Neutral Bharat Forge Ltd for the Target Rs. 1,090 by Motilal Oswal Financial Services Ltd

Steady performance but weak outlook

Demand outlook for most of the businesses remains weak

* In 4QFY25, BHFC (standalone) posted a 9% YoY decline in PAT to INR3.6b (in line). The key highlight of 4Q was that the US subsidiary achieved EBITDA break-even for the first time in many quarters. However, the demand outlook for most of its segments remains uncertain given the adverse global macro.

* We have marginally lowered our estimates to factor in demand weakness across its key auto segments. Given the current uncertain outlook for standalone and overseas subsidiaries, the stock at 37.9x/28.6x FY26E/FY27E consolidated EPS appears fairly valued. We reiterate our Neutral rating with a TP of INR1,090 (based on 28x FY7E cons. EPS).

4Q performance in line with estimates

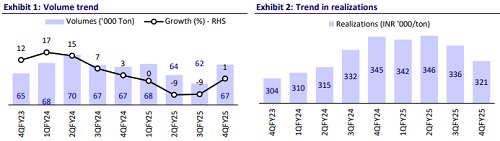

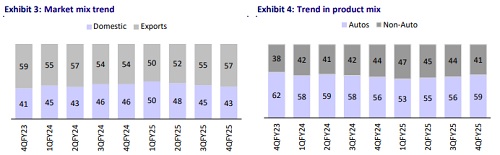

* In 4Q, standalone revenue declined 7% YoY to INR 21.6b (in line). While domestic business declined 14% YoY, exports were down 1% YoY.

* Domestic revenue fell 14% YoY, largely due to a 30% YoY drop in the nonauto segment, which was attributed to the conclusion of some export orders at KSSL.

* EBITDA margin declined 60bp QoQ to 28.5% (+40bp YoY), below our estimate of 29%.

* Adjusted PAT fell 9% YoY to INR 3.6b, largely in line with our estimate.

* At a consolidated level, margins declined 30bp YoY to 17.7% (+230bp YoY). Its overseas subsidiaries posted improved performance in 4Q. The key highlight was that the US subsidiary posted positive EBITDA margin (1.3%) for the first time in many quarters.

* For FY25, standalone business revenue declined 1% YoY to INR88.4b. While domestic revenues grew 2% YoY, exports declined 4% YoY. The key growth driver in FY25 was non-auto, wherein segments like defense, aerospace and oil and gas posted healthy growth.

* BHFC standalone margins improved 70bp YoY to 28.3%.

* Overall, BHFC standalone business posted 7% YoY decline in FY25.

* At a consolidated level, BHFC has posted 10% YoY growth in PAT to INR10.1b. Overseas subsidiaries and KPTL continued to be a drag on overseas performance.

* Consolidated long-term debt has come down to INR19.8b from INR24.6b YoY. As a result, net D/E decreased to 0.35x from 0.61x.

Highlights from the management interaction

* Management has refrained from giving any growth guidance for its exports business (30% of consolidated revenues) given the volatility and lack of visibility caused by the tariff situation globally.

* In the domestic market, BHFC is likely to grow largely in line with the industry in both PVs and CVs.

* In domestic non-auto, the scale-up of the defense business and opportunities for component supply to small nuclear reactors would be key growth drivers. Management has guided for 15-20% YoY growth in defense business in FY26.

* In this situation, management has indicated that they would focus on improving its consolidated profitability by: 1) evaluating options for steel forging business in Europe, 2) improving operational performance in Al business leading to meaningful reduction in losses, 3) leveraging their manufacturing footprint in North America to garner new business, and 4) reducing losses in e-mobility vertical. Further, the integration of AAM India is expected to be completed in FY26 after which they will target to leverage that platform to grow their product portfolio.

Valuation and view

* The majority of BHFC’s core segments, auto (both domestic and exports) and select industrials businesses, are currently witnessing a demand slowdown. Further, the ongoing slowdown in the European PV segment has hurt the rampup of its overseas subsidiaries. Given this backdrop, its defense, JS Auto Cast, and aerospace segments are likely to be the growth pillars in the near term.

* We have marginally lowered our estimates to factor in demand weakness across its key auto segments. Given the current uncertain outlook for standalone and overseas subsidiaries, the stock at 37.9x/28.6x FY26E/FY27E consolidated EPS appears fairly valued. We reiterate our Neutral rating with a TP of INR1,090 (based on 28x FY7E consolidated EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412