Buy DCB Bank Ltd for the Target Rs.210 by JM Financial Services Ltd

We attended DCB Bank’s investor day where the management reinforced its confidence in delivering ~18%-20% growth with ~0.92%-1.0% RoA and ~13.5%-14.5% RoE for the next 2 years. The bank highlighted the last 6 quarters of consistent 18–20% balance sheet expansion, a sharper focus on secured/granular lending, and disciplined cost management. Improvement in RoA/RoE would be driven by NIM recovery, operating leverage, and a large cross-sell runway. While asset quality remains a risk, with GNPA at 2.9%, the management expects gradual improvement through stronger recoveries, enhanced underwriting and better portfolio mix. With deposit repricing benefits unfolding, we see improving visibility on earnings. We expect ~20%/26% loan/EPS CAGR over FY25-27E and 14% RoE over FY26/27F. We revise our TP to INR 210, valuing the bank at 0.9x FY27E BVPS, and maintain BUY. DCB Bank remains one of our key ideas in midcap banks along with CUB and Ujjivan SFB.

* Sustained growth momentum with portfolio rebalancing: DCB has consistently delivered ~18–20% growth in both loans and deposits across the last 6 quarters. The management aims to maintain high-teen growth driven by secured retail, gold loans, school finance, and selective corporate lending. It noted that the BL:HL disbursement mix has been shifted to 60:40, enhancing yield resilience. New sourcing is increasingly direct rather than DSA-based, improving risk visibility and reducing acquisition costs. The management also guided that colending will remain capped below 15% of the balance sheet.

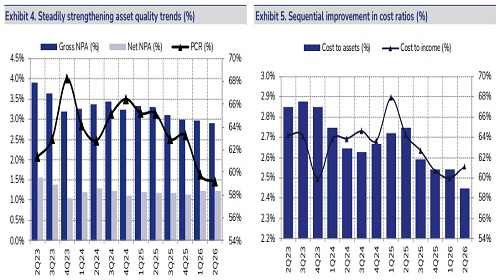

* Asset quality: A key monitorable but expected to improve: Asset quality remains an area of caution, with GNPA at 2.9% and historically higher slippages in the SME/LAP segments. The management acknowledged this as a key monitorable, but stressed that recoveries remain strong, credit costs have normalised to <45bps, and collection efficiency in home and LAP portfolios is ~99%. It guided that GNPA should trend toward ~2% over the medium term, supported by the bank’s secure, small-ticket lending model (86% of loans

* NIMs bottomed out; profitability entering a multi-year upcycle: NIMs have likely bottomed out, with the management guiding an improvement to 3.30–3.40% over the next 3–4 quarters (3.23% in 2QFY26), reflecting rebalancing of liabilities and better product mix. Opex discipline remains strong—employee optimisation and tech enablement are expected to keep cost/assets at 2.4–2.5%. Fee income, which saw its highest YoY growth in 16 years in FY25, is expected to grow at mid-teens annually. Together, these drivers reinforce the management’s guidance of achieving ~0.92%-1.0% RoA and ~13.5–14.5% RoE in the next 2 years.

* Strengthening deposit profile and improving funding costs: The bank’s deposit franchise remains strong, with the management highlighting that DCB’s peak term-deposit premium vs, large banks has reduced meaningfully from ~90bps to ~60bps, as rate discipline strengthens. It expect cost of deposits to decline for another 3–4 quarters as older high-cost deposits reprice. Digital channels (Niyo, UPI growth, secured credit cards), along with branch-level productivity initiatives, are expected to accelerate CASA growth. The management continues to focus on flow-led deposits rather than chasing CASA ratio, ensuring stability of the liability base.

* Valuation: DCB remains adequately capitalised with CAR above 16%, and it expects RWA/total assets to reduce further from the current 49%. The bank guided for 18–20% loan growth, stable credit costs (<45bps), improving margins, and better cross-sell intensity as the key earnings drivers. We revise our TP to INR 210, valuing the bank at 0.9x FY27E BVPS, and maintain BUY

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361