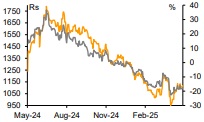

Buy Bharat Forge Ltd for Target Rs. 1,200 By Emkay Global Financial Services Ltd

Soft quarter; global uncertainty affects FY26 outlook

BHFC’s Q4 revenue fell ~7% YoY across SA/consol operations, with margin also weaker QoQ (albeit lower at consol level amid ~270bps margin expansion for subsidiaries). While order-win momentum remains healthy led by Defense (incl due to Rs37bn accretion seen from domestic artillery guns; executable book now at Rs94bn), the mgmt did not provide outlook on exports for FY26 (30% of consol operations) amid the tariff-led global uncertainty; BHFC also expects domestic PV business growth to now track underlying industry growth vs strong outperformance seen in FY25. We reduce FY26E/27E consol EPS by 8.6%/3.6%, amid weakening global demand (eg recent lowering of 2025 guidance by global truck majors) and gradual recovery expected in the domestic CV/PV space; however, valuations at LTA on 1YF P/B provide some comfort. We retain ADD with unchanged TP of Rs1,200 at 17x FY27E EV/EBITDA.

Soft performance in Q4; improvement in subsidiary margins a silver lining

Consolidated revenue declined ~7.5% YoY to Rs38.5bn, with standalone revenue lower by 7% YoY (~7% miss on Consensus). Domestic Auto revenue grew 11%, though NonAuto revenue declined 30%; export revenue was flattish, with 8% decline in Auto and 13% growth in Non-Auto. Consolidated EBITDA grew 6% YoY to Rs6.8bn (~7.5% beat vs Consensus), with EBITDA margin down by 28bps QoQ to 17.7% amid ~240bps gross margin contraction. Margins at subsidiaries improved to 3.8% vs (0.9%) in Q4FY24 and 1.1% in Q3FY25. Adjusted consolidated PAT was higher by ~17% YoY to Rs2.9bn. Consolidated net debt for FY25 stood at Rs364bn vs Rs481bn in FY24.

Earnings Call KTAs

1) Overall orders won in FY25 entailed Rs69.6bn – Defense comprised 70%; executable Defense order book stands at Rs94bn, incl the recent domestic artillery guns order of Rs34bn. 2) Defense revenue (Rs17bn in FY25) seen growing 15-20% in FY26; domestic artillery guns order to start contributing to revenue from Q4, with overall execution over 2Y. 3) The mgmt did not provide outlook for the exports business for FY26 due to volatility and lack of visibility caused by the tariff situation (incl uncertainty around applicability on truck parts), though initial consultations with customers regarding pass-through have been positive. 4) Expects decline in CV exports in FY26, amid potential deferment of emission norm changes in the US and continued weakness in Europe; lower discretionary spends can impact PV exports. 5) Expects to grow in line with domestic PV industry in FY26. 6) JS Autocast (ferrous castings business) revenue grew 23%; on track to reach the vicinity of ~Rs10bn soon; profitability also improving; EBITDA margin now at 15- 16%, return ratios at over 20%. 7) Aerospace now forms 15% of Industrial exports; on course to achieve multifold growth in coming years; new ring mill and machining facilities to come onstream in 2027. 8) Capacity utilization in Europe/US at 60-65%; working toward restructuring European steel operations; phase 2 of US aluminium operations can increase output substantially. 9) Hopeful of completing consolidation of American Axles India by Jun-25. 10) Electronics foray by H2. 11) FY26 consol capex guidance: Rs5bn.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354