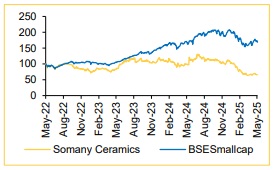

Buy Somany Ceramics Ltd For Target Rs. 540 - Choice Broking Ltd

Positive Management Outlook Is Conservative In Our View

We maintain BUY rating on Somany Ceramics (SOMC) with a revised target price of INR 540/share as we factor in 1) volume CAGR of 9% over FY25-28E driven by market share gains from unorganized players in the Tiles segment, 2) Bathware segment revenue CAGR of 12% over FY25-28E, 3) higher revenue contribution of 25% from projects segment (vs. 20% in FY25) which is a higher margin business. The strong launches and sales of Real Estate sector between FY22 to FY25 would help drive volume for SOMC during FY26-28E as these projects near completion, 4) EBITDA margin expansion of ~150 bps over FY25- 28E, and 5) incorporate a PEG ratio based valuation framework that allows us a rational basis to assign a valuation multiple that better captures earnings growth.

We forecast SOMC EPS to grow at a CAGR of 43% over FY25-28E, basis our volume CAGR of 9%, and realization CAGR of 0.4% over the same period.

We arrive at a 1-year forward TP of INR 540/share for SOMC. We now value SOMC on our PEG ratio based framework – we assign a PEG ratio of 0.85x on FY25-28E core EPS CAGR of 43%, which we believe is a conservative multiple. This valuation framework gives us the flexibility to assign a commensurate valuation multiple based on quantifiable earnings growth

We do a sanity check of our PEG ratio based TP using implied EV/EBITDA, P/BV, and P/E multiples. On our TP of INR 540, FY27E implied EVEBITDA/PB/PE multiples are 6.5x/2.2x/16x all of which are reasonable in our view. Increased dumping from Morbi into the domestic market, slowdown in Real Estate execution and home improvement activities are risks to our BUY rating.

Q4FY25: Sequential Uptick

Tiles: Q4FY25 volume came in at 20.3 MSM (up by 3.1%/20.2% on YoY/QoQ), realization was down by 1.2%/1.9% on YoY/QoQ to INR 314 per SQM due to higher discounts, while revenue was up by 1.9/17.9% YoY/QoQ to INR 6,439Mn in line with CEBPL estimates of INR 6,336Mn.

Bathware: Q4FY25 Bathware segment revenue grew by 32.4/18.2% YoY/QoQ to INR 941Mn well ahead of CEBPL estimates of INR 844Mn.

SOMC reported Q4FY25 consolidated Revenue/EBITDA of INR 7,659Mn (+4.7% YoY, 19.7% QoQ) / INR 625Mn (-21.4% YoY, +16.8% QoQ) vs CEBPL estimates of INR 7,380Mn and INR 688Mn, respectively. Core PAT for Q4FY25 came in at INR 213Mn, (vs CEBPL est. INR 231Mn), down 30.7 on YoY, while it is up by 129% QoQ. EPS for the quarter came in at INR 5.2 vs CEBPS estimates of 5.6. SOMC announced a dividend of INR 3/sh which is on the expected lines.

Tiles segment - guidance for FY26 is conservative in our view: Management is targeting high single-digit volume growth and a 100–150 bps EBITDA margin improvement in FY26, supported by a strategic shift towards higher-margin project sales. Project sales are expected to increase to 25% of the revenue mix in FY26, up from 20% in FY25, with a corresponding decline in channel sales. This shift is driven by Real Estate sector projects entering into finishing stage over FY26E-28E from the strong launches and bookings witnessed between FY22-25, encouraging SOMC to adopt a more aggressive approach in the project segment, which generally has higher margins compared to select channel sales.

Bathware segment – guidance for FY26 is optimistic, but achievable in our view: Management is now targeting double digit growth for FY26 (on a low base though) backed by Real Estate demand and a differentiated product portfolio, which is achievable in our view.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131