Buy Indian Hotels Ltd for the Target Rs.900 by Motilal Oswal Financial Services Ltd

Resilient operating performance backed by diversification and scale

Operating performance in line with estimate

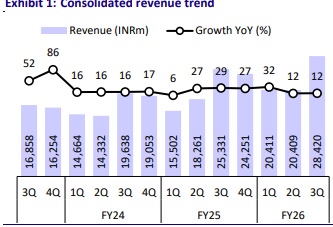

* Indian Hotels (IH) reported healthy consolidated revenue growth of 12% YoY in 3QFY26, led by growth in standalone business (up 9.5%). Subsidiaries business was up 16% YoY. The growth in standalone business was led by 13% growth in F&B and 6% growth in room revenue (ARR up 7%, OR flat). Higher F&B growth was led by increased MICE activity amid a wedding season and a higher number of events during the quarter.

* We expect the similar momentum to continue in 4Q, translating into double-digit revenue growth in 4Q. This is in line with management’s medium-term guidance of double-digit revenue growth in FY26 and FY27. Key growth drivers will be the increase in MICE activities, new partnerships (such as ANK, Pride, Brij and Atmantan), and scale-up in new and reimagined brands. Moreover, IH has a pipeline of 30,200 keys (with 94% of the total pipeline being asset light), almost equal to its current operational keys of 32,300, thereby aiding higher profitability.

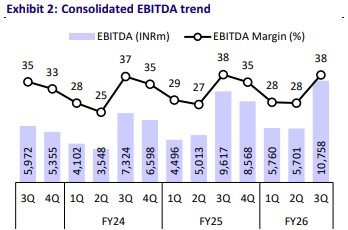

* We expect IH’s performance to continue its uptrend and estimate a CAGR of 14%/18%/16% in revenue/EBITDA/adj. PAT over FY25-28. We broadly maintain our FY26/FY27/FY28 EBITDA estimates and reiterate BUY with our SoTP-based TP of INR900.

Continued momentum across segments

* 3Q consolidated revenue/EBITDA/adj. PAT grew 12%/12%/20% YoY to INR28.4b/INR10.8b/INR6.9b (est. INR6.4b).

* Standalone revenue/EBITDA rose 9.5%/11% YoY to INR16.1b/INR7.5b, aided by an increase in ARR (up 7% YoY to INR21,900), while OR remained flat at 78.0%. F&B/other services/management fee incomes grew 12%/17%/11% YoY.

* For subsidiaries (consol. less standalone; including TajSATS), sales/EBITDA grew 16%/14% YoY to INR12.3b/INR3.2b. TajSATS revenue/EBITDA grew ~15%/15% YoY.

* International hotels performed better this quarter, with UOH/St. James’ revenue growing 13%/19% YoY and EBITDA up 31%/flat.

* IH’s new business verticals, comprising Ginger, Qmin, and amã Stays & Trails, grew 31% YoY to INR2.2b in 3QFY26.

* For 9MFY26, revenue/EBITDA/adj. PAT grew 17%/16%/11% to INR69b/INR22b/INR12b. ? Exceptional items of INR2.8b primarily included a profit of INR3.9b on the sale of its stake in Taj GVK, which was partially offset by new labor code impact of INR502m.

Highlights from the management commentary

* International business: The New York asset crossed INR1b in revenue for the first time in December, with improving profitability; therefore, the company intends to retain the asset with no exit plans. RevPAR rose 50% in San Francisco, while the London property is under renovation and is expected to reopen by Feb/Mar’26, providing a boost from 1QFY27. Currency movements benefitted RevPAR by 1.5-2%.

* Taj Bandstand: Excavation at the Taj Bandstand site has been underway for the past few months, with the tendering process currently in progress and development undergoing as planned. After stabilization, it is expected to generate ~INR10b in revenue and EBITDA margins of nearly 50%.

* Atmantan (a luxury wellness resort): The company plans to pursue a hybrid growth strategy, combining owned assets with select asset-light expansions. It plans to establish properties across key regions—West India, Kerala, Hyderabad, and North India—while maintaining healthy margins of ~40%. Each project typically requires 25-35 acres of land, along with strong transportation connectivity.

Valuation and view

* The outlook remains healthy for IH, led by strong traction in the core business as well as new and reimagined businesses.

* We expect the strong momentum to continue in the medium term, led by: 1) a strong room addition pipeline in owned/management hotels (5,940/24,630 rooms), 2) continued favorable demand-supply dynamics, and 3) increasing MICE activities in India. ? We broadly maintain our FY26/FY27/FY28 EBITDA estimates and reiterate BUY with our SoTP-based TP of INR900.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412