Buy Marico Ltd for the Target Rs. 800 by Motilal Oswal Financial Services Ltd

Robust topline growth; near-term margin pressure persists

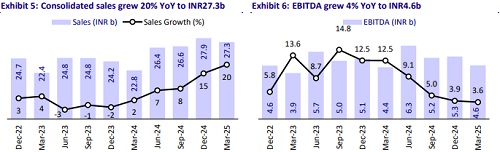

* Marico (MRCO) reported consol. revenue growth of 20% YoY (in line) in 4QFY25. Domestic revenue growth was 23% YoY, while volume growth was 7%. International growth was 11% YoY (16% CC growth).

* Domestic revenue growth was driven by strong core category growth and sustained success for its new growth drivers. Parachute coconut oil (PCNO) posted 22% YoY value growth with a 1% volume decline, driven primarily by price hikes. With copra inflation persisting, an additional 8-10% price increase was implemented in Apr’25, bringing the total YoY hike to ~30%. Value-added Hair Oils’ (VAHO) revenue was up only 1% YoY, affected by persistent weakness in the mass segment. Saffola oil clocked a marginal decline in volume growth, with revenue growing 26% YoY, led by pricing. Foods maintained a strong growth momentum of 44% YoY. Premium Personal Care sustained its healthy growth trajectory.

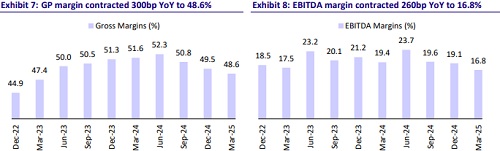

* Gross margin contracted 300bp YoY to 48.6%. Ad spends increased 35% YoY, leading to an EBITDA margin contraction of 260bp YoY to 16.8%. EBITDA grew 4% (est. 7%). The company expects margin pressure to sustain over the next 1-2 quarters, driven by elevated copra prices. We model EBITDA margins of 19.6% for FY26 and 20.3% for FY27.

* Revenue growth is expected to remain in double digits in FY26 in the medium term (unlike other FMCG peers), driven by pricing, expanded direct reach, and strong performance in Foods and Premium Personal Care. While rising input costs may impact near-term margins, the margin outlook for 2HFY26 remains positive. The stock was the top performer among peers in FY25 (>35% return). With the growth trajectory continuing, we expect the rich valuation to sustain. We reiterate our BUY rating on the stock with a TP of INR800 (based on 50x Mar’27E EPS).

Strong 20% revenue growth led by pricing; ad spends impact margin

* Sustaining revenue growth outperformance: Consolidated net sales grew 20% YoY to INR27.3b (in line) in 4QFY25. Domestic revenue growth was 23% YoY and volume growth stood at 7% YoY (est. 6%). International business delivered 16% CC growth, led by Bangladesh/MENA/South Africa, which posted 11%/47%/13% CC growth, while Vietnam saw a 1% CC decline.

* Pressure on margin to persist in the near term: Consolidated gross margin contracted 300bp YoY to 48.6% (est. 49.9%). Copra prices increased 14% sequentially and ~48% YoY in FY25. Vegetable oil prices remained firm, rising ~25% YoY in FY25. Crude oil derivatives remained stable during the period. Employee expenses were up 12% YoY, ad spends were up 35% YoY, and other expenses were up 11% YoY. EBITDA margin contracted 260bp YoY to 16.8% in 4QFY25 (est. 17.7%). EBITDA/PBT/PAT grew 4%/11%/8% YoY to INR4.6b/INR4.4b/INR3.4b/ (est. INR4.7b/4.5/INR3.4b).

* In FY25, net sales, EBITDA, and APAT grew 12%/6%/8%, respectively.

Highlights from the management commentary

* Consumer sentiment remained stable during 4Q, supported by improving rural demand and mixed trends across the mass and premium urban segments. ? Quick Commerce contributed ~3% to Indian business revenues in FY25. The company sees this channel as incrementally accretive, especially for impulse categories.

* The company recently implemented an additional 8-10% price hike, bringing the total hike to ~30% due to rising copra costs. It has not yet seen a significant volume impact from the recent price hikes.

* The company has made notable progress in premiumizing its portfolio across international markets by driving innovation and expanding into premium personal care categories such as shampoos, skincare, hair styling and care (excluding hair oils), and baby care. The revenue share of premium portfolio in international business increased to 29% in FY25 from 20% in FY21.

Valuation and view

* We largely maintain our EPS estimates for FY26 and FY27.

* The improvement in market share gain, accelerated growth in Foods and Premium Personal Care, healthy growth in the International business, and normalization of prices are expected to help MRCO deliver a better revenue print in FY26.

* To improve its distribution reach, MRCO has also started Project SETU, which helps drive growth in GT through a transformative expansion of its direct reach.

* We model 11%/13% revenue and EBITDA CAGR during FY25-27E and reiterate our BUY rating on the stock with a TP of INR800 (based on 50x Mar’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)