Buy Genus Power Infrastructure Ltd For Target Rs. 330 by by Axis Securities

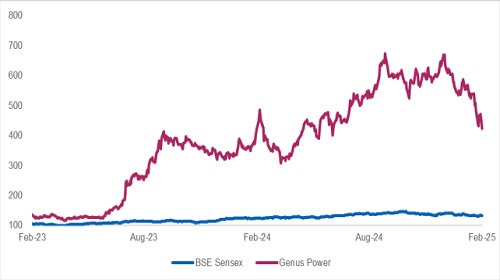

* We recommend a BUY on Genus Power Infrastructure Limited with a target price of Rs 330, implying an upside of 10% from CMP of Rs 300 and a stop loss of Rs 285

* Genus is one of the largest players in the electricity metering solutions industry in India. As a pioneer in electricity metering solutions with over 8 Cr meters installed globally, Genus has been at the forefront of electricity metering since its inception in 1992 with ~27% market share

* The company’s order book stood at Rs 31,776 Cr as of Sep’24 with concessions for over 8-10 years. The current orderbook is not the peak and a further increase from this level is expected from Q1FY26 onwards.

* The Revamped Distribution Sector Scheme (RDSS) has a target of installing 25 Cr smart meters across India by 2025. Out of the 25 Cr smart meters, only 50% i.e., ~13.8 Cr have been awarded while ~2.0 Cr are installed (as on 22 Jan’25), providing enough future growth potential for smart metering players like Genus.

* The company recorded a revenue of Rs 901 Cr in H1FY25 with the FY25 guidance being Rs 2500 Cr. The management remains confident of achieving the annual target. This would be driven by a strong performance in H2FY25 led by a pickup in the pace of execution.

* The company’s Q3FY25 result is expected on 10th February 2025. Led by a strong orderbook and execution, we expect a strong Q3 with a healthy YoY growth.

OBJECTIVE:

The objective of Axis Alpha is to generate absolute return for investors and traders. Axis Alpha is fundamental short term stock call based on the events, valuations, market direction or a mix of these. The duration of the call can be as short as a week to as long as a month (30 days). These short term calls are generated by the fundamental research team of Axis securities and the calls can differ from the fundamental long-term recommendation on the stock. The average expected returns for these calls will be 5%. All the calls will be provided with Stop Losses.

EVENTS BASED:

The calls are based on the following factors. While this is not a complete list of factors but most of the calls will be based on the following:

* Quarterly results: Results are likely to be better or worse than expectations resulting in a +/-5% move for the stock

* Mergers and acquisition: Mergers or acquisitions by companies can result in significant price movements in either directions

* Major blocks or capital raising programs results in significant price movements Regulatory announcements affecting the industry

* Competition announcements impacting the industry as a whole. Example Jio cutting tariffs impacts all the telecom players

* Others

VALUATIONS BASED:

Significant run up or compression can result in short term opportunities for corrections in either direction.

MARKET MODES:

Risk on or risk off mode of market has impact on stocks depending on stocks beta, leverage and nature of industry. These provide opportunities

SUITABILITY:

This product is suitable for seasoned investors and traders as we stop losses get triggered based on market conditions. Also there can be high degree of volatility as some months can be very bad and some could be exceptionally good. However, the endeavour will be to deliver solid absolute returns.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

.jpg)

.jpg)