances portfolio, and driving cost saving measures across the value chain to ensure sustainable margins. VOLT anticipates a softer recovery in RAC demand with GST rationalization and festive demand due to inventory accumulation in Q1FY26. VOLT maintains the top position in RAC segment (18% market share) and aims to be the top player in air coolers from current #2 spot. Price hikes are anticipated in Jan’26 in 3 and 5 star RAC products. We introduce FY28 numbers and estimate revenue/EBITDA/PAT CAGR at 9.7%/11.5%/14.9% over FY25-28E. The stock is currently trading at 42x/37x of FY27/FY28E. There is no change in our estimates and roll forward to Sep’27E, revise SOTP-based TP to Rs1,441 (earlier Rs1,268), implying PE of 40x Sep’27E earnings. Maintain ‘HOLD’.

Key takeaways:

Muted revenue due to channel inventory & GST window

* Both primary as well as secondary sales have been impacted in Q2FY26. Primary because of the overhang of the inventory in the channel, and secondary because of the 5-week window which has created due to GST.

* Channel inventory stands at 2–3 months between industry and distribution channels.

Outlook on GST 2.0 and upcoming festive demand

* Recent GST reduction from 28% to 18% on RACs and dishwashers is expected to be a strong demand catalyst.

* The management highlighted that while Q2FY26 faced pressure due to channel inventory build-up and deferred purchases in anticipation of the GST cut, the festive season is expected to drive sequential recovery during Q3- Q4FY26.

Growth trajectory across cooling sub-segments

* VOLT continues to be #1 player in the RAC category with ~18% market share.

* The company will focus on its core 3 star products while expanding the premium portfolio, aiming to widen the gap with #2 player in the RAC segment.

* Its Air Coolers segment holds the 2nd spot in the industry and the company aims to reach the top position by Q4FY26.

* Commercial air conditioning business is expected to be a key growth driver from FY26–28, growing 15–20% annually with an expanding channel network across 150 cities.

* Commercial refrigeration segment saw a soft Q1FY26 and is expected to grow 15–18% in the coming quarters.

Price hikes in 3 and 5 star AC

* The company indicated a likely price hike in Jan’26, with 3 star AC prices rising by 3–5%. Further, primary sales are anticipated to increase in Q3FY26.

* A higher increase is anticipated in the 5 star category, with specific details currently under assessment.

Project business update

* Earlier, certain domestic projects, especially electrical and water related, faced temporary labor shortages, leading to higher labor costs.

* This challenge has now been resolved, and workforce availability is no longer a concern for ongoing and upcoming projects.

Strategic cost optimization and outsourcing of key sub-assemblies

* The company is aggressively implementing cost-saving initiatives, with benefits expected from Q4FY26 and Q1FY27 to enhance margins.

* The company will not prioritize in-house production of key sub-assemblies such as compressors, copper and aluminum components, DC motors and drives, and PCB drives, which together account for ~70% of total costs. Instead, it will rely on specialized contract manufacturers to supply these critical components.

Expanding reach across key sales channels

* The company is focusing on retaining its strong position in the traditional channel.

* Expansion in modern trade, regional retail, and e-commerce is expected to drive incremental market share gains.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271