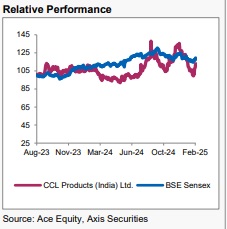

Buy CCL Products Ltd For the Target Rs. 730 By the Axis Securites

Recommendation Rationale

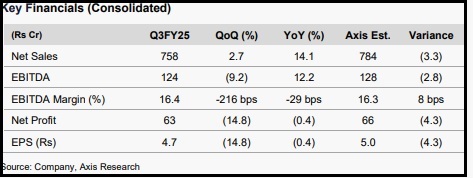

Revenue Performance: Revenue grew 14% YoY to Rs 758 Cr, driven by a ~3% volume increase (vs. double-digit guidance). The moderation in volume growth was due to higher volatility in coffee prices, leading to slower long-term contracts. However, management remains optimistic, reiterating its long-term volume growth target of 15%

Pricing Strategy: Over the past 18 months, the company has taken price hikes of 30%– 40% in the B2C segment, with an additional 10%–15% increase still under consideration. Future pricing decisions will be guided by market conditions and competitive responses, as the company closely tracks industry leaders before finalising its strategy.

EBITDA Growth Outlook: Management indicated that coffee prices are expected to stay elevated in the near term. However, they remain confident in sustaining EBITDA growth within the 15–20% range by prioritizing long-term agreements, private label partnerships, and higher-margin contracts, which provide better pricing stability and profitability.

Debt and Working Capital Position: The company's working capital remains elevated at approx. Rs 1,200 Cr, primarily due to high coffee prices. Meanwhile, long-term debt stands at Rs 790–800 Cr, bringing total debt to around Rs 2,000 Cr. The sustained increase in working capital reflects the impact of commodity price fluctuations, which continue to influence the company’s financial position. Management indicated that going forward, total debt would not exceed Rs 2,200 Cr.

Sector Outlook: Positive

Company Outlook & Guidance: We have revised our FY25/26 estimates downward to account for elevated coffee prices, increased depreciation, and higher interest costs. Despite these adjustments, we maintain our BUY recommendation on the stock as we roll over our estimates to Dec’26

Current Valuation: 23x Dec-26 EPS (Earlier Valuation: 23x Dec-26 EPS ).

Current TP: Rs 730/share(Earlier TP: Rs 820/share)

Recommendation: With a 13% upside from the CMP, we maintain our BUY rating on the stock.

Financial Performance: CCL Products’ consolidated revenue for Q3FY25 stood at Rs 758 Cr, registering a 14% YoY growth, driven by ~3% volume growth. Gross margins declined by 104 bps to 40.1%, impacted by volatility in coffee prices. EBITDA increased to Rs 124 Cr, up 12.2% YoY, while EBITDA margins declined by 29 bps YoY to 16.4%. The company's PAT stood at Rs 63 Cr, down 0.4% YoY.

Outlook & Recommendation CCL Products has maintained consistent performance despite volatility in coffee prices. Following supply chain disruptions, several global coffee companies are looking to de-risk their supplies by partnering with manufacturers that have a presence across multiple geographies. In this context, CCL Products is well-positioned as a preferred choice due to the following factors: 1) It has facilities in Vietnam and India, unlike Brazilian players that operate only in their home country. This geographic advantage has helped CCL strengthen its foothold in international markets, gain market share, and access new business. Additionally, it is looking to invest further in the UK and US markets. The company targets a 15% global market share in the next few years; 2) It operates a cost-efficient business model; 3) It is doubling its capacity from 38,500 MT in FY22 to approximately 77,000 MT by FY25 across Vietnam and India; 4) It is expanding capacity in valueadded products such as FDC and small packs in Vietnam; and 5) It is aggressively scaling up its domestic business, led by its branded segment. We have revised our FY25/26 PAT estimates downward to factor in high coffee prices, increased depreciation, and higher interest costs

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633